-

Fela Kuti: first African to get Grammys Lifetime Achievement Award

Fela Kuti: first African to get Grammys Lifetime Achievement Award

-

'Schitt's Creek' star Catherine O'Hara dead at 71

-

Curran hat-trick seals 11 run DLS win for England over Sri Lanka

Curran hat-trick seals 11 run DLS win for England over Sri Lanka

-

Cubans queue for fuel as Trump issues energy ultimatum

-

France rescues over 6,000 UK-bound Channel migrants in 2025

France rescues over 6,000 UK-bound Channel migrants in 2025

-

Surprise appointment Riera named Frankfurt coach

-

Maersk to take over Panama Canal port operations from HK firm

Maersk to take over Panama Canal port operations from HK firm

-

US arrests prominent journalist after Minneapolis protest coverage

-

Analysts say Kevin Warsh a safe choice for US Fed chair

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Trump predicts Iran will seek deal to avoid US strikes

-

US oil giants say it's early days on potential Venezuela boom

US oil giants say it's early days on potential Venezuela boom

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

-

US Justice Dept releases new batch of documents, images, videos from Epstein files

-

Four memorable showdowns between Alcaraz and Djokovic

Four memorable showdowns between Alcaraz and Djokovic

-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

Mateta omitted from Palace squad to face Forest

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

-

Dutch PM-elect Jetten says not yet time to talk to Putin

Dutch PM-elect Jetten says not yet time to talk to Putin

-

Social media fuels surge in UK men seeking testosterone jabs

-

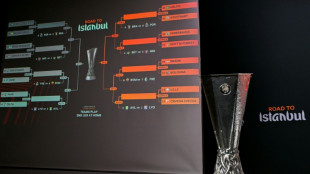

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

-

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

New Dutch government pledges ongoing Ukraine support

-

Newcastle still coping with fallout from Isak exit, says Howe

Newcastle still coping with fallout from Isak exit, says Howe

-

Chad, France eye economic cooperation as they reset strained ties

| CMSC | 0.02% | 23.7 | $ | |

| RIO | -3.92% | 91.54 | $ | |

| SCS | 0.12% | 16.14 | $ | |

| CMSD | -0.05% | 24.049 | $ | |

| BCC | 0.74% | 80.77 | $ | |

| JRI | 0.58% | 13.03 | $ | |

| BTI | 0.82% | 60.71 | $ | |

| GSK | 1.77% | 51.57 | $ | |

| BCE | 1.28% | 25.815 | $ | |

| BP | -0.46% | 37.865 | $ | |

| RBGPF | 1.65% | 83.78 | $ | |

| NGG | -0.04% | 85.015 | $ | |

| RELX | -1.19% | 35.74 | $ | |

| AZN | 0.69% | 93.235 | $ | |

| VOD | -0.48% | 14.64 | $ | |

| RYCEF | -2.69% | 16 | $ |

Miner Anglo American rejects BHP's $38.8 billion takeover bid

British mining giant Anglo American on Friday rejected a blockbuster $38.8-billion takeover bid from Australian rival BHP, slamming it as "highly unattractive" and "opportunistic".

The snub came one day after BHP had launched its colossal bid, which aims to create the world's biggest listed copper producer and reshape the global mining sector.

"The board has considered the proposal with its advisers and concluded that the proposal significantly undervalues Anglo American and its future prospects," the London-listed company said in a statement.

"The proposal contemplates a structure which the Board believes is highly unattractive for Anglo American's shareholders, given the uncertainty and complexity inherent in the proposal, and significant execution risks.

"The board has therefore unanimously rejected the proposal," it added.

The group advised shareholders to take no action over the gigantic offer, which would first hinge on Anglo splitting off its platinum and iron ore holdings in South Africa.

BHP is keen to obtain the group's global copper assets that include operations in Chile and Peru.

"The BHP proposal is opportunistic and fails to value Anglo American's prospects, while significantly diluting the relative value upside participation of Anglo American's shareholders relative to BHP's shareholders," said Anglo chairman Stuart Chambers.

"The proposed structure is also highly unattractive, creating substantial uncertainty and execution risk borne almost entirely by Anglo American, its shareholders and its other stakeholders."

He added that copper represents 30 percent of total production of Anglo, which stands to benefit from "significant value appreciation" arising from strong future demand.

"Anglo American is well positioned to create significant value from its portfolio of high quality assets that are well aligned with the energy transition and other major demand trends," noted Chambers.

The offer, which was pitched at £25.08 per share, caused Anglo stock to surge 16 percent in value on the London stock market on Thursday.

- Critical copper -

Chambers insisted that the group was committed to its growth strategy.

"Anglo American has defined clear strategic priorities -- of operational excellence, portfolio, and growth -- to deliver full value potential and is entirely focused on that delivery."

Both Anglo and BHP have been wrestling with the transition away from traditional money makers such as gas and coal, increasingly eyeing opportunities to mine metals and critical minerals.

Copper is critical to the world's transition to renewable energy because it is vital for technology like electric vehicles, solar panels, wind turbines and energy storage.

Before the transition copper was primarily used in construction, electrical wiring and kitchen utensils.

But its exceptional conductivity and ductility -- the capacity to bend without breaking -- have made it a crucial product for the renewable energy industry.

T.Zimmermann--VB