-

Balkan wild rivers in steady decline: study

Balkan wild rivers in steady decline: study

-

Injured Capuozzo misses out on Italy Six Nations squad

-

Mourners pay last respects to Italian icon Valentino

Mourners pay last respects to Italian icon Valentino

-

EU parliament refers Mercosur trade deal to bloc's top court

-

Odermatt seeks first Kitzbuehel victory with eye on Olympics

Odermatt seeks first Kitzbuehel victory with eye on Olympics

-

Italy's Brignone to be rested for Spindleruv Mlyn giant slalom

-

Alcaraz spearheads big names into Australian Open third round

Alcaraz spearheads big names into Australian Open third round

-

European stocks dip ahead of Trump's Davos speech

-

Trump flies into Davos maelstrom over Greenland

Trump flies into Davos maelstrom over Greenland

-

EU won't ask Big Tech to pay for telecoms overhaul

-

Railway safety questioned as Spain reels from twin train disasters

Railway safety questioned as Spain reels from twin train disasters

-

Marcell Jacobs back with coach who led him to Olympic gold

-

Syria army enters Al-Hol camp holding relatives of jihadists: AFP

Syria army enters Al-Hol camp holding relatives of jihadists: AFP

-

Brook apologises, admits nightclub fracas 'not the right thing to do'

-

NATO chief says 'thoughtful diplomacy' only way to deal with Greenland crisis

NATO chief says 'thoughtful diplomacy' only way to deal with Greenland crisis

-

Widow of Iran's last shah says 'no turning back' after protests

-

Waugh targets cricket's 'last great frontier' with European T20 venture

Waugh targets cricket's 'last great frontier' with European T20 venture

-

Burberry sales rise as China demand improves

-

Botswana warns diamond oversupply to hit growth

Botswana warns diamond oversupply to hit growth

-

Spaniard condemns 'ignorant drunks' after Melbourne confrontation

-

Philippines to end short-lived ban on Musk's Grok chatbot

Philippines to end short-lived ban on Musk's Grok chatbot

-

Police smash European synthetic drug ring in 'largest-ever' op

-

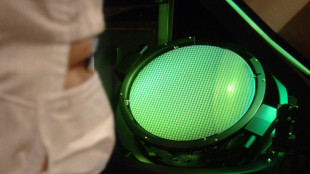

Japan to restart world's biggest nuclear plant Wednesday

Japan to restart world's biggest nuclear plant Wednesday

-

South Korean ex-PM Han gets 23 years jail for martial law role

-

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

Alcaraz, Sabalenka, Gauff surge into Australian Open third round

-

Over 1,400 Indonesians left Cambodian scam groups in five days: embassy

-

Raducanu to 're-evaluate' after flat Australian Open exit

Raducanu to 're-evaluate' after flat Australian Open exit

-

Doncic triple-double leads Lakers comeback over Nuggets, Rockets down Spurs

-

Bangladesh will not back down to 'coercion' in India T20 World Cup row

Bangladesh will not back down to 'coercion' in India T20 World Cup row

-

Alcaraz comes good after shaky start to make Australian Open third round

-

Trump departs for Davos forum again after switching to new plane: AFP

Trump departs for Davos forum again after switching to new plane: AFP

-

Impressive Gauff storms into Australian Open third round

-

Dazzling Chinese AI debuts mask growing pains

Dazzling Chinese AI debuts mask growing pains

-

Medvedev battles into Melbourne third round after early scare

-

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

Denmark's Andresen upstages sprint stars to take Tour Down Under opener

-

Turkey's Sonmez soaks in acclaim on historic Melbourne run

-

Sheppard leads Rockets to sink Spurs in Texas derby

Sheppard leads Rockets to sink Spurs in Texas derby

-

Sabalenka shuts down political talk after Ukrainian's ban call

-

Trump's plane returns to air base after 'minor' electrical issue: White House

Trump's plane returns to air base after 'minor' electrical issue: White House

-

Barcelona train crash kills 1 in Spain's second deadly rail accident in days

-

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

North produces enough nuclear material a year for 10-20 weapons: S. Korea president

-

Japan ex-PM Abe's alleged killer faces verdict

-

Climate change fuels disasters, but deaths don't add up

Climate change fuels disasters, but deaths don't add up

-

Stocks stable after tariff-fuelled selloff but uncertainty boosts gold

-

What growth?: Taiwan's traditional manufacturers miss out on export boom

What growth?: Taiwan's traditional manufacturers miss out on export boom

-

'Super-happy' Sabalenka shines as Alcaraz gets set at Australian Open

-

With monitors and lawsuits, Pakistanis fight for clean air

With monitors and lawsuits, Pakistanis fight for clean air

-

Sabalenka sets up potential Raducanu showdown at Australian Open

-

Chile president picks Pinochet lawyers as ministers of human rights, defense

Chile president picks Pinochet lawyers as ministers of human rights, defense

-

Osaka says 'I'm a little strange' after Melbourne fashion statement

Asian markets sink on concerns over tech rally, Fed rates

Asian markets sank Friday, tracking a selloff on Wall Street as worries over next month's Federal Reserve interest rate decision and persistent speculation about a tech bubble dampened sentiment.

With the US shutdown saga now out the way, focus returned to the central bank's policy meeting next month, when officials will decide whether or not to lower borrowing costs again.

For much of the year, equities have been boosted by optimism that rates would come down, despite persistent inflation, and the Fed has delivered at its past two gatherings.

But comments from bank boss Jerome Powell last month that a December repeat was not "a foregone conclusion" sowed the seeds of doubt, while several other decision-makers have made similar noises.

The latest came this week, with three regional presidents voicing concerns about moving while inflation remained stubbornly high.

St. Louis head Alberto Musalem urged "caution", adding that "there’s limited room for further easing without monetary policy becoming overly accommodative".

His Minneapolis counterpart Neel Kashkari, who called for a pause in October, pointed to "underlying resilience in economic activity, more than I had expected".

And Cleveland's Beth Hammack told the Pittsburgh Economic Club: "On balance, I think we need to remain somewhat restrictive to continue putting pressure to bring inflation down toward our target."

She called current rates "barely restrictive, if at all" and that "we need to keep rates around these levels".

The comments come as investors await the release of economic data that had been held up by the record shutdown, with jobs and inflation the main focus, even though some are expected to be incomplete.

"As we await this schedule, we've seen some recalibration of expectations around whether the Fed cuts by 25 basis points on 10 December," wrote Pepperstone's Chris Weston.

He added that markets saw a 52 percent chance of a cut, down from 60 percent the day before.

The dimmer outlook for rates compounded worries that the tech sector may be overpriced after an AI-fuelled surge this year that has sent markets to records.

There is growing talk that the mind-boggling amounts of cash invested in artificial intelligence may take some time to be realised as profit.

Chip titan "Nvidia's earnings (are) the key bottom-up focal point next week -- potentially prompting traders to de-risk, lock in performance and sit tight until the tape turns and risk appetite returns into year-end", said Weston.

All three main indexes on Wall Street ended well in the red, with the tech-rich Nasdaq down more than two percent, while the Dow and S&P 500 were each off 1.7 percent.

And Asia followed the lead, having enjoyed a broadly positive week.

Tokyo, Hong Kong, Sydney and Taipei all shed at least one percent and Seoul -- which has hit multiple records of late -- shed more than two percent.

There were also losses in Shanghai, Singapore and Wellington.

Oil rallied after the International Energy Agency flagged risks to Russian output caused by hefty sanctions imposed by Washington last month, including the country's top two producers.

The IEA said the decision could have "the most far-reaching impact yet on global oil markets".

Friday's surge of more than two percent came days after the commodity tumbled following OPEC's monthly crude market report, which forecast an oversupply in the third quarter.

- Key figures at around 0230 GMT -

Tokyo - Nikkei 225: DOWN 1.7 percent at 50,434.54 (break)

Hong Kong - Hang Seng Index: DOWN 1.0 percent at 26,804.22

Shanghai - Composite: DOWN 0.2 percent at 4,022.82

Dollar/yen: UP at 154.55 yen from 154.53 yen on Thursday

Euro/dollar: DOWN at $1.1632 from $1.1634

Pound/dollar: DOWN at $1.3142 from $1.3189

Euro/pound: UP at 88.50 pence from 88.21 pence

West Texas Intermediate: UP 2.7 percent at $60.27 per barrel

Brent North Sea Crude: UP 2.4 percent at $64.49 per barrel

L.Stucki--VB