-

Israel's Netanyahu warns wildfires could reach Jerusalem

Israel's Netanyahu warns wildfires could reach Jerusalem

-

Istanbul lockdown aims to prevent May Day marches

-

Australian guard Daniels of Hawks named NBA's most improved

Australian guard Daniels of Hawks named NBA's most improved

-

Mexico City to host F1 races until 2028

-

Morales vows no surrender in bid to reclaim Bolivian presidency

Morales vows no surrender in bid to reclaim Bolivian presidency

-

Ukraine, US sign minerals deal, tying Trump to Kyiv

-

Phenomenons like Yamal born every 50 years: Inter's Inzaghi

Phenomenons like Yamal born every 50 years: Inter's Inzaghi

-

Ukraine, US say minerals deal ready as Kyiv hails sharing

-

Global stocks mostly rise following mixed economic data

Global stocks mostly rise following mixed economic data

-

O'Sullivan says he must play better to win eighth snooker world title after seeing off Si Jiahui

-

Sabalenka eases past Kostyuk into Madrid Open semis

Sabalenka eases past Kostyuk into Madrid Open semis

-

Netflix's 'The Eternaut' echoes fight against tyranny: actor Ricardo Darin

-

US economy unexpectedly shrinks, Trump blames Biden

US economy unexpectedly shrinks, Trump blames Biden

-

Barca fight back against Inter in sensational semi-final draw

-

Meta quarterly profit climbs despite big cloud spending

Meta quarterly profit climbs despite big cloud spending

-

US Supreme Court weighs public funding of religious charter school

-

Climate change made fire conditions twice as likely in South Korea blazes: study

Climate change made fire conditions twice as likely in South Korea blazes: study

-

Amorim says not even Europa League glory can save Man Utd's season

-

Syria reports Israeli strikes as clashes with Druze spread

Syria reports Israeli strikes as clashes with Druze spread

-

Ukraine, US say minerals deal ready as suspense lingers

-

Everything is fine: Trump's cabinet shrugs off shrinking economy

Everything is fine: Trump's cabinet shrugs off shrinking economy

-

Chelsea boss Maresca adamant money no guarantee of success

-

Wood warns England cricketers against 'dumb' public comments

Wood warns England cricketers against 'dumb' public comments

-

US economy shrinks, Trump blames Biden

-

Caterpillar so far not hiking prices to offset tariff hit

Caterpillar so far not hiking prices to offset tariff hit

-

Japan's Kawasaki down Ronaldo's Al Nassr to reach Asian Champions League final

-

Trump praises Musk as chief disruptor eyes exit

Trump praises Musk as chief disruptor eyes exit

-

Chahal hat-trick helps Punjab eliminate Chennai from IPL playoff race

-

Pope Francis saw clergy's lack of humility as a 'cancer': author

Pope Francis saw clergy's lack of humility as a 'cancer': author

-

Weinstein accuser recounts alleged rape at assault retrial in NY

-

Piastri heads into Miami GP as the man to beat

Piastri heads into Miami GP as the man to beat

-

US economy unexpectedly shrinks in first quarter, Trump blames Biden

-

Maxwell likely to miss rest of IPL with 'fractured finger'

Maxwell likely to miss rest of IPL with 'fractured finger'

-

Syria reports Israeli strikes after warning over Druze as sectarian clashes spread

-

Despite war's end, Afghanistan remains deep in crisis: UN relief chief

Despite war's end, Afghanistan remains deep in crisis: UN relief chief

-

NFL fines Falcons and assistant coach over Sanders prank call

-

British teen Brennan takes stage 1 of Tour de Romandie

British teen Brennan takes stage 1 of Tour de Romandie

-

Swedish reporter gets suspended term over Erdogan insult

-

Renewable energy in the dock in Spain after blackout

Renewable energy in the dock in Spain after blackout

-

South Africa sets up inquiry into slow apartheid justice

-

Stocks retreat as US GDP slumps rattles confidence

Stocks retreat as US GDP slumps rattles confidence

-

Migrants' dreams buried under rubble after deadly strike on Yemen centre

-

Trump blames Biden's record after US economy shrinks

Trump blames Biden's record after US economy shrinks

-

UK scientists fear insect loss as car bug splats fall

-

Mexico avoids recession despite tariff uncertainty

Mexico avoids recession despite tariff uncertainty

-

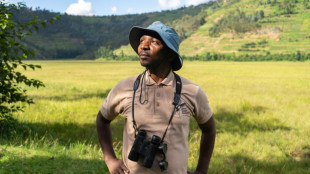

Rwandan awarded for saving grey crowned cranes

-

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

-

Microsoft president urges fast 'resolution' of transatlantic trade tensions

-

Poppies flourish at Tower of London for WWII anniversary

Poppies flourish at Tower of London for WWII anniversary

-

US economy unexpectedly shrinks on import surge before Trump tariffs

Stocks mixed as US hits Nvidia chip export to China

Wall Street shares fell but European stocks diverged Wednesday after the US government imposed restrictions on exports of a key Nvidia chip to China, the latest trade war salvo between the world's biggest economies.

After a relatively peaceful couple of days on markets following tariff-related volatility last week, investors were once again on the defensive, sending gold, a safe-haven asset in times of uncertainty, above $3,300 an ounce for the first time.

Wall Street's main indexes were down in late morning deals, with Nvidia shares tanking by more than six percent and the dollar under pressure again.

Nvidia notified regulators late Tuesday that it expects a $5.5 billion hit this quarter owing to a new US licencing requirement on the chip it can legally sell in China.

The company at the heart of helping to power artificial intelligence said it must obtain licences to export its H20 chips to the Asian country because of concerns they would be used in supercomputers there.

"It's another stark reminder that geopolitics and technology remain deeply entangled -- and that markets will continue to dance to Washington's tune, whether they like it or not," said Fawad Razaqzada, market analyst at City Index and Forex.com.

The United States on Monday opened the door to tariffs targeting semiconductors and chip-making equipment, with Trump saying on Sunday an announcement would be made "over the next week".

Trump has also kicked off an investigation that could see tariffs imposed on critical minerals such as rare earths, which are used in a wide range of products including smartphones, wind turbines and electric vehicle motors.

It is the latest front in Trump's erratic trade war, which has seen the US leader impose a universal 10-percent duty, pause higher levies on some countries and temporarily exempt some sectors from duties.

"Markets continue to suffer from the White House's tariff flip-flopping," Razaqzada said.

"The stop-start nature of US trade policy this month has made long-term positioning something of a fool's errand, with volatility dominating the landscape."

In Europe, London's benchmark FTSE 100 stock index closed 0.3 percent higher, as official data showed UK inflation slowed more than expected in March.

Frankfurt also finished 0.3 percent in the green but Paris fell almost 0.1 percent.

Shares in Dutch tech giant ASML, which makes machines that produce semiconductors, fell more than five percent as its net bookings came in below expectations.

ASML's disappointing earnings report "has only added to the sector-wide tech concerns", said David Morrison, analyst at Trade Nation.

The dollar slid once more against main rivals. Yields on 10-year Treasury bills eased but remain high following a selloff last week that raised doubts about the haven stauts of US bonds.

Gold hit a record $3,317.75 an ounce before paring back gains.

Oil prices rose almost two percent after recent sharp falls on fears that the tariffs will dampen global economic growth.

- Key figures at 1540 GMT -

New York - Dow: DOWN 0.1 percent at 40,332.34 points

New York - S&P 500: DOWN 0.7 percent at 5,356.74

New York - Nasdaq: DOWN 1.6 percent at 16,556.19

London - FTSE 100: UP 0.3 percent at 8,275.60 (close)

Paris - CAC 40: DOWN 0.1 percent at 7,329.97 (close)

Frankfurt - DAX: UP 0.3 percent at 21,311.02 (close)

Tokyo - Nikkei 225: DOWN 1.0 percent at 33,920.40 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 21,056.98 (close)

Shanghai - Composite: UP 0.3 percent at 3,276.00 (close)

Euro/dollar: UP at $1.1370 from $1.1291 on Tuesday

Pound/dollar: UP at $1.3235 from $1.3232

Dollar/yen: DOWN at 142.65 yen from 143.18 yen

Euro/pound: UP at 85.90 pence from 85.30 pence

Brent North Sea Crude: UP 1.9 percent at $65.92 per barrel

West Texas Intermediate: UP 1.9 percent at $61.91 per barrel

burs-bcp-lth/rmb

L.Meier--VB