-

Canada's Patrick Watson channels dread into new 'Uh Oh' album

Canada's Patrick Watson channels dread into new 'Uh Oh' album

-

Trump brands indicted opponent Comey a 'dirty cop'

-

Walker an all-time great, says Guardiola ahead of Man City return

Walker an all-time great, says Guardiola ahead of Man City return

-

Alonso warns against overconfidence before Madrid derby

-

Fritz says path to Grand Slam glory goes through Alcaraz, Sinner

Fritz says path to Grand Slam glory goes through Alcaraz, Sinner

-

UK court drops terror case against Kneecap rapper

-

UK's Starmer urges liberals to fight 'the lies' told by far right

UK's Starmer urges liberals to fight 'the lies' told by far right

-

Bagnaia and Pennetta among first Winter Olympic torch carriers: organisers

-

Sarkozy conviction exposes political divide in crisis-hit France

Sarkozy conviction exposes political divide in crisis-hit France

-

Ryder Cup begins in electric atmosphere at Bethpage Black

-

UK to launch digital ID scheme to curb illegal migration

UK to launch digital ID scheme to curb illegal migration

-

Chelsea's Palmer sidelined with groin injury

-

India retires Soviet fighter jet after six decades

India retires Soviet fighter jet after six decades

-

Slovak parliament approves anti-LGBTQ constitutional change

-

Train tragedy hunger striker captures hearts in Greece

Train tragedy hunger striker captures hearts in Greece

-

I.Coast historic beachside town boasts new modern art museum

-

PSG captain Marquinhos out with thigh injury

PSG captain Marquinhos out with thigh injury

-

UK court drops terror charge against Kneecap rapper

-

Turkish Airlines inks big Boeing deal after Erdogan visits US

Turkish Airlines inks big Boeing deal after Erdogan visits US

-

Liverpool's Leoni faces year out after ACL injury on debut

-

'We are not afraid,' jailed Istanbul mayor tells court

'We are not afraid,' jailed Istanbul mayor tells court

-

Canada's women tilt for World Cup thanks to 'incredible' crowdfunding

-

India retires 'flying coffin' Soviet fighter jet after six decades

India retires 'flying coffin' Soviet fighter jet after six decades

-

Erasmus makes late Springboks change as Nche injured

-

Ukrainian YouTuber arrested in Japan over Fukushima livestream

Ukrainian YouTuber arrested in Japan over Fukushima livestream

-

Foreign doctors in Gaza describe worst wounds 'they've ever seen'

-

India-Pakistan to clash in first Asia Cup final

India-Pakistan to clash in first Asia Cup final

-

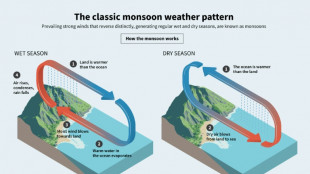

South Asia monsoon: climate change's dangerous impact on lifeline rains

-

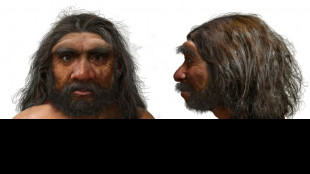

Million-year-old skull could change human evolution timeline

Million-year-old skull could change human evolution timeline

-

Gauff launches China Open title defence in style

-

Netanyahu set for defiant UN speech as Trump warns on annexation

Netanyahu set for defiant UN speech as Trump warns on annexation

-

The world's last linen beetling mill eyes strong future

-

Iran sanctions look set to return after last-ditch UN vote

Iran sanctions look set to return after last-ditch UN vote

-

Poland cools on Ukrainians despite their economic success

-

Canada signs free trade agreement with Indonesia

Canada signs free trade agreement with Indonesia

-

Danish airport closes again after suspected new drone sighting

-

Cheap moonshine kills 11 in Colombia

Cheap moonshine kills 11 in Colombia

-

Quake-hit Myanmar city becomes epicentre of junta election offensive

-

400,000 evacuated, 3 dead as fresh storm batters Philippines

400,000 evacuated, 3 dead as fresh storm batters Philippines

-

In India's Mumbai, the largest slum in Asia is for sale

-

Red-hot Liverpool face Palace test as Arsenal try to keep pace

Red-hot Liverpool face Palace test as Arsenal try to keep pace

-

Israeli strikes kill 9 in Yemen's rebel-held capital: Huthis

-

Cardinals agony as Seahawks snatch victory

Cardinals agony as Seahawks snatch victory

-

Cameroon's president Biya: absent candidate in election

-

Asian markets drop as US data, new tariff threats dent sentiment

Asian markets drop as US data, new tariff threats dent sentiment

-

Spanish great Busquets to retire after MLS season

-

Title-chasing Marquez third-fastest in first Japan MotoGP practice

Title-chasing Marquez third-fastest in first Japan MotoGP practice

-

Wallabies primed for "pressure cooker" All Blacks Test

-

Sought by luxury labels, Nigerian leather reclaims home market

Sought by luxury labels, Nigerian leather reclaims home market

-

Heavy hand: Free-market US tested as Trump takes stakes in private companies

Oil prices drop following Trump's Iran comments, US stocks rise

Oil prices dropped Wednesday as comments by President Donald Trump trimmed concerns about an imminent US intervention in the Israel-Iran conflict.

Meanwhile, Wall Street's main indices advanced in late morning trading as investors also awaited the Federal Reserve rate decision, although they were mixed elsewhere.

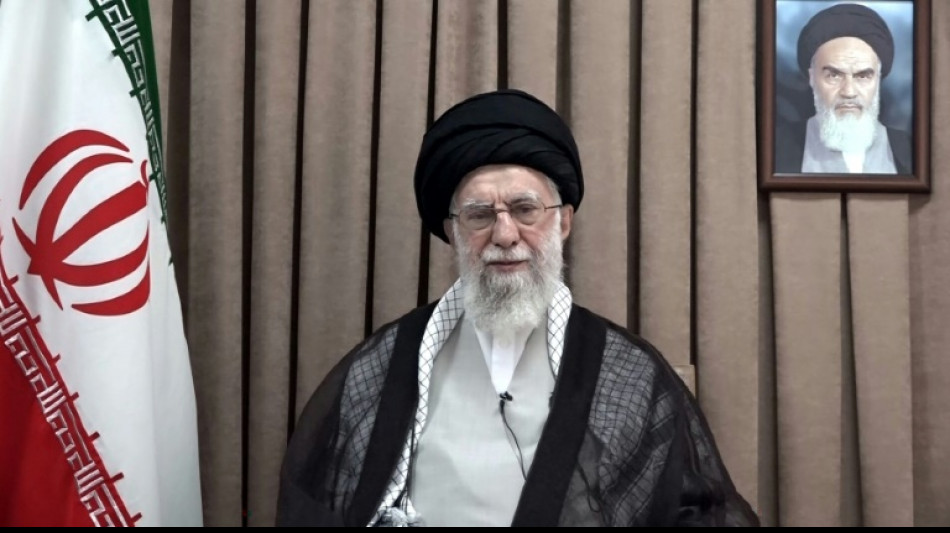

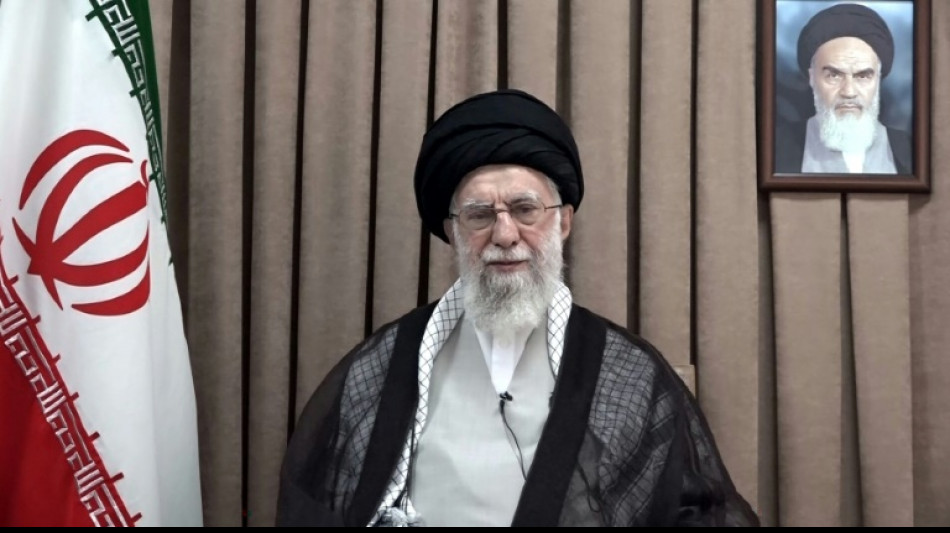

Oil prices initially rose after Iran's supreme leader Ali Khamenei rejected US President Donald Trump's demand for an "unconditional surrender", adding to sharp gains made the previous day.

Six days into the conflict, Khamenei warned the United States would face "irreparable damage" if it intervenes in support of Israel.

But oil prices then fell after Trump spoke later and indicated he was still considering whether the United States would join Israeli strikes and indicated that Iran had reached out to seek negotiations.

"For now at least, the US is not getting involved, if one can believe Trump," said City Index and FOREX.com analyst Fawad Razaqzada.

Despite heightened tensions, "there has been no sense of panic from investors", said David Morrison, market analyst at financial services firm Trade Nation.

"As far as the US is concerned, events are taking place a long way from home," he said.

"But there's also a feeling that investors are betting on a short and sharp engagement, resulting in a more stable position across the Middle East than the one that currently exists."

Of particular concern, however, is the possibility of Iran shutting off the Strait of Hormuz, through which around one fifth of global oil supply is transported.

In Europe, the London stock market rose but Paris and Frankfurt ended the day down. Asian equities closed mixed as well.

- Fed watch -

The Federal Reserve is widely expected to hold interest rates steady on Wednesday, as officials gauge the impact of US tariffs on inflation.

The central bank has ignored calls from Trump to cut borrowing costs as the world's biggest economy faces pressure.

Trump again publicly berated Fed chief Jerome Powell on Wednesday, calling him a "stupid person" for not cutting interest rates.

The Federal Reserve will also release on Wednesday its rate and economic growth outlook for the rest of the year, which are expected to take account of Trump's tariff war.

Weak US retail sales and factory output data on Tuesday rekindled worries about the impact of tariffs on the economy but also provided hope that the Fed would still cut rates this year.

"The Fed would no doubt be cutting again by now if not for the uncertainty regarding tariffs and a recent escalation of tensions in the Middle East," said KPMG senior economist Benjamin Shoesmith.

In a busy week for monetary policy, Sweden's central bank cut its key interest rate on Wednesday to try and boost the country's economy, as it cited risks linked to trade tensions and the escalating conflict in the Middle East.

The Bank of England is expected to keep its key rate steady Thursday, especially after official data Wednesday showed UK annual inflation fell less than expected in May.

The Bank of Japan on Tuesday kept interest rates unchanged and said it would taper its purchase of government bonds at a slower pace, as trade uncertainty threatens to weigh on the world's number four economy.

- Key figures at around 1530 GMT -

Brent North Sea Crude: DOWN 2.0 percent at $74.93 per barrel

West Texas Intermediate: DOWN 2.0 percent at $71.82 per barrel

New York - Dow: UP 0.5 percent at 42,411.50 points

New York - S&P 500: UP 0.4 percent at 6,007.85

New York - Nasdaq Composite: UP 0.5 percent at 19,624.09

London - FTSE 100: UP 0.1 at 8,843.47 (close)

Paris - CAC 40: DOWN 0.4 percent at 7,656.12 (close)

Frankfurt - DAX: DOWN 0.5 percent at 23,317.81 (close)

Tokyo - Nikkei 225: UP 0.9 percent at 38,885.15 (close)

Hong Kong - Hang Seng Index: DOWN 1.1 percent at 23,710.69 (close)

Shanghai - Composite: FLAT at 3,388.81 (close)

Euro/dollar: UP at $1.1530 from $1.1488 on Tuesday

Pound/dollar: UP at $1.3471 from $1.3425

Dollar/yen: DOWN at 144.59 yen from 145.27 yen

Euro/pound: UP at 85.59 pence from 85.54 pence

burs-rl/rmb

U.Maertens--VB