-

'Surreal' Freeman hat-trick stuns Leinster to take Northampton into Champions Cup final

'Surreal' Freeman hat-trick stuns Leinster to take Northampton into Champions Cup final

-

Huge crowds head to Copacabana for free Lady Gaga concert

-

Warren Buffett: billionaire investor with simple tastes

Warren Buffett: billionaire investor with simple tastes

-

Serbian president out of hospital after cutting short US trip

-

Arsenal rocked by Bournemouth, Villa boost top five bid

Arsenal rocked by Bournemouth, Villa boost top five bid

-

Freeman hat-trick stuns Leinster to take Northampton into Champions Cup final

-

Warren Buffett says will retire from Berkshire Hathaway by year's end

Warren Buffett says will retire from Berkshire Hathaway by year's end

-

Al Ahli beat Kawasaki Frontale to win Asian Champions League

-

Shepherd, Dayal edge Bengaluru past Chennai in IPL thriller

Shepherd, Dayal edge Bengaluru past Chennai in IPL thriller

-

Sabalenka beats Gauff to win third Madrid Open crown

-

Arsenal suffer Bournemouth defeat ahead of PSG showdown

Arsenal suffer Bournemouth defeat ahead of PSG showdown

-

Napoli six clear in Serie A after win at fiery Lecce

-

Van Nistelrooy glad as Leicester end goal drought against sorry Saints

Van Nistelrooy glad as Leicester end goal drought against sorry Saints

-

Meta fighting Nigerian fines, warns could shut Facebook, Instagram

-

Hamas armed wing releases video of apparently injured Israeli hostage

Hamas armed wing releases video of apparently injured Israeli hostage

-

Norris wins wild and wet Miami GP sprint race

-

Gabon ex-junta chief Oligui sworn in after election win

Gabon ex-junta chief Oligui sworn in after election win

-

Singapore ruling party wins election in landslide

-

Eurovision warms up with over-60s disco

Eurovision warms up with over-60s disco

-

Russell helps Bath beat Edinburgh in Challenge Cup semi-final

-

Second-string PSG beaten by Strasbourg before Arsenal return leg

Second-string PSG beaten by Strasbourg before Arsenal return leg

-

Zelensky says won't play Putin 'games' with short truce

-

Norris wins Miami GP sprint race

Norris wins Miami GP sprint race

-

PM of Yemen government announces resignation

-

South Africa bowler Rabada serving ban for positive drug test

South Africa bowler Rabada serving ban for positive drug test

-

Serbian president stable in hospital after cutting short US trip

-

UN envoy urges Israel to halt Syria attacks 'at once'

UN envoy urges Israel to halt Syria attacks 'at once'

-

Villa boost top five bid, Southampton beaten at Leicester

-

Leipzig put Bayern and Kane's title party on ice

Leipzig put Bayern and Kane's title party on ice

-

Serbian president hospitalised after cutting short US trip

-

Buick and Appleby rule again in English 2000 Guineas

Buick and Appleby rule again in English 2000 Guineas

-

Singapore ruling party headed for clear victory in test for new PM

-

Martinez climbs into Tour de Romandie lead with penultimate stage win

Martinez climbs into Tour de Romandie lead with penultimate stage win

-

O'Sullivan backs Zhao Xintong to become snooker 'megastar'

-

Simbine wins 100m in photo finish thriller as Duplantis dominates

Simbine wins 100m in photo finish thriller as Duplantis dominates

-

Atletico held at Alaves in dry Liga draw

-

Cardinals meet ahead of vote for new pope

Cardinals meet ahead of vote for new pope

-

Snooker star Zhao: from ban to cusp of Chinese sporting history

-

Tielemans keeps Villa in chase for Champions League place

Tielemans keeps Villa in chase for Champions League place

-

Anthony Albanese: Australia's dog-loving, Tory fighting PM

-

Trump may have aided Australian PM's election victory: analysts

Trump may have aided Australian PM's election victory: analysts

-

Right-leaning Australian opposition leader loses election, and seat

-

India blocks Pakistani celebrities on social media

India blocks Pakistani celebrities on social media

-

Ancelotti says he will reveal future plans at end of season

-

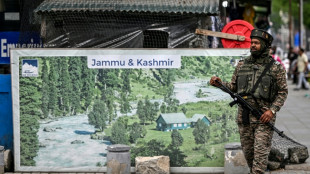

India-Pakistan tensions hit tourism in Kashmiri valley

India-Pakistan tensions hit tourism in Kashmiri valley

-

Bangladesh Islamists rally in show of force

-

Zelensky says won't play Putin's 'games' with short truce

Zelensky says won't play Putin's 'games' with short truce

-

Cardinals meet ahead of papal election

-

Pakistan tests missile weapons system amid India standoff

Pakistan tests missile weapons system amid India standoff

-

France charges 21 prison attack suspects

Equities resume selloff as Trump cranks up trade war

Equities and oil plunged again Wednesday after Donald Trump ramped up his trade war by hitting China with tariffs of more than 100 percent as sweeping measures against the United States' dozens of partners are set to come into effect.

After a brief respite Tuesday from the panic-selling at the start of the week, investors were once again scurrying for the hills amid fears that the US president's hammer blow to global commerce will plunge the economy into a recession.

The two economic superpowers were headed for a vicious standoff after Trump said China would be hit with another 50 percent levy in response to its retaliation in kind to his initial 34 percent duty announced last week.

With Beijing already subject to a 20 percent toll, its exporters are now facing tariffs of up to 104 percent.

China has blasted what it called US blackmail and vowed to "fight it to the end", fanning worries the crisis could spiral out of control.

Meanwhile, the European Union could unveil its response next week, with French President Emmanuel Macron calling for Washington to reconsider but adding that if the bloc was forced to respond "so be it".

In response to steel and aluminium levies that took effect last month, Brussels is planning measures of up to 25 percent on US goods ranging from soybeans to motorcycles, according to a document seen by AFP.

Chinese Premier Li Qiang told EU chief Ursula von der Leyen that Beijing had the "tools" to handle headwinds, according to state news agency Xinhua.

On Wednesday, South Korea unveiled a $2 billion emergency support package for its crucial export-focused carmakers, warning that Trump's 25 percent tariffs on the sector could deal it a terrible blow.

And in New Zealand, the central bank cut interest rates citing US tariffs, saying that "uncertainty about global trade policy (has) weakened the outlook".

"Any illusion of calm in Asia just got nuked. Trump's latest tariff tantrum hits like a macro wrecking ball, torching what was left of risk appetite and plunging markets back into full-blown panic mode," said Stephen Innes at SPI Asset Management.

"The only question on every desk this morning is: Is he really willing to light a global recession match just to redraw the trade map?"

- 50% chance of recession -

The US president believes his policy will revive America's lost manufacturing base by forcing companies to relocate to the United States, saying Tuesday countries were "dying to make a deal" with duties of at least 10 percent set to kick in at 0401 GMT.

Earlier he said the country was "taking in almost $2 billion a day" from tariffs but the measures have sent shockwaves through markets and wiped trillions of dollars off company valuations.

Jack Ablin of Cresset Capital estimated that the market now sees a greater than 50 percent chance of a US recession.

The gains in Asia and Europe on Tuesday came on optimism that the White House could be open to compromise.

But a lack of movement and Trump's confirmation of the 50 percent duties on China took the air out of investor sentiment.

That saw Wall Street's three main indexes reverse healthy gains at the open to end deep in the red -- the S&P 500 finished below 5,000 points for the first time in almost a year.

And Asia resumed its retreat Wednesday, though traders pared their initial hefty selling.

Tokyo fell more than two, while Hong Kong, Shanghai, Sydney, Singapore and Taipei lost more than one percent. Seoul and Wellington were also under pressure.

On currency markets, China's offshore yuan hit a record low against the dollar, while the South Korean won hit its lowest level since 2009 during the global financial crisis.

Oil prices also tanked more than four percent, with both main contracts hitting their lowest levels since 2021 during Covid amid growing fears that the hit to economies will batter demand.

- Key figures around 0230 GMT -

Tokyo - Nikkei 225: DOWN 2.6 percent at 32,147.04 (break)

Hong Kong - Hang Seng Index: DOWN 1.6 percent at 19,739.70

Shanghai - Composite: DOWN 0.4 percent at 3,134.38

Dollar/yen: DOWN at 145.78 yen from 146.23 yen on Tuesday

Euro/dollar: UP at $1.1027 from $1.0959

Pound/dollar: UP at $1.2830 from $1.2766

Euro/pound: UP at 85.95 pence from 85.78 pence

West Texas Intermediate: DOWN 4.6 percent at $56.87 per barrel

Brent North Sea Crude: DOWN 4.1 percent at $60.26 per barrel

New York - Dow: DOWN 0.8 percent at 37,645.59 (close)

London - FTSE 100: UP 2.7 percent at 7,910.53 (close)

A.Ruegg--VB