-

Meta quarterly profit climbs despite big cloud spending

Meta quarterly profit climbs despite big cloud spending

-

US Supreme Court weighs public funding of religious charter school

-

Climate change made fire conditions twice as likely in South Korea blazes: study

Climate change made fire conditions twice as likely in South Korea blazes: study

-

Amorim says not even Europa League glory can save Man Utd's season

-

Syria reports Israeli strikes as clashes with Druze spread

Syria reports Israeli strikes as clashes with Druze spread

-

Ukraine, US say minerals deal ready as suspense lingers

-

Everything is fine: Trump's cabinet shrugs off shrinking economy

Everything is fine: Trump's cabinet shrugs off shrinking economy

-

Chelsea boss Maresca adamant money no guarantee of success

-

Wood warns England cricketers against 'dumb' public comments

Wood warns England cricketers against 'dumb' public comments

-

US economy shrinks, Trump blames Biden

-

Caterpillar so far not hiking prices to offset tariff hit

Caterpillar so far not hiking prices to offset tariff hit

-

Japan's Kawasaki down Ronaldo's Al Nassr to reach Asian Champions League final

-

Trump praises Musk as chief disruptor eyes exit

Trump praises Musk as chief disruptor eyes exit

-

Chahal hat-trick helps Punjab eliminate Chennai from IPL playoff race

-

Pope Francis saw clergy's lack of humility as a 'cancer': author

Pope Francis saw clergy's lack of humility as a 'cancer': author

-

Weinstein accuser recounts alleged rape at assault retrial in NY

-

Piastri heads into Miami GP as the man to beat

Piastri heads into Miami GP as the man to beat

-

US economy unexpectedly shrinks in first quarter, Trump blames Biden

-

Maxwell likely to miss rest of IPL with 'fractured finger'

Maxwell likely to miss rest of IPL with 'fractured finger'

-

Syria reports Israeli strikes after warning over Druze as sectarian clashes spread

-

Despite war's end, Afghanistan remains deep in crisis: UN relief chief

Despite war's end, Afghanistan remains deep in crisis: UN relief chief

-

NFL fines Falcons and assistant coach over Sanders prank call

-

British teen Brennan takes stage 1 of Tour de Romandie

British teen Brennan takes stage 1 of Tour de Romandie

-

Swedish reporter gets suspended term over Erdogan insult

-

Renewable energy in the dock in Spain after blackout

Renewable energy in the dock in Spain after blackout

-

South Africa sets up inquiry into slow apartheid justice

-

Stocks retreat as US GDP slumps rattles confidence

Stocks retreat as US GDP slumps rattles confidence

-

Migrants' dreams buried under rubble after deadly strike on Yemen centre

-

Trump blames Biden's record after US economy shrinks

Trump blames Biden's record after US economy shrinks

-

UK scientists fear insect loss as car bug splats fall

-

Mexico avoids recession despite tariff uncertainty

Mexico avoids recession despite tariff uncertainty

-

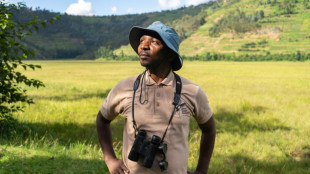

Rwandan awarded for saving grey crowned cranes

-

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

-

Microsoft president urges fast 'resolution' of transatlantic trade tensions

-

Poppies flourish at Tower of London for WWII anniversary

Poppies flourish at Tower of London for WWII anniversary

-

US economy unexpectedly shrinks on import surge before Trump tariffs

-

Stocks drop after US economy contracts amid tariffs turmoil

Stocks drop after US economy contracts amid tariffs turmoil

-

US economy unexpectedly shrinks on import surge ahead of Trump tariffs

-

Dravid says Suryavanshi, 14, needs support from fame

Dravid says Suryavanshi, 14, needs support from fame

-

Arsenal can win 'anywhere' says Merino after Champions League defeat by PSG

-

Bangladesh crush Zimbabwe by an innings in second Test

Bangladesh crush Zimbabwe by an innings in second Test

-

Swiatek recovers against Keys to reach Madrid Open semis

-

Spurs captain Son out of first leg of Europa League semi-final

Spurs captain Son out of first leg of Europa League semi-final

-

US economy unexpectedly shrinks in first three months of Trump presidency

-

India to ask caste status in next census for first time in decades

India to ask caste status in next census for first time in decades

-

Burkina junta rallies supporters after claimed coup 'plot'

-

Forest owner Marinakis steps back as European qualification looms

Forest owner Marinakis steps back as European qualification looms

-

US economy unexpectedly contracts in first three months of Trump presidency

-

Bilbao will give 'soul' to beat Man United: Nico Williams

Bilbao will give 'soul' to beat Man United: Nico Williams

-

Sweden arrests teen after triple killing

ECB cuts rates as Trump tariffs raise fears for eurozone growth

The European Central Bank cut interest rates again Thursday amid fears that US President Donald Trump's stop-start tariff announcements could threaten growth across the eurozone.

ECB policymakers decided to lower rates by a quarter-point, marking the central bank's sixth consecutive cut to borrowing costs for the single-currency area.

The decision brought the ECB's benchmark deposit rate down to 2.25 percent, the lowest it has been since the beginning of 2023.

Rate-setters have slowly lowered borrowing costs in the eurozone as inflation has drifted back towards the ECB's two-percent target.

But while inflation was headed in the right direction, "the outlook for growth has deteriorated owing to rising trade tensions", the ECB said in a statement.

The ECB had looked set to pause its cuts after its last meeting in March but the fears stirred up by Trump's whirlwind tariff policy look to have forced its hand.

Thursday's cut "came as little surprise", ING bank analyst Carsten Brzeski said.

Having sought a "very measured" approach to gradually bring rates down, the ECB now risked "falling behind the curve once again", Brzeski said.

- Tariff confusion -

Going into the meeting, ECB rate-setters will have had little idea what tariff rates would eventually apply to transatlantic trade -- and what impact they could have on growth.

Besides a basic 10 percent tariff rate on imports into the United States, Trump has also imposed 25 percent levies on the automotive, steel and aluminium sectors.

The US president spooked global markets with the unveiling of swingeing "Liberation Day" tariffs at the beginning of April, before promptly pausing higher duties for dozens of countries, including the EU, for 90 days.

The White House has also opened probes into chips and pharmaceuticals that could lead to more industry-specific tariffs that could impact the eurozone.

The ECB said it was facing "exceptional uncertainty" and would follow a "data-dependent and meeting-by-meeting" approach as it went forward.

The uncertainty was "likely to reduce confidence among households and firms", the central bank said, while market tensions would lead to tighter financing conditions.

In that context, another cut to relieve stress on households and businesses and support the economy seemed "straightforward", according to analysts at Italian lender UniCredit.

The ramifications of higher US tariffs would "outweigh the positive impulse" given by massive planned spending in the eurozone's biggest member, Germany, they said.

The incoming government in Berlin led by Friedrich Merz has lined up hundreds of billions of euros in extra cash for defence and infrastructure, providing a boost that could be felt across Europe.

- 'Always ready' -

But Germany's stimulus measures would only "kick in" in 2026, while the impact of Trump's shake-up of the global trading system would be felt almost immediately, the UniCredit analysts warned.

As for the prices of goods and services, US tariffs made a "further decline in inflation in the eurozone even more likely", said Robert Greil, a strategist at private bank Merck Finck.

Inflation among the 20 members of the eurozone has come down significantly from the double-digit highs seen in late 2022 and sat at 2.2 percent in March.

The single currency has gained in strength relative to the dollar, which should make imports cheaper going forward, while hefty US tariffs on China could see cheap goods diverted to Europe, Greil said.

Observers will listen carefully to ECB president Christine Lagarde's remarks after the rates announcement for a hint of how the ECB may respond going forward.

Lagarde last week signalled policymakers' willingness to support the eurozone in a more critical scenario, where Trump's tariff policy caused a threat to financial stability.

The ECB "is always ready to use the instruments that it has available", Lagarde said in Warsaw.

L.Maurer--VB