-

All hands on deck: British Navy sobers up alcohol policy

All hands on deck: British Navy sobers up alcohol policy

-

Sabalenka says Serena return would be 'cool' after great refuses to rule it out

-

Rybakina plots revenge over Sabalenka in Australian Open final

Rybakina plots revenge over Sabalenka in Australian Open final

-

Irish Six Nations hopes hit by Aki ban

-

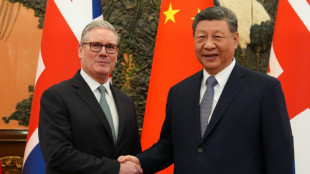

Britain's Starmer hails 'good progress' after meeting China's Xi

Britain's Starmer hails 'good progress' after meeting China's Xi

-

Parrots rescued as landslide-hit Sicilian town saves pets

-

Gold surges further, oil jumps on Trump's Iran threat

Gold surges further, oil jumps on Trump's Iran threat

-

No handshake as Sabalenka sets up repeat of 2023 Melbourne final

-

Iran's IRGC: the feared 'Pasdaran' set for EU terror listing

Iran's IRGC: the feared 'Pasdaran' set for EU terror listing

-

EU eyes migration clampdown with push on deportations, visas

-

Umpire call fired up Sabalenka in politically charged Melbourne clash

Umpire call fired up Sabalenka in politically charged Melbourne clash

-

Rybakina battles into Australian Open final against Sabalenka

-

Iran vows 'crushing response', EU targets Revolutionary Guards

Iran vows 'crushing response', EU targets Revolutionary Guards

-

Northern Mozambique: massive gas potential in an insurgency zone

-

Gold demand hits record high on Trump policy doubts: industry

Gold demand hits record high on Trump policy doubts: industry

-

Show must go on: London opera chief steps in for ailing tenor

-

UK drugs giant AstraZeneca announces $15 bn investment in China

UK drugs giant AstraZeneca announces $15 bn investment in China

-

US scrutiny of visitors' social media could hammer tourism: trade group

-

'Watch the holes'! Paris fashion crowd gets to know building sites

'Watch the holes'! Paris fashion crowd gets to know building sites

-

Power, pace and financial muscle: How Premier League sides are ruling Europe

-

'Pesticide cocktails' pollute apples across Europe: study

'Pesticide cocktails' pollute apples across Europe: study

-

Ukraine's Svitolina feels 'very lucky' despite Australian Open loss

-

Money laundering probe overshadows Deutsche Bank's record profits

Money laundering probe overshadows Deutsche Bank's record profits

-

Huge Mozambique gas project restarts after five-year pause

-

Britain's Starmer reports 'good progress' after meeting China's Xi

Britain's Starmer reports 'good progress' after meeting China's Xi

-

Sabalenka crushes Svitolina in politically charged Australian Open semi

-

Turkey to offer mediation on US–Iran tensions, weighs border measures

Turkey to offer mediation on US–Iran tensions, weighs border measures

-

Mali's troubled tourism sector crosses fingers for comeback

-

China issues 73 life bans, punishes top football clubs for match-fixing

China issues 73 life bans, punishes top football clubs for match-fixing

-

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

South Africa drops 'Melania' just ahead of release

South Africa drops 'Melania' just ahead of release

-

Senegal coach Thiaw banned, fined after AFCON final chaos

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Australian Open chief Tiley says 'fine line' after privacy complaints

-

Trump-era trade stress leads Western powers to China

Trump-era trade stress leads Western powers to China

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

-

China executes 11 linked to Myanmar scam compounds

-

Germany to harden critical infrastructure as Russia fears spike

Germany to harden critical infrastructure as Russia fears spike

-

Colombia plane crash investigators battle poor weather to reach site

-

Serena Williams refuses to rule out return to tennis

Serena Williams refuses to rule out return to tennis

-

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

-

New glove, same fist: Myanmar vote ensures military's grip

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

-

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

-

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

World approves UN rules for carbon trading between nations at COP29

New rules allowing wealthy polluting countries to buy carbon-cutting "offsets" from developing nations were agreed at UN climate talks Saturday, in a move already raising fears they will be used to greenwash climate targets.

This decision, taken during extra time at the COP29 conference, is a major step forward in a thorny debate that has dragged through climate talks for years, and diplomats broke into applause when the decision was gavelled.

Supporters say a UN-backed framework for carbon trading could direct investment to developing nations where many credits are generated.

Critics fear if set up poorly, these schemes could undermine the world's efforts to curb global warming.

Carbon credits are generated by activities that reduce or avoid planet-heating greenhouse gas emissions, like planting trees, protecting existing carbon sinks or replacing polluting coal with clean-energy alternatives.

Until now, these credits have mainly been traded by companies on an unregulated market dogged by scandal.

But the 2015 Paris climate deal envisaged that countries could also take part in a cross-border trade of carbon reductions.

The broad idea is that countries -- mainly wealthy polluters -- can buy carbon credits from other nations that are doing better on their own emissions-cutting targets.

- Article 6 -

The initiative, known as Article 6, includes both direct country-to-country trading and a separate UN-backed marketplace.

It has proved popular with both developing countries looking for international financing, and wealthier nations eager to find new ways to meet steep emissions reduction targets.

The European Union and the United States pushed for an agreement at COP29 in Azerbaijan's capital Baku, while many developing nations particularly in Asia and Africa have already signed up for projects.

But experts fear that the systems could allow countries to trade dubious emissions reductions that cover up their failure to actually reduce greenhouse gas emissions.

As of earlier this month, more than 90 deals have already been agreed between nations for over 140 pilot projects, according to the UN.

But so far only one trade has happened between countries, involving Switzerland buying credits linked to a new fleet of electric buses in Thailand's capital Bangkok.

Switzerland has other agreements lined up with Vanuatu and Ghana, while other buyer countries include Singapore, Japan and Norway.

- 'Biggest threat to Paris agreement' -

The Climate Action Tracker project has warned that Switzerland's lack of transparency over its own emissions cuts risks "setting a bad precedent".

Niklas Hohne of NewClimate Institute, one of the groups behind the project, warned there was a concern that the market will create an incentive for developing countries to underpromise emission cuts in their own national plans so that they can sell credits from any reductions that go above this level.

"There's big motivation on both sides to do it wrong," he said.

Injy Johnstone, a researcher specialising in carbon neutrality at Oxford University, told AFP that the fact that nations can set their own standards in these country-to-country deals was a major concern.

She said overall the risk of greenwashing makes Article 6 "the biggest threat to the Paris agreement".

Alongside this decentralised, state-to-state system, there will be another UN-run system for trading carbon credits, open to both states and companies.

On the opening day of COP29, nations agreed a number of crucial ground rules for setting this UN-administered market in motion after nearly a decade of complex discussions.

"There are many projects waiting" for the market, Andrea Bonzanni of the IETA International Emissions Trading Association, which has more than 300 members including energy giants such as BP, told AFP.

Despite these positive signs, some experts expressed doubt that the quality of the carbon credits traded on the regulated market would be much better than those that came before.

Erika Lennon of the Center for International Environmental Law said it would be necessary to make sure these markets do not create "even more problems and more scandals than the voluntary carbon markets".

These "voluntary" markets have been rocked by scandals in recent years amid accusations that some credits sold did not reduce emissions as promised, or that projects exploited local communities.

F.Mueller--VB