-

Balkan wild rivers in steady decline: study

Balkan wild rivers in steady decline: study

-

Injured Capuozzo misses out on Italy Six Nations squad

-

Mourners pay last respects to Italian icon Valentino

Mourners pay last respects to Italian icon Valentino

-

EU parliament refers Mercosur trade deal to bloc's top court

-

Odermatt seeks first Kitzbuehel victory with eye on Olympics

Odermatt seeks first Kitzbuehel victory with eye on Olympics

-

Italy's Brignone to be rested for Spindleruv Mlyn giant slalom

-

Alcaraz spearheads big names into Australian Open third round

Alcaraz spearheads big names into Australian Open third round

-

European stocks dip ahead of Trump's Davos speech

-

Trump flies into Davos maelstrom over Greenland

Trump flies into Davos maelstrom over Greenland

-

EU won't ask Big Tech to pay for telecoms overhaul

-

Railway safety questioned as Spain reels from twin train disasters

Railway safety questioned as Spain reels from twin train disasters

-

Marcell Jacobs back with coach who led him to Olympic gold

-

Syria army enters Al-Hol camp holding relatives of jihadists: AFP

Syria army enters Al-Hol camp holding relatives of jihadists: AFP

-

Brook apologises, admits nightclub fracas 'not the right thing to do'

-

NATO chief says 'thoughtful diplomacy' only way to deal with Greenland crisis

NATO chief says 'thoughtful diplomacy' only way to deal with Greenland crisis

-

Widow of Iran's last shah says 'no turning back' after protests

-

Waugh targets cricket's 'last great frontier' with European T20 venture

Waugh targets cricket's 'last great frontier' with European T20 venture

-

Burberry sales rise as China demand improves

-

Botswana warns diamond oversupply to hit growth

Botswana warns diamond oversupply to hit growth

-

Spaniard condemns 'ignorant drunks' after Melbourne confrontation

-

Philippines to end short-lived ban on Musk's Grok chatbot

Philippines to end short-lived ban on Musk's Grok chatbot

-

Police smash European synthetic drug ring in 'largest-ever' op

-

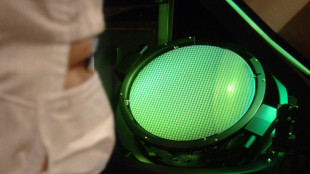

Japan to restart world's biggest nuclear plant Wednesday

Japan to restart world's biggest nuclear plant Wednesday

-

South Korean ex-PM Han gets 23 years jail for martial law role

-

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

-

Over 1,400 Indonesians left Cambodian scam groups in five days: embassy

-

Raducanu to 're-evaluate' after flat Australian Open exit

Raducanu to 're-evaluate' after flat Australian Open exit

-

Doncic triple-double leads Lakers comeback over Nuggets, Rockets down Spurs

-

Bangladesh will not back down to 'coercion' in India T20 World Cup row

Bangladesh will not back down to 'coercion' in India T20 World Cup row

-

Alcaraz comes good after shaky start to make Australian Open third round

-

Trump departs for Davos forum again after switching to new plane: AFP

Trump departs for Davos forum again after switching to new plane: AFP

-

Impressive Gauff storms into Australian Open third round

-

Dazzling Chinese AI debuts mask growing pains

Dazzling Chinese AI debuts mask growing pains

-

Medvedev battles into Melbourne third round after early scare

-

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

-

Turkey's Sonmez soaks in acclaim on historic Melbourne run

-

Sheppard leads Rockets to sink Spurs in Texas derby

Sheppard leads Rockets to sink Spurs in Texas derby

-

Sabalenka shuts down political talk after Ukrainian's ban call

-

Trump's plane returns to air base after 'minor' electrical issue: White House

Trump's plane returns to air base after 'minor' electrical issue: White House

-

Barcelona train crash kills 1 in Spain's second deadly rail accident in days

-

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

-

Japan ex-PM Abe's alleged killer faces verdict

-

Climate change fuels disasters, but deaths don't add up

Climate change fuels disasters, but deaths don't add up

-

Stocks stable after tariff-fuelled selloff but uncertainty boosts gold

-

What growth?: Taiwan's traditional manufacturers miss out on export boom

What growth?: Taiwan's traditional manufacturers miss out on export boom

-

'Super-happy' Sabalenka shines as Alcaraz gets set at Australian Open

-

With monitors and lawsuits, Pakistanis fight for clean air

With monitors and lawsuits, Pakistanis fight for clean air

-

Sabalenka sets up potential Raducanu showdown at Australian Open

-

Chile president picks Pinochet lawyers as ministers of human rights, defense

Chile president picks Pinochet lawyers as ministers of human rights, defense

-

Osaka says 'I'm a little strange' after Melbourne fashion statement

China retail sales grew at slowest pace in over a year

Retail sales in China grew last month at the slowest pace in over a year, official data showed Friday, highlighting the battle facing authorities' efforts to counteract persistent consumer malaise.

The world's second-largest economy has been confronted with sluggish domestic spending since the end of the Covid pandemic, with a prolonged debt crisis in the property sector weighing on sentiment.

Many economists argue that China must shift to a growth model driven more by consumption than infrastructure investment and exports, long the key sources of activity.

Leaders are targeting overall growth in 2025 of five percent, a goal experts say remains within reach despite an apparent slowdown in the latter half of the year.

"External instability and uncertainty factors remain numerous, domestic structural adjustment pressures are significant, and the stable operation of the economy faces many challenges," Fu Linghui, chief economist at the National Bureau of Statistics (NBS), told a news conference.

Retail sales rose 2.9 percent on-year last month, data from the NBS showed, slightly lower than the three percent increase recorded in September.

The figure represented the slowest increase since August of last year.

It also marked the fifth straight month of slowing growth since the peak of 6.4 percent reached in May.

The spending slump last month came as Beijing and Washington worked to ease a damaging trade war, with presidents Donald Trump and Xi Jinping agreeing in October to a one-year truce.

China's exports have largely remained resilient this year despite Washington's tariffs, with a decline in shipments to the United States offset by increases elsewhere, particularly Southeast Asia.

But spurring activity in the domestic economy has been more challenging.

At a Communist Party gathering last month that was focused on economic planning, leaders said the country must "vigorously boost consumption".

Moody's Ratings warned in a report this week that China's "domestic demand may be slow to revive".

After last month's meeting, priorities are "accelerating innovation in strategic technologies and reinforcing domestic demand through structural improvements in income distribution and social safety nets", the report said.

- Factory slowdown -

NBS data also showed factory activity in October fell short of expectations.

Industrial production rose 4.9 percent year-on-year, lower than a Bloomberg forecast of 5.5 percent and the slowest increase since August last year.

"A key drag came from weaker external demand -- export values and industrial sales for export both weakened significantly," Zichun Huang of Capital Economics said in a note about Friday's data.

"We expect the economy to remain weak over the coming quarter," she wrote, adding that Beijing's recent trade truce with Washington "is unlikely to provide much relief".

China's real estate sector has been mired in a debt crisis since 2020, having enjoyed a decades-long construction boom powered by rapid urbanisation and rising living standards.

Friday data showed home values -- a key store of wealth for Chinese households -- continued to decline.

Prices for new residential properties fell year-on-year in October in 61 out of 70 major cities surveyed by the NBS.

"The housing sector still clouds the overall outlook," wrote Sheana Yue, Senior Economist at Oxford Economics.

There is "limited policymaker appetite for new housing stimulus despite fading property momentum" she said, adding that "a nationwide turnaround remains distant".

In another worrying sign for policymakers, fixed-asset investment in the January-October period was down 1.7 percent year-on-year.

The indicator slipped into negative territory in September, falling 0.5 percent year-on-year.

F.Wagner--VB