-

Champions League crunch time as pressure piles on Europe's elite

Champions League crunch time as pressure piles on Europe's elite

-

Harry arrives at London court for latest battle against UK newspaper

-

Swiatek survives scare to make Australian Open second round

Swiatek survives scare to make Australian Open second round

-

Over 400 Indonesians 'released' by Cambodian scam networks: ambassador

-

Japan PM calls snap election on Feb 8 to seek stronger mandate

Japan PM calls snap election on Feb 8 to seek stronger mandate

-

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

-

What is the EU's anti-coercion 'bazooka' it could use against US?

What is the EU's anti-coercion 'bazooka' it could use against US?

-

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

-

Gold, silver hit peaks and stocks sink on new US-EU trade fears

Gold, silver hit peaks and stocks sink on new US-EU trade fears

-

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

-

Warhorse Wawrinka stays alive at farewell Australian Open

Warhorse Wawrinka stays alive at farewell Australian Open

-

Bangladesh face deadline over refusal to play World Cup matches in India

-

High-speed train collision in Spain kills 39, injures dozens

High-speed train collision in Spain kills 39, injures dozens

-

Gold, silver hit peaks and stocks struggle on new US-EU trade fears

-

Auger-Aliassime retires in Melbourne heat with cramp

Auger-Aliassime retires in Melbourne heat with cramp

-

Melbourne home hope De Minaur 'not just making up the numbers'

-

Risking death, Indians mess with the bull at annual festival

Risking death, Indians mess with the bull at annual festival

-

Ghana's mentally ill trapped between prayer and care

-

UK, France mull social media bans for youth as debate rages

UK, France mull social media bans for youth as debate rages

-

Japan PM to call snap election seeking stronger mandate

-

Switzerland's Ruegg sprints to second Tour Down Under title

Switzerland's Ruegg sprints to second Tour Down Under title

-

China's Buddha artisans carve out a living from dying trade

-

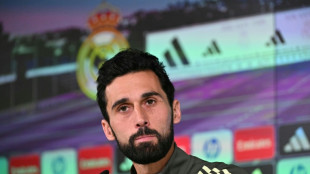

Stroking egos key for Arbeloa as Real Madrid host Monaco

Stroking egos key for Arbeloa as Real Madrid host Monaco

-

'I never felt like a world-class coach', says Jurgen Klopp

-

Ruthless Anisimova races into Australian Open round two

Ruthless Anisimova races into Australian Open round two

-

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

-

South Korea, Italy agree to deepen AI, defence cooperation

South Korea, Italy agree to deepen AI, defence cooperation

-

Vietnam begins Communist Party congress to pick leaders

-

China's 2025 economic growth among slowest in decades

China's 2025 economic growth among slowest in decades

-

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

-

Who said what at 2025 Africa Cup of Nations

Who said what at 2025 Africa Cup of Nations

-

Grizzlies win in London as heckler interrupts US anthem

-

Three-time finalist Medvedev grinds into Australian Open round two

Three-time finalist Medvedev grinds into Australian Open round two

-

Auger-Aliassime retires from Melbourne first round with cramp

-

Rams fend off Bears comeback as Patriots advance in NFL playoffs

Rams fend off Bears comeback as Patriots advance in NFL playoffs

-

Thousands march in US to back Iranian anti-government protesters

-

Gotterup charges to Sony Open victory in Hawaii

Gotterup charges to Sony Open victory in Hawaii

-

Gold, silver hit records and stocks fall as Trump fans trade fears

-

Auger-Aliassime retires injured from Melbourne first round

Auger-Aliassime retires injured from Melbourne first round

-

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

-

China says economy grew 5% last year, among slowest in decades

China says economy grew 5% last year, among slowest in decades

-

Young star Zheng may have to give back Australian Open prize money

-

Gauff overcomes wobble in winning start to Melbourne title bid

Gauff overcomes wobble in winning start to Melbourne title bid

-

Harry set for final courtroom battle against UK media

-

'It wasn't clean': Mother mourns son killed in US Maduro assault

'It wasn't clean': Mother mourns son killed in US Maduro assault

-

Louvre heist probe: What we know

-

Surging billionaire wealth a political threat, Oxfam warns as Davos opens

Surging billionaire wealth a political threat, Oxfam warns as Davos opens

-

Morocco fans stunned, disappointed as Senegal win Africa title

-

Senegal fuelled by 'injustice' in AFCON final triumph, says hero Gueye

Senegal fuelled by 'injustice' in AFCON final triumph, says hero Gueye

-

Morocco coach Regragui laments 'shameful' scenes in AFCON final defeat

Stocks mixed with focus on central banks, tech

European stock markets steadied Friday after solid gains in Asia, as traders reacted to central bank activity and easing concerns over the technology sector.

Below-forecast US inflation data Thursday boosted hopes that the Federal Reserve would cut interest rates next month.

The yen fell against the dollar on profit-taking after the Bank of Japan on Friday hiked, as expected, its own borrowing costs to a three-decade high, hours after data showed prices in the country rising.

Russia's central bank said it was cutting its benchmark interest rate to 16 percent as the country's economy sags under the financial burden of the Ukraine offensive and Western sanctions.

The Bank of England cut rates Thursday, when the European Central Bank left eurozone borrowing costs unchanged.

Germany's central bank on Friday predicted a slower recovery for Europe's biggest economy following three years of stagnation.

On the corporate front, blockbuster earnings from chip firm Micron Technology helped soothe nerves over a tech bubble.

"Stocks in the tech sector have been boosted by yesterday's bumper earnings from Micron," noted Joshua Mahony, chief market analyst at trading group Scope Markets.

"As we close out a week that has seen a huge amount of data and central bank announcements, there is an expectation that we start to see volumes and volatility ease off from here."

Equity markets, particularly on Wall Street, have come under pressure in recent weeks amid questions about when, if ever, investors will see returns on the colossal amounts of cash that have been pumped into artificial intelligence.

Those concerns, though, were tempered Thursday after blowout earnings from Micron, which said its quarterly profits nearly tripled to $5.2 billion as it benefits from the AI boom. It also gave an upbeat outlook for the current three months.

- Key figures at around 1115 GMT -

London - FTSE 100: FLAT at 9,836.52 points

Paris - CAC 40: DOWN 0.1 percent at 8,142.66

Frankfurt - DAX: DOWN 0.1 percent at 24,172.03

Tokyo - Nikkei 225: UP 1.0 percent at 49,507.21 (close)

Hong Kong - Hang Seng Index: UP 0.8 percent at 25,690.53 (close)

Shanghai - Composite: UP 0.4 percent at 3,890.45 (close)

New York - Dow: UP 0.1 percent at 47,951.85 (close)

Dollar/yen: UP at 157.31 yen from 155.63 yen on Thursday

Euro/dollar: DOWN at $1.1716 from $1.1721

Pound/dollar: DOWN at $1.3377 from $1.3378

Euro/pound: DOWN at 87.59 pence from 87.62 pence

Brent North Sea Crude: FLAT at $59.82 per barrel

West Texas Intermediate: FLAT at $56.01 per barrel

L.Maurer--VB