-

Trump to charge $1bn for permanent 'peace board' membership: reports

Trump to charge $1bn for permanent 'peace board' membership: reports

-

Trump says world 'not secure' until US has Greenland

-

Gold hits peak, stocks sink on new Trump tariff threat

Gold hits peak, stocks sink on new Trump tariff threat

-

Champions League crunch time as pressure piles on Europe's elite

-

Harry arrives at London court for latest battle against UK newspaper

Harry arrives at London court for latest battle against UK newspaper

-

Swiatek survives scare to make Australian Open second round

-

Over 400 Indonesians 'released' by Cambodian scam networks: ambassador

Over 400 Indonesians 'released' by Cambodian scam networks: ambassador

-

Japan PM calls snap election on Feb 8 to seek stronger mandate

-

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

-

What is the EU's anti-coercion 'bazooka' it could use against US?

-

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

-

Gold, silver hit peaks and stocks sink on new US-EU trade fears

-

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

-

Warhorse Wawrinka stays alive at farewell Australian Open

-

Bangladesh face deadline over refusal to play World Cup matches in India

Bangladesh face deadline over refusal to play World Cup matches in India

-

High-speed train collision in Spain kills 39, injures dozens

-

Gold, silver hit peaks and stocks struggle on new US-EU trade fears

Gold, silver hit peaks and stocks struggle on new US-EU trade fears

-

Auger-Aliassime retires in Melbourne heat with cramp

-

Melbourne home hope De Minaur 'not just making up the numbers'

Melbourne home hope De Minaur 'not just making up the numbers'

-

Risking death, Indians mess with the bull at annual festival

-

Ghana's mentally ill trapped between prayer and care

Ghana's mentally ill trapped between prayer and care

-

UK, France mull social media bans for youth as debate rages

-

Japan PM to call snap election seeking stronger mandate

Japan PM to call snap election seeking stronger mandate

-

Switzerland's Ruegg sprints to second Tour Down Under title

-

China's Buddha artisans carve out a living from dying trade

China's Buddha artisans carve out a living from dying trade

-

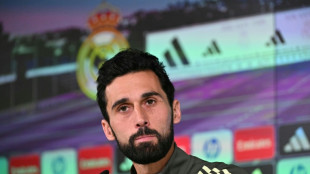

Stroking egos key for Arbeloa as Real Madrid host Monaco

-

'I never felt like a world-class coach', says Jurgen Klopp

'I never felt like a world-class coach', says Jurgen Klopp

-

Ruthless Anisimova races into Australian Open round two

-

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

-

South Korea, Italy agree to deepen AI, defence cooperation

-

Vietnam begins Communist Party congress to pick leaders

Vietnam begins Communist Party congress to pick leaders

-

China's 2025 economic growth among slowest in decades

-

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

-

Who said what at 2025 Africa Cup of Nations

-

Grizzlies win in London as heckler interrupts US anthem

Grizzlies win in London as heckler interrupts US anthem

-

Three-time finalist Medvedev grinds into Australian Open round two

-

Auger-Aliassime retires from Melbourne first round with cramp

Auger-Aliassime retires from Melbourne first round with cramp

-

Rams fend off Bears comeback as Patriots advance in NFL playoffs

-

Thousands march in US to back Iranian anti-government protesters

Thousands march in US to back Iranian anti-government protesters

-

Gotterup charges to Sony Open victory in Hawaii

-

Gold, silver hit records and stocks fall as Trump fans trade fears

Gold, silver hit records and stocks fall as Trump fans trade fears

-

Auger-Aliassime retires injured from Melbourne first round

-

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

-

China says economy grew 5% last year, among slowest in decades

-

Young star Zheng may have to give back Australian Open prize money

Young star Zheng may have to give back Australian Open prize money

-

Gauff overcomes wobble in winning start to Melbourne title bid

-

Harry set for final courtroom battle against UK media

Harry set for final courtroom battle against UK media

-

'It wasn't clean': Mother mourns son killed in US Maduro assault

-

Louvre heist probe: What we know

Louvre heist probe: What we know

-

Surging billionaire wealth a political threat, Oxfam warns as Davos opens

European stocks rise before central bank decisions on rates

Europe's main stock markets rose Thursday ahead of interest-rate decisions from the Bank of England and European Central Bank.

The BoE is widely expected to cut its main rate by a quarter point to 3.75 percent as UK inflation has fallen faster than expected. In a later decision Thursday, the ECB is forecast to keep eurozone borrowing costs unchanged.

"Risk sentiment is stabilising as we move towards the end of a week that is packed with policy risks and three central bank meetings," noted Kathleen Brooks, research director at trading group XTB, as traders awaited also Friday's rate decision from the Bank of Japan.

The British pound and euro were both down against the dollar awaiting the central bank updates in Europe. Investors will pore over also US inflation data due Thursday for clues on the outlook for Federal Reserve interest rates.

Asian stock markets mostly sank Thursday after Wednesday's sell-off on Wall Street as worries over the tech sector's colossal spending on artificial intelligence continued to dog investor sentiment.

Hopes for an end-of-year rally have been dealt a blow after the Fed last week hinted that it could pause its rate cuts next month while more questions are being asked about the cash pumped into AI.

Those worries were compounded Wednesday by a report that private capital group Blue Owl had pulled out of market giant Oracle's $10 billion data centre, putting the project in doubt.

That came after Oracle and chip giant Broadcom last week unveiled disappointing earnings reports.

Oracle's share price plunged more than five percent Wednesday, while Broadcom and other sector heavyweights -- including Nvidia, Alphabet and Advanced Micro Devices -- also tumbled.

In Europe, shares in BP rose slightly in late morning deals Thursday after the British energy giant appointed a new chief executive and as oil prices flattened.

- Key figures at around 1045 GMT -

London - FTSE 100: UP 0.3 percent at 9,798.77 points

Paris - CAC 40: UP 0.4 percent at 8,115.00

Frankfurt - DAX: UP 0.2 percent at 24,010.31

Tokyo - Nikkei 225: DOWN 1.0 percent at 49,001.50 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 25,447.44 (close)

Shanghai - Composite: UP 0.2 percent at 3,876.37 (close)

New York - Dow: DOWN 0.5 percent at 47,885.97 (close)

Euro/dollar: DOWN at $1.1727 from $1.1743 on Wednesday

Pound/dollar: DOWN at $1.3352 from $1.3379

Dollar/yen: UP at 155.89 yen from 155.70

Euro/pound: UP at 87.86 pence from 87.77

Brent North Sea Crude: FLAT at $59.69 per barrel

West Texas Intermediate: UP 0.1 percent at $55.86 per barrel

L.Wyss--VB