-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

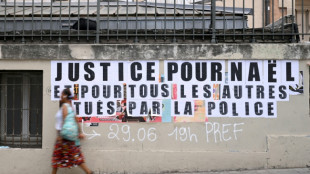

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

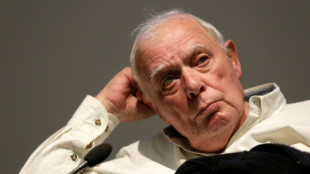

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

Hong Kong economy faces uncertain future 25 years after handover

When Hong Kong transitioned from British to Chinese rule, Edmond Hui was a floor trader at the bustling stock exchange, witnessing the roaring growth of a city at the crossroads of the West and Asia.

Under a deal signed with Britain ahead of the 1997 handover, China promised Hong Kong could keep its capitalist system for 50 years, an arrangement that helped the city thrive as one of the world's top financial hubs.

Friday marks the halfway point of that experiment, with uncertainty clouding the economic future of Hong Kong -- a city reliant on an increasingly isolated China, struggling to shake off the reputational damage from political unrest and pandemic-induced border closures.

Hui, now the chief executive of a mid-tier stockbroker with nearly 300 employees, said post-handover markets have undergone a drastic shift, becoming more China-focused than ever.

"Before 1997, foreign capital propped up half of the market," he said. "After 1997, things changed gradually until the whole market was held up by Chinese capital."

China's meteoric rise in the past two decades yielded vast benefits for Hong Kong, which became the gateway for mainland firms to raise funds and for foreign businesses to access what is today the world's second-largest economy.

"Hong Kong was sort of a poster child of free trade and open markets," veteran pro-Beijing Hong Kong politician Regina Ip told AFP.

But the interlocking of its fate with China has also led to warnings about overreliance and complacency.

Chinese companies made up around 80 percent of the market capitalisation in Hong Kong's stock market this year, up from 16 percent in 1997.

And Chinese firms now account for seven of the top 10 holdings of the benchmark Hang Seng Index, which used to be anchored by homegrown brands such as Cathay Pacific and Television Broadcasts Limited.

Hong Kong's GDP, meanwhile, has gone from being equivalent to 18 percent of mainland China's in 1997 to less than three percent in 2020.

Hui greeted this comprehensive shift with a mild shrug.

"It's just a matter of changing who's boss," he said.

"We can only hope that our country's momentum will surpass that of Europe and the United States."

- 'The gateway to China' -

As China's economic and political power has grown over the last few decades, so have tensions with Western nations -- which has also affected Hong Kong.

Beijing cracked down on dissent in the city after massive democracy protests in 2019, prompting the United States to revoke Hong Kong's preferential trade status on the grounds that it was no longer autonomous enough.

Washington also sanctioned some Hong Kong officials.

"Back in 1997, we were able to play the role of a very important middleman. But now... everyone has more doubts about our background," Yan Wai-hin, an economics lecturer at the Chinese University of Hong Kong, told AFP.

"If a trading partner feels that (Hong Kong) isn't a neutral middleman... then the mutual trust might be lost."

Yan said regional rivals such as Singapore were looking to capitalise on what they saw as an opening to supplant Hong Kong.

Adding to that pressure, the tightening of political control has also meant Hong Kong has stuck to mainland China's zero-Covid policy.

Stringent travel restrictions have kept the business hub cut off both from China and the world for the last two years, with authorities acknowledging it has prompted a talent exodus.

But Ip said once restrictions were lifted, Hong Kong would recover.

"Our extremely advantageous geographical location is still there," she said.

"We're still the gateway to China."

- 'Complacent and insular' -

Some industries other than finance, though, have struggled after the handover.

"In the past 10 years or so, our GDP growth has lost steam and I think this had to do with Hong Kongers being complacent and insular," said Simon Ho, president of the Hang Seng University of Hong Kong.

The city's port, for instance, was among the world's busiest for decades but has slipped in the rankings after peaking in 2004.

"The government took a neoliberal, non-interventionist approach, and there was no blueprint for developing industries and the economy," Ho added.

He said authorities had devoted resources to sectors such as research and development, but that the results were "half-baked" and not competitive enough when compared with neighbouring tech hub Shenzhen.

"Hong Kong needs to figure out its role," Ho said.

"In the past, we didn't know how to complement the mainland, and in some cases even competed with it. In the long run, that will only get harder."

S.Keller--BTB