-

New Zealand landslips kill at least two, others missing

New Zealand landslips kill at least two, others missing

-

Djokovic says heaving Australian Open crowds 'good problem'

-

Swiatek in cruise control to make Australian Open third round

Swiatek in cruise control to make Australian Open third round

-

Austrian ex-agent to go on trial in Russia spying case

-

Bangladesh launches campaigns for first post-Hasina elections

Bangladesh launches campaigns for first post-Hasina elections

-

Afghan resistance museum gets revamp under Taliban rule

-

Multiple people missing in New Zealand landslips

Multiple people missing in New Zealand landslips

-

Sundance Film Festival hits Utah, one last time

-

Philippines convicts journalist on terror charge called 'absurd'

Philippines convicts journalist on terror charge called 'absurd'

-

Anisimova grinds down Siniakova in 'crazy' Australian Open clash

-

Djokovic rolls into Melbourne third round, Keys defence alive

Djokovic rolls into Melbourne third round, Keys defence alive

-

Vine, Narvaez take control after dominant Tour Down Under stage win

-

Chile police arrest suspect over deadly wildfires

Chile police arrest suspect over deadly wildfires

-

Djokovic eases into Melbourne third round - with help from a tree

-

Keys draws on champion mindset to make Australian Open third round

Keys draws on champion mindset to make Australian Open third round

-

Knicks halt losing streak with record 120-66 thrashing of Nets

-

Philippine President Marcos hit with impeachment complaint

Philippine President Marcos hit with impeachment complaint

-

Trump to unveil 'Board of Peace' at Davos after Greenland backtrack

-

Bitter-sweet as Pegula crushes doubles partner at Australian Open

Bitter-sweet as Pegula crushes doubles partner at Australian Open

-

Hong Kong starts security trial of Tiananmen vigil organisers

-

Keys into Melbourne third round with Sinner, Djokovic primed

Keys into Melbourne third round with Sinner, Djokovic primed

-

Bangladesh launches campaigns for first post-Hasina polls

-

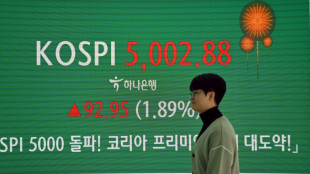

Stocks track Wall St rally as Trump cools tariff threats in Davos

Stocks track Wall St rally as Trump cools tariff threats in Davos

-

South Korea's economy grew just 1% in 2025, lowest in five years

-

Snowboard champ Hirano suffers fractures ahead of Olympics

Snowboard champ Hirano suffers fractures ahead of Olympics

-

'They poisoned us': grappling with deadly impact of nuclear testing

-

Keys blows hot and cold before making Australian Open third round

Keys blows hot and cold before making Australian Open third round

-

Philippine journalist found guilty of terror financing

-

Greenlanders doubtful over Trump resolution

Greenlanders doubtful over Trump resolution

-

Real Madrid top football rich list as Liverpool surge

-

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

-

Higher heating costs add to US affordability crunch

-

Eight stadiums to host 2027 Rugby World Cup matches in Australia

Eight stadiums to host 2027 Rugby World Cup matches in Australia

-

Plastics everywhere, and the myth that made it possible

-

Interim Venezuela leader to visit US

Interim Venezuela leader to visit US

-

Australia holds day of mourning for Bondi Beach shooting victims

-

Liverpool cruise as Bayern reach Champions League last 16

Liverpool cruise as Bayern reach Champions League last 16

-

Fermin Lopez brace leads Barca to win at Slavia Prague

-

Newcastle pounce on PSV errors to boost Champions League last-16 bid

Newcastle pounce on PSV errors to boost Champions League last-16 bid

-

Fermin Lopez brace hands Barca win at Slavia Prague

-

Kane double fires Bayern into Champions League last 16

Kane double fires Bayern into Champions League last 16

-

Newcastle pounce on PSV errors to close in on Champions League last 16

-

In Davos speech, Trump repeatedly refers to Greenland as 'Iceland'

In Davos speech, Trump repeatedly refers to Greenland as 'Iceland'

-

Liverpool see off Marseille to close on Champions League last 16

-

Caicedo strikes late as Chelsea end Pafos resistance

Caicedo strikes late as Chelsea end Pafos resistance

-

US Republicans begin push to hold Clintons in contempt over Epstein

-

Trump says agreed 'framework' for US deal over Greenland

Trump says agreed 'framework' for US deal over Greenland

-

Algeria's Zidane and Belghali banned over Nigeria AFCON scuffle

-

Iran says 3,117 killed during protests, activists fear 'far higher' toll

Iran says 3,117 killed during protests, activists fear 'far higher' toll

-

Atletico frustrated in Champions League draw at Galatasaray

In Latin America, Brazilian fintech firms rule

When Brazilian sisters Daniela and Juliana Binatti quit their jobs to launch a new financial technology -- or fintech -- product, colleagues called them a pair of upstart nuts.

Alas, they ended up founding a company that US credit card giant Visa acquired this year for a cool $1 billion.

Pismo, as the firm these entrepreneurs created in 2016 is called, is the latest big success story of a Brazilian company in the fintech sector -- the one luring the most venture capital in Brazil and Latin America in general.

"When I was 16, my mother sent me out to leave my CV with banks along (the famous road) Paulista Avenue to find a job," said Daniela Binatti, who is 46 and grew up in a family of modest means in the megacity Sao Paulo.

Many of those same banks have now ended up becoming clients of hers.

With more than 450 employees and five offices around the world -- in Brazil, Britain, the United States, Singapore and India -- Pismo was acquired by Visa in June in one of the biggest deals yet in the Brazilian tech sector.

Brazil thus enlarged its herd of unicorns, or startups with a market value of at least $1 billion, to 21 out of a total of 38 in Latin America as a whole.

"Many people thought we were crazy," said Daniela Binatti, the company's director of technology.

She said she and her sister had to "break through a lot of prejudice to set up a Brazilian tech firm at an international level but we were convinced" it would succeed.

Pismo produces technology designed to make it easier for banks to launch card and payment products.

It will allow Visa to serve its customers no matter where they are or what currency they use, because Pismo's technological tools are based in the cloud and accessible from anywhere, Ricardo Josua, Pismo's executive director, said in a joint ad with Visa.

Other fintech companies created in Latin America's largest economy have shown growth potential, such as Nubank, one of the world's largest online banks, listing on Wall Street and with nearly 84 million clients; or Neon, another such bank, which in 2022 received a $300 million investment from the Spanish banking giant BBVA.

- An appealing ecosystem -

Pismo and its predecessors "show that Brazil is the region's ripest ecosystem for creating financial technology companies," said Diego Herrera, a specialist in the Connectivity, Markets and Finance Division at the Inter-American Development Bank.

Brazil, and in particular its fintech firms, lured 40 percent of the nearly $8 billion in venture capital that Latin America received in 2022, said LAVCA, the Association for Private Capital Investment in Latin America.

This is due mainly to the size of the Brazilian market, in which 84 percent of the adult population has a bank account in a country with 203 million people, said Eduardo Fuentes, head of research at an innovation platform called Distrito.

Brazil's outsized role in luring VC money also stems from the fact that just a few banks control this huge market, causing "many problems that entrepreneurs try to resolve," Fuentes added, citing high costs as an example.

What is more, "Brazil attracts international investors because it has skills and an environment favorable to innovation," said Fuentes, citing things like platforms for collective financing, payment institutions, and PIX, a revolutionary system for making small, instant payments.

Herrera said Brazil "is still the most attractive country in the region and keeps luring investment" even though the flow of money has dropped off from the record levels it hit during the pandemic, as the world economy slowed and interest rates rose.

- Opportunities -

There are 869 financial technology companies in Brazil, giving it eighth place in a global ranking in this category created by financial services company Finnovating.

Most of them focus on credit, payments and financial management, said Mariana Bonora, head of ABFintechs.

"Many opportunities arise in niches that are neglected" by traditional banks, such as products that serve people who are vulnerable or for entrepreneurs, Bonora added.

The online bank Cora -- seen as a possible unicorn -- seized on one of those niches to set up its business.

"We serve small and medium-sized companies, which account for more than 90 percent of all companies in this country, with lower costs and less red tape," said cofounder of Cora.

This Sao Paulo-based bank received $116 million in international funding during the pandemic, and boasts 400 employees and a million customers.

Looking ahead, Brazil hopes to consolidate its fintech ecosystem thanks mainly to the "open finance" system promoted by the country's central bank, which will facilitate exchange of data among institutions, said Herrera.

Other sources of innovation will be the regulation of crypto assets and the implementation of the digital real, the Brazilian currency.

T.Bondarenko--BTB