-

Iran missile barrage sparks explosions over Tel Aviv

Iran missile barrage sparks explosions over Tel Aviv

-

US says Venezuela to protect mining firms as diplomatic ties restored

-

Trump honors Messi and MLS Cup champion Miami teammates

Trump honors Messi and MLS Cup champion Miami teammates

-

Dismal Spurs can still avoid relegation vows Tudor

-

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

Berger sets early pace at Arnold Palmer with 'unbelievable' 63

-

Morocco part company with coach Regragui as World Cup looms

-

Lens beat Lyon on penalties to reach French Cup semis

Lens beat Lyon on penalties to reach French Cup semis

-

El Salvador's Bukele holding dozens of political prisoners: rights group

-

With Iran war, US goes it alone like never before

With Iran war, US goes it alone like never before

-

Spurs slip deeper into relegation trouble after loss to Palace

-

European, US stocks back in sell-off mode as oil prices surge

European, US stocks back in sell-off mode as oil prices surge

-

Pete Hegseth: Trump's Iran war attack dog

-

Celtics' Tatum could make injury return on Friday

Celtics' Tatum could make injury return on Friday

-

'Enemy at home': Iranian authorities tighten grip as war rages

-

Bethell set for 'hell of a career', says England captain Brook

Bethell set for 'hell of a career', says England captain Brook

-

France coach Galthie slams Scotland for 'smallest changing room in the world'

-

Medvedev arrives in Indian Wells after being stranded in Dubai

Medvedev arrives in Indian Wells after being stranded in Dubai

-

Trump fires homeland security chief Kristi Noem

-

Mideast war risks pulling more in as conflict boils over

Mideast war risks pulling more in as conflict boils over

-

Wales' James Botham 'sledged' by grandfather Ian Botham after Six Nations error

-

India hero Samson eyes 'one more' big knock in T20 World Cup final

India hero Samson eyes 'one more' big knock in T20 World Cup final

-

Britney Spears detained on suspicion of driving while intoxicated

-

Grooming makes Crufts debut as UK dog show widens offer

Grooming makes Crufts debut as UK dog show widens offer

-

Townsend insists Scots' focus solely on France not Six Nations title race

-

UK sends more fighter jets to Gulf: PM

UK sends more fighter jets to Gulf: PM

-

EU to ban plant-based 'bacon' but veggie 'burgers' survive chop

-

Leagues Cup to hold matches in Mexico for first time

Leagues Cup to hold matches in Mexico for first time

-

India reach T20 World Cup final after England fail in epic chase

-

Conservative Anglicans press opposition to Church's first woman leader

Conservative Anglicans press opposition to Church's first woman leader

-

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

Italy bring back Brex to face England

-

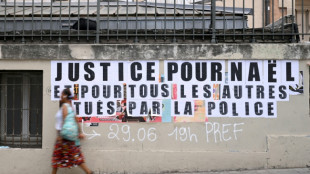

French policeman to be tried over 2023 killing of teen

-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

-

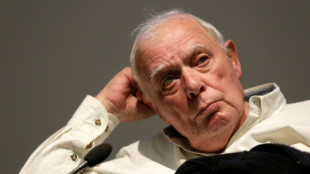

Portugal mourns acclaimed writer Antonio Lobo Antunes

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

How tariffs in the EU work

Customs duties, or tariffs, have become a political punching ball as the European Union prepares to respond to US President Donald Trump's recent offensive.

But what exactly do we mean when we talk about tariffs? How does the EU policy work? Who pays them and what are they for?

Some answers:

- What are tariffs? -

Used by almost every country, tariffs are a tax on products imported from abroad.

They take many forms, the most common being a percentage of the economic value of the product -- the "ad valorem" duty.

The EU, like other economies, also uses so-called "specific" tariffs, such as an amount set per kilogramme or per litre of any given product.

Globally in 2022, the average tariff was 3.6 percent, according to the CCI-Cepii database (Centre for Prospective Studies and International Information).

In other words, each product crosses a border at a price 3.6 percent higher than its cost domestically.

"This average figure hides very strong differences between countries and sectors," Houssein Guimbard, a trade policies specialist at Cepii, told AFP.

- What are they for? -

The most immediate objective of these taxes is to give domestic producers a competitive advantage against foreign competition, said Guimbard.

Another goal, which is more the case in developing countries, is to supplement the government budget.

Some African or island countries, for example, finance more than 30 percent of their expenses this way, according to Guimbard.

Countries also use tariffs to maintain a positive trade balance and keep the amount of imports down by taxing them.

"It's a bit like President Trump's current logic," Guimbard told AFP.

- Who decides them in the EU? -

As a consequence of the customs union, the 27 member states have a common customs tariff for imported goods.

They do not apply any internal customs duties. The common customs tariff rates are set by the EU Council, based on proposals from the European Commission (EC).

They vary depending on agreements negotiated with trade partners and according to the "economic sensitivity of the products," the Commission says.

Typically, very low customs duties are applied to oil or liquefied gas "because consumers and companies need them, and the European Union does not necessarily produce them," said Guimbard.

Conversely, agriculture is highly protected: 40 to 60 percent protection on beef or dairy products, including all rights and quotas, compared to an average protection of 2.2 percent in the EU in 2022, according to Guimbard.

Since 2023, the EC has planned a "graduated response if our companies were victims of a significant increase in customs duties," Yann Ambach, head of the Tariff and Trade Policy Office at the Directorate General of French Customs, told AFP.

"It is within this framework that the countermeasures currently being considered by the EC would be implemented," Ambach said.

- Who pays them? -

In the EU, as a general rule, the importer, rather than the exporter, pays the customs duties.

If they increase, the main question is whether companies pass on the additional costs to the consumer.

"One must consider how important the product is for consumers and whether companies can raise the price of this product without reducing their margins," said Guimbard.

"The translation of the increase in customs duty also depends on the ability of companies to find alternative sources when importing, or alternative destinations when exporting."

- Who collects them? -

The member states are responsible for collecting customs duties.

They "must have adequate control infrastructure to ensure that their administrations, especially their customs authorities, carry out their tasks in an appropriate manner", according to the EC.

"The American measures and the subsequent European retaliatory measures correspond to an intensification of the missions of monitoring, verification, and control of imports and exports," said Ambach.

- Where do they go? -

For the period 2021-2027, the member states retain 25 percent of the collected customs duties.

"This measure not only covers collection costs but also serves as an incentive to ensure a diligent collection of the amounts due," the EC says.

The remaining 75 percent directly funds the EU budget. Tariffs on imported goods therefore account for approximately 14 percent of the community budget.

S.Leonhard--VB