-

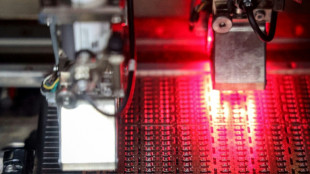

OpenAI signs multi-billion dollar chip deal with AMD

OpenAI signs multi-billion dollar chip deal with AMD

-

Salah under fire as Liverpool star loses his spark

-

Paris stocks drop as French PM resigns, Tokyo soars

Paris stocks drop as French PM resigns, Tokyo soars

-

ICC finds Sudan militia chief guilty of crimes against humanity

-

Zverev dumped out of Shanghai Masters by France's Rinderknech

Zverev dumped out of Shanghai Masters by France's Rinderknech

-

One hiker dead, hundreds rescued after heavy snowfall in China

-

Hundreds stage fresh anti-government protests in Madagascar

Hundreds stage fresh anti-government protests in Madagascar

-

Feminist icon Gisele Pelicot back in court as man appeals rape conviction

-

US government shutdown enters second week

US government shutdown enters second week

-

Kasatkina ends WTA season early after hitting 'breaking point'

-

Paris stocks drop as French PM resigns

Paris stocks drop as French PM resigns

-

Death toll from Indonesia school collapse rises to 63

-

Medicine Nobel to trio who identified immune system's 'security guards'

Medicine Nobel to trio who identified immune system's 'security guards'

-

UN rights council launches probe into violations in Afghanistan

-

UK author Jilly Cooper dies aged 88

UK author Jilly Cooper dies aged 88

-

Jilly Cooper: Britain's queen of the 'bonkbuster' novel

-

Streaming stars' Le Mans race scores Twitch viewer record

Streaming stars' Le Mans race scores Twitch viewer record

-

England rugby star Moody 'shocked' by motor neurone disease diagnosis

-

Leopard captured after wandering into Indonesian hotel

Leopard captured after wandering into Indonesian hotel

-

Israel, Hamas due in Egypt for ceasefire talks

-

Rescuers scramble to deliver aid after deadly Nepal, India floods

Rescuers scramble to deliver aid after deadly Nepal, India floods

-

Tokyo stocks soar on Takaichi win, Paris sinks as French PM resigns

-

OpenAI offers more copyright control for Sora 2 videos

OpenAI offers more copyright control for Sora 2 videos

-

Australia prosecutors appeal 'inadequate' sentence for mushroom murderer: media

-

Rugby World Cup-winning England star Moody has motor neurone disease

Rugby World Cup-winning England star Moody has motor neurone disease

-

Trump says White House to host UFC fight on his 80th birthday

-

Vast reserves, but little to drink: Tajikistan's water struggles

Vast reserves, but little to drink: Tajikistan's water struggles

-

US government shutdown may last weeks, analysts warn

-

Arsenal host Lyon to start new Women's Champions League format

Arsenal host Lyon to start new Women's Champions League format

-

Gloves off, Red run, vested interests: Singapore GP talking points

-

Bills, Eagles lose unbeaten records in day of upsets

Bills, Eagles lose unbeaten records in day of upsets

-

Muller on target as Vancouver thrash San Jose to go joint top

-

Tokyo soars, yen sinks after Takaichi win on mixed day for Asia

Tokyo soars, yen sinks after Takaichi win on mixed day for Asia

-

China's chip challenge: the race to match US tech

-

UN rights council to decide on creating Afghanistan probe

UN rights council to decide on creating Afghanistan probe

-

Indonesia sense World Cup chance as Asian qualifying reaches climax

-

ICC to give war crimes verdict on Sudan militia chief

ICC to give war crimes verdict on Sudan militia chief

-

Matthieu Blazy to step out as Coco's heir in Chanel debut

-

Only man to appeal in Gisele Pelicot case says not a 'rapist'

Only man to appeal in Gisele Pelicot case says not a 'rapist'

-

Appetite-regulating hormones in focus as first Nobel Prizes fall

-

Gisele Pelicot: French rape survivor and global icon

Gisele Pelicot: French rape survivor and global icon

-

Negotiators due in Egypt for Gaza talks as Trump urges quick action

-

'My heart sank': Surging scams roil US job hunters

'My heart sank': Surging scams roil US job hunters

-

Competition heats up to challenge Nvidia's AI chip dominance

-

UK police to get greater powers to restrict demos

UK police to get greater powers to restrict demos

-

Global Tech Pioneers CZ and Co-Founder of Shazam to Headline FinTech Forward 2025 in Bahrain

-

Guerrero grand slam fuels Blue Jays in 13-7 rout of Yankees

Guerrero grand slam fuels Blue Jays in 13-7 rout of Yankees

-

Five-try Bayonne stun champions Toulouse to go top in France

-

Fisk reels in Higgo to win maiden PGA Tour title in Mississippi

Fisk reels in Higgo to win maiden PGA Tour title in Mississippi

-

Aces overpower Mercury for 2-0 lead in WNBA Finals

| NGG | -0.03% | 73.41 | $ | |

| SCS | -0.44% | 17.035 | $ | |

| BCC | -1.5% | 76.48 | $ | |

| JRI | -0.46% | 14.235 | $ | |

| GSK | 1.06% | 43.815 | $ | |

| RELX | 0.26% | 46.53 | $ | |

| RIO | 1.68% | 67.24 | $ | |

| CMSD | -0.58% | 24.31 | $ | |

| BCE | -0.91% | 23.15 | $ | |

| RYCEF | -0.06% | 15.75 | $ | |

| BTI | -0.45% | 51.01 | $ | |

| BP | 2.46% | 35.02 | $ | |

| AZN | 0.86% | 86.05 | $ | |

| VOD | -0.49% | 11.305 | $ | |

| RBGPF | -2.92% | 76 | $ | |

| CMSC | -0.32% | 23.795 | $ |

US stocks edge higher while dollar dips after Moody's downgrade

Wall Street stocks finished a meandering session higher Monday, shrugging off Moody's downgrade of US sovereign debt, which could balloon further.

Yields of US Treasury bonds spiked early in the day in a dynamic that revived talk of the "Sell America" narrative that unsettled markets in early April following President Donald Trump's sweeping tariff announcements.

But US Treasury yields subsequently eased as markets concluded that Moody's analysis contained no surprises.

After the knee-jerk reaction, "the market settles down and focuses on the economic fundamentals," said Subadra Rajappa, head of US rates strategy at Societe Generale.

The downgrade reflects serious concerns about the US' fiscal picture, but these were well known prior to the Moody's downgrade, Rajappa said.

All three major US indices finished with modest gains.

The dollar retreated somewhat against the euro and other major currencies. But the move was less substantial than during most volatile stretches earlier this year.

In comparison with that turbulent period, a closely-watched volatility index remained relatively stable on Monday. Stocks have rallied since Trump suspended many of his most onerous tariff measures.

Gold, seen as a safe haven investment, jumped more than one percent.

In Europe, London and Frankfurt erased early losses to close higher after UK and EU leaders reached a series of defense and trade accords at a landmark summit, the first since Britain's acrimonious exit from the European Union.

British Prime Minister Keir Starmer said leaders had agreed a "win-win" deal that his office said would add nearly £9 billion ($12 billion) to the British economy by 2040.

The euro, meanwhile, strengthened despite a cut to the eurozone's 2025 economic growth forecast due to global trade tensions sparked by Trump's tariffs.

The European Commission said the 20-country single currency area's economy should grow 0.9 percent in 2025 -- down from a previous forecast of 1.3 percent -- due to "a weakening global trade outlook and higher trade policy uncertainty".

"Underpinned by a robust labor market and rising wages, growth is expected to continue in 2025, albeit at a moderate pace," EU economy chief Valdis Dombrovskis said.

In company news, Walmart returned to the list of firms feeling a rollercoaster effect under Trump, after the US president slammed the retail giant for warning of price increases due to his tariffs.

Trump called on the company to "EAT THE TARIFFS" on social media, adding, "I'll be watching."

Walmart shares finished slightly lower on Monday.

- Key figures at around 2030 GMT -

New York - Dow: UP 0.3 percent at 42,792.07 (close)

New York - S&P 500: UP 0.1 percent at 5,963.60 (close)

New York - Nasdaq Composite: UP less than 0.1 percent at 19,104.28

London - FTSE 100: UP 0.2 percent at 8,699.31 (close)

Paris - CAC 40: FLAT at 7,883.63 (close)

Frankfurt - DAX: UP 0.7 percent at 23,934.98 (close)

Tokyo - Nikkei 225: DOWN 0.7 percent at 37,498.63 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 23,332.72 (close)

Shanghai - Composite: FLAT at 3,367.58 (close)

Euro/dollar: UP at $1.1244 from $1.1163 on Friday

Pound/dollar: UP at $1.3360 from $1.3283

Dollar/yen: DOWN at 144.87 yen from 145.70 yen

Euro/pound: UP at 84.14 pence from 84.04 pence

West Texas Intermediate: UP 0.3 percent at $62.69 per barrel

Brent North Sea Crude: UP 0.2 percent at $65.54 per barrel

burs-jmb/dw

F.Fehr--VB