-

Dybala out for six weeks as Roma battle for top-four spot

Dybala out for six weeks as Roma battle for top-four spot

-

Sleepless Iranians count cost of war as damage mounts

-

Itoje tells faltering England to 'take the game to Italy' in Six Nations

Itoje tells faltering England to 'take the game to Italy' in Six Nations

-

Leading satellite firm to hold back Gulf state images

-

Tuipulotu urges Scotland to stay in Six Nations title hunt against France

Tuipulotu urges Scotland to stay in Six Nations title hunt against France

-

Trump says only Iran's 'unconditional surrender' can end war

-

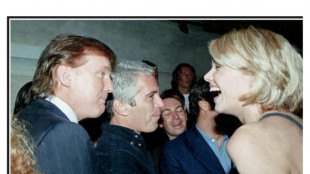

US releases Epstein files with uncorroborated Trump allegations

US releases Epstein files with uncorroborated Trump allegations

-

Securing shipping lane from Mideast war 'challenging', say experts

-

Italy have to start beating the best, says captain Lamaro

Italy have to start beating the best, says captain Lamaro

-

India's Bumrah only 'human' says Phillips ahead of T20 World Cup final

-

Oil prices climb as Mideast war rages, stocks fall on US jobs

Oil prices climb as Mideast war rages, stocks fall on US jobs

-

US retail sales decline as consumer pullback deepens

-

War in Middle East raises stagflation fears in Europe and beyond

War in Middle East raises stagflation fears in Europe and beyond

-

UN demands swift probe into Israeli strikes on Lebanon

-

Chelsea happy to rotate goalkeepers, says Rosenior

Chelsea happy to rotate goalkeepers, says Rosenior

-

Soaring gas prices spark renewed debate about European electricity

-

Elite pilots and US support drive Israel's air power

Elite pilots and US support drive Israel's air power

-

Germany's Axel Springer swoops for British newspaper The Telegraph

-

US sheds jobs in February in warning sign for Trump's economy

US sheds jobs in February in warning sign for Trump's economy

-

Sole Iranian competitor out of Paralympics due to Middle East war

-

Spanish PM says 'cooperation' with US should prevail over 'confrontation'

Spanish PM says 'cooperation' with US should prevail over 'confrontation'

-

Lebanese relive 'nightmare' of displacement from war

-

US must probe Iran school strike 'very quickly', UN says

US must probe Iran school strike 'very quickly', UN says

-

AC Milan hoping to revive dimming title hopes in derby against Inter

-

Iceland proposes August 29 referendum on resuming EU membership talks

Iceland proposes August 29 referendum on resuming EU membership talks

-

Hungary to expel 7 Ukrainians as Zelensky, Orban quarrel over Russian oil

-

Ohtani homers as Japan thrash Taiwan at World Baseball Classic

Ohtani homers as Japan thrash Taiwan at World Baseball Classic

-

Who rules the seas? Torpedoed Iran ship brings focus underwater

-

Mideast war escalates as fresh strikes batter Iran

Mideast war escalates as fresh strikes batter Iran

-

Pirovano takes downhill at Val di Fassa for first World Cup win

-

Iran drone strike on Azerbaijan raises fears of Mideast war spreading to Caucasus

Iran drone strike on Azerbaijan raises fears of Mideast war spreading to Caucasus

-

Decades of planning and US backing helps fuel Israel's air power

-

Hungary to expel seven Ukrainians as Zelensky, Orban quarrel over Russian oil

Hungary to expel seven Ukrainians as Zelensky, Orban quarrel over Russian oil

-

Mideast war is heightening uncertainty, Lufthansa warns

-

Fresh Israeli strikes on Lebanon as PM warns of 'looming humanitarian disaster'

Fresh Israeli strikes on Lebanon as PM warns of 'looming humanitarian disaster'

-

Italian general challenges Meloni from the right

-

China says 'clearly aware' of economic risks, vows to boost spending

China says 'clearly aware' of economic risks, vows to boost spending

-

Hungary detains seven Ukrainians as Kyiv, Budapest quarrel over Russian oil

-

North Korea, China power into Women's Asian Cup quarter-finals

North Korea, China power into Women's Asian Cup quarter-finals

-

Extensive destruction in Beirut's southern suburbs following Israeli strikes

-

Most Asian equities drop as Mideast crisis rages, though oil dips

Most Asian equities drop as Mideast crisis rages, though oil dips

-

'Super special' Allen can light up big occasion for New Zealand

-

'Genie' Bumrah: India's yorker king who carries a billion hopes

'Genie' Bumrah: India's yorker king who carries a billion hopes

-

'There will be nerves': India face New Zealand for T20 World Cup glory

-

Lufthansa warns of heightened 'uncertainty' from Mideast war

Lufthansa warns of heightened 'uncertainty' from Mideast war

-

Mideast war enters 'next phase' as strikes hit Iran, Lebanon

-

Equities mixed as Mideast crisis rages, though oil dips

Equities mixed as Mideast crisis rages, though oil dips

-

Sri Lanka denounces war deaths, houses Iran sailors

-

Inoue primed for 'historic' Nakatani clash in Tokyo

Inoue primed for 'historic' Nakatani clash in Tokyo

-

Italy challenges EU over key climate tool

Dutch chip giant ASML reports 2024 net profit dip but solid orders

Dutch tech giant ASML, which sells cutting-edge machines to make semiconductor chips, reported a drop in annual net profit Wednesday, as geopolitical headwinds and the emergence of Chinese AI start-up DeepSeek disrupt the sector.

ASML's after-tax profit for 2024 came in at 7.6 billion euros ($7.9 billion), compared to 7.8 billion euros for 2023.

However, the firm said it had solid net bookings in the fourth quarter of last year of 7.1 billion euros -- the most closely watched figure in the markets as a guide to future performance.

CEO Christophe Fouquet hailed "another record year" for the firm in terms of annual sales.

Total net sales last year were 28.3 billion euros, a slight gain on the company's forecast of 28 billion euros. In 2023, ASML booked sales of 27.6 billion euros.

"Consistent with our view from the last quarter, the growth in artificial intelligence is the key driver for growth in our industry," Fouquet said in a statement.

"It has created a shift in the market dynamics that is not benefiting all of our customers equally, which creates both opportunities and risks," he said.

ASML left its annual sales forecast of between 30-35 billion euros for 2025 unchanged since its last guidance in October.

- US-China tech war -

The tech giant is caught in the middle of a US-led effort to curb high-tech exports to China over fears they could be used to bolster the country's military.

Earlier this month, the Dutch government announced it was tightening its export controls on advanced semiconductor production equipment, but said the measures targeted a "very limited" number of goods.

ASML responded at the time that the moves would have "no additional impact" on its business.

Chief financial officer Roger Dassen admitted there were "quite a few moving parts when it comes to export controls from the US."

"But I would say that the combination and the impact of those, both US and Dutch measures, has been appropriately reflected in the guidance that we've given before," he said.

"So, the 30 to 35 billion euros properly reflects the limitations that we see from an export controls perspective."

Beijing has been infuriated by the export curbs, describing them as "technological terrorism."

The tech sector has also been buffeted by the sudden emergence of DeepSeek, a low-cost Chinese artificial intelligence chatbot to rival its US competitors.

In a paper detailing its development, DeepSeek said the model was trained using only a fraction of the chips used by its Western competitors.

"We used to talk about semiconductors everywhere. I think since November we started to talk about AI everywhere," said Fouquet.

"We truly believe that AI is going to bring even more opportunity to this semiconductor industry."

- 'Technical error' -

ASML left its long-term sale guidance unchanged at between 44 and 60 billion euros for 2030 as it pins its hopes on the rapidly expanding AI market.

Turning to the fourth quarter, ASML sales came in at 9.3 billion euros, above the previous guidance of between 8.8 billion and 9.2 billion euros.

Net profit for the fourth quarter was 2.7 billion euros, compared to the 2.1 billion euros booked in the third quarter of last year.

The firm has identified 2024 as a transition year, before what it hopes will be significant growth in 2025, although it has described the recovery as slower than expected.

It predicted total net sales in the first quarter of this year to be between 7.5 billion and 8.0 billion euros.

ASML executives were left red-faced in October when a "technical error" resulted in the early release of the firm's third-quarter figures.

The unexpected leak, plus a slump in bookings, sparked a major sell-off in ASML stock, with shares down as much as 15 percent.

L.Meier--VB