-

US says Venezuela to protect mining firms as diplomatic ties restored

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

Spurs slip deeper into relegation trouble after loss to Palace

-

European, US stocks back in sell-off mode as oil prices surge

-

Pete Hegseth: Trump's Iran war attack dog

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

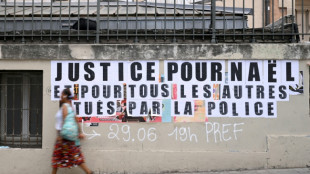

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

What's in Biden's big climate and health bill?

Hundreds of billions of dollars for clean energy projects, cheaper prescription drugs and new corporate taxes are a few of the key items in US President Joe Biden's massive investment plan, which the House of Representatives is expected to pass Friday, after Senate approval.

Here's a closer look at the signature elements of the plan, which could offer the Democratic leader a big political win heading into November's crucial midterm elections.

- $370 billion for clean energy, climate -

If the legislation is passed, it will mark the biggest investment in US history in the fight against climate change.

Rather than attempting to punish the biggest polluters in corporate America, the bill put forward by Biden's party instead proposes a series of financial incentives aimed at steering the world's biggest economy away from fossil fuels.

Tax credits would be given to producers and consumers of wind, solar and nuclear power.

If passed, the legislation would allot up to $7,500 in tax credits to every American who buys an electric vehicle. Anyone installing solar panels on their roof would see 30 percent of the cost subsidized.

Around $60 billion would be allocated for clean energy manufacturing, from wind turbines to the processing of minerals needed for electric car batteries.

The same amount would go towards programs to help drive investment in underprivileged communities, notably through grants for home renovation to improve energy efficiency and access to less polluting modes of transportation.

Huge investments would go into making forests less susceptible to wildfires and protect coastal areas from erosion caused by devastating hurricanes.

The bill aims to help the United States reduce its carbon emissions by 40 percent by 2030, as compared with 2005 levels.

- $64 billion for health care -

The second major aspect of the legislation is to help reduce the huge disparities in access to health care across the United States, notably by reining in skyrocketing prescription drug prices.

If the draft eventually becomes law, Medicare -- the nation's health insurance plan for those aged 65 and older, or with modest incomes -- could be permitted to negotiate prices of certain medications directly with Big Pharma for the first time, likely yielding far better deals.

The plan would require pharmaceutical companies to offer rebates on certain drugs if the prices rise faster than soaring US inflation.

It also would extend benefits under Barack Obama's signature Affordable Care Act -- known colloquially as Obamacare -- until 2025.

- Minimum corporate tax of 15% -

Alongside these huge investments, the so-called "Inflation Reduction Act" would seek to pare down the federal deficit through the adoption of a minimum corporate tax of 15 percent for all companies with profits exceeding one billion dollars.

The new tax seeks to prevent certain huge firms from using tax havens to pay far less than what they theoretically owe.

According to estimates, the measure could generate more than $258 billion in tax revenue for US government coffers over the next 10 years.

S.Keller--BTB