-

Trump to charge $1bn for permanent 'peace board' membership: reports

Trump to charge $1bn for permanent 'peace board' membership: reports

-

Trump says world 'not secure' until US has Greenland

-

Gold hits peak, stocks sink on new Trump tariff threat

Gold hits peak, stocks sink on new Trump tariff threat

-

Champions League crunch time as pressure piles on Europe's elite

-

Harry arrives at London court for latest battle against UK newspaper

Harry arrives at London court for latest battle against UK newspaper

-

Swiatek survives scare to make Australian Open second round

-

Over 400 Indonesians 'released' by Cambodian scam networks: ambassador

Over 400 Indonesians 'released' by Cambodian scam networks: ambassador

-

Japan PM calls snap election on Feb 8 to seek stronger mandate

-

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

Europe readying steps against Trump tariff 'blackmail' on Greenland: Berlin

-

What is the EU's anti-coercion 'bazooka' it could use against US?

-

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

Infantino condemns Senegal for 'unacceptable scenes' in AFCON final

-

Gold, silver hit peaks and stocks sink on new US-EU trade fears

-

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

Trailblazer Eala exits Australian Open after 'overwhelming' scenes

-

Warhorse Wawrinka stays alive at farewell Australian Open

-

Bangladesh face deadline over refusal to play World Cup matches in India

Bangladesh face deadline over refusal to play World Cup matches in India

-

High-speed train collision in Spain kills 39, injures dozens

-

Gold, silver hit peaks and stocks struggle on new US-EU trade fears

Gold, silver hit peaks and stocks struggle on new US-EU trade fears

-

Auger-Aliassime retires in Melbourne heat with cramp

-

Melbourne home hope De Minaur 'not just making up the numbers'

Melbourne home hope De Minaur 'not just making up the numbers'

-

Risking death, Indians mess with the bull at annual festival

-

Ghana's mentally ill trapped between prayer and care

Ghana's mentally ill trapped between prayer and care

-

UK, France mull social media bans for youth as debate rages

-

Japan PM to call snap election seeking stronger mandate

Japan PM to call snap election seeking stronger mandate

-

Switzerland's Ruegg sprints to second Tour Down Under title

-

China's Buddha artisans carve out a living from dying trade

China's Buddha artisans carve out a living from dying trade

-

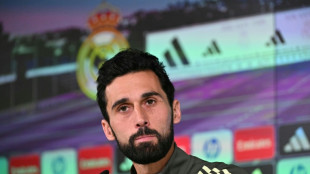

Stroking egos key for Arbeloa as Real Madrid host Monaco

-

'I never felt like a world-class coach', says Jurgen Klopp

'I never felt like a world-class coach', says Jurgen Klopp

-

Ruthless Anisimova races into Australian Open round two

-

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

Australia rest Cummins, Hazlewood, Maxwell for Pakistan T20 series

-

South Korea, Italy agree to deepen AI, defence cooperation

-

Vietnam begins Communist Party congress to pick leaders

Vietnam begins Communist Party congress to pick leaders

-

China's 2025 economic growth among slowest in decades

-

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

Gauff, Medvedev through in Australia as Djokovic begins record Slam quest

-

Who said what at 2025 Africa Cup of Nations

-

Grizzlies win in London as heckler interrupts US anthem

Grizzlies win in London as heckler interrupts US anthem

-

Three-time finalist Medvedev grinds into Australian Open round two

-

Auger-Aliassime retires from Melbourne first round with cramp

Auger-Aliassime retires from Melbourne first round with cramp

-

Rams fend off Bears comeback as Patriots advance in NFL playoffs

-

Thousands march in US to back Iranian anti-government protesters

Thousands march in US to back Iranian anti-government protesters

-

Gotterup charges to Sony Open victory in Hawaii

-

Gold, silver hit records and stocks fall as Trump fans trade fears

Gold, silver hit records and stocks fall as Trump fans trade fears

-

Auger-Aliassime retires injured from Melbourne first round

-

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

Gauff through, Auger-Aliassime retires as Djokovic begins record quest

-

China says economy grew 5% last year, among slowest in decades

-

Young star Zheng may have to give back Australian Open prize money

Young star Zheng may have to give back Australian Open prize money

-

Gauff overcomes wobble in winning start to Melbourne title bid

-

Harry set for final courtroom battle against UK media

Harry set for final courtroom battle against UK media

-

'It wasn't clean': Mother mourns son killed in US Maduro assault

-

Louvre heist probe: What we know

Louvre heist probe: What we know

-

Surging billionaire wealth a political threat, Oxfam warns as Davos opens

Asian markets track Wall St lower as AI fears mount

Asian markets sank Thursday after another sell-off on Wall Street as worries over the tech sector's colossal spending on artificial intelligence continued to dog investor sentiment.

Hopes for an end-of-year rally have been dealt a blow after the Federal Reserve last week hinted that it could pause its interest rate cuts next month while more questions are being asked about the cash pumped into AI.

While the US central bank's three successive rate reductions have provided a boost to equities in the back end of the year, some fear that support will be taken away.

Key US inflation data due later Thursday could provide some idea about officials' plans after a jobs report Tuesday provided little clarity.

Focus is now back on the tech sector amid rising speculation that a bubble has formed and could be close to popping.

While software and chip firms have led a surge in markets to record highs this year, a growing number of investors are beginning to wonder whether their valuations have been stretched and are asking when the cash pumped into AI will start to see returns.

Those worries were compounded Wednesday by a report that private capital group Blue Owl had pulled out of market giant Oracle's $10 billion data centre, putting the project in doubt.

That came after Oracle and chip giant Broadcom last week unveiled disappointing earnings reports.

Oracle plunged more than five percent Wednesday, while Broadcom and other sector heavyweights, including Nvidia, Alphabet and Advanced Micro Devices, also tumbled.

The Nasdaq on Wall Street dived 1.8 percent and the broader S&P 500 was off more than one percent.

Michael Hewson at CMC Markets said the "surge in valuations has... prompted fears of a bubble in the sector with some wild swings in recent weeks on the back of some end-of-year profit taking".

He added that there was "some chatter that 2026 could prompt a bit of a reset when it comes to AI winners, and AI losers".

Asian markets tracked the US losses, led by tech firms including Japan's Renesas and investment giant SoftBank.

Tokyo shed more than one percent along with Seoul, while Hong Kong, Sydney, Singapore, Wellington, Taipei, Manila and Jakarta were also in the red. Shanghai was flat.

Oil prices rose more than one percent for a second successive day after Washington said US forces carried out a strike on a vessel it said was engaged in drug trafficking in the Pacific Ocean, killing four "narco-terrorists".

The move ramped up concerns about Donald Trump's plans for Venezuela after he ordered a blockade of "sanctioned" oil tankers heading to and leaving the country.

The US president's Venezuelan counterpart Nicolas Maduro claims the White House is seeking regime change instead of its stated goal of stopping drug trafficking.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.0 percent at 49,006.89 (break)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 25,414.87

Shanghai - Composite: FLAT at 3,870.37

Euro/dollar: DOWN at $1.1739 from $1.1743 on Wednesday

Pound/dollar: DOWN at $1.3367 from $1.3379

Dollar/yen: UP at 155.78 yen from 155.70

Euro/pound: UP at 87.82 pence from 87.77

West Texas Intermediate: UP 1.7 percent at $56.90 per barrel

Brent North Sea Crude: UP 1.6 percent at $60.61 per barrel

New York - Dow: DOWN 0.5 percent at 47,885.97 (close)

London - FTSE 100: UP 0.9 percent at 9,774.32 (close)

L.Stucki--VB