-

Epstein offered ex-prince Andrew meeting with Russian woman: files

Epstein offered ex-prince Andrew meeting with Russian woman: files

-

Jokic scores 31 to propel Nuggets over Clippers in injury return

-

Montreal studio rises from dark basement office to 'Stranger Things'

Montreal studio rises from dark basement office to 'Stranger Things'

-

US government shuts down but quick resolution expected

-

Mertens and Zhang win Australian Open women's doubles title

Mertens and Zhang win Australian Open women's doubles title

-

Venezuelan interim president announces mass amnesty push

-

China factory activity loses steam in January

China factory activity loses steam in January

-

Melania Trump's atypical, divisive doc opens in theatres

-

Bad Bunny set for historic one-two punch at Grammys, Super Bowl

Bad Bunny set for historic one-two punch at Grammys, Super Bowl

-

Five things to watch for on Grammys night Sunday

-

Venezuelan interim president proposes mass amnesty law

Venezuelan interim president proposes mass amnesty law

-

Rose stretches lead at Torrey Pines as Koepka makes cut

-

Online foes Trump, Petro set for White House face-to-face

Online foes Trump, Petro set for White House face-to-face

-

Seattle Seahawks deny plans for post-Super Bowl sale

-

US Senate passes deal expected to shorten shutdown

US Senate passes deal expected to shorten shutdown

-

'Misrepresent reality': AI-altered shooting image surfaces in US Senate

-

Thousands rally in Minneapolis as immigration anger boils

Thousands rally in Minneapolis as immigration anger boils

-

US judge blocks death penalty for alleged health CEO killer Mangione

-

Lens win to reclaim top spot in Ligue 1 from PSG

Lens win to reclaim top spot in Ligue 1 from PSG

-

Gold, silver prices tumble as investors soothed by Trump Fed pick

-

Ko, Woad share lead at LPGA season opener

Ko, Woad share lead at LPGA season opener

-

US Senate votes on funding deal - but shutdown still imminent

-

US charges prominent journalist after Minneapolis protest coverage

US charges prominent journalist after Minneapolis protest coverage

-

Trump expects Iran to seek deal to avoid US strikes

-

Guterres warns UN risks 'imminent financial collapse'

Guterres warns UN risks 'imminent financial collapse'

-

NASA delays Moon mission over frigid weather

-

First competitors settle into Milan's Olympic village

First competitors settle into Milan's Olympic village

-

Fela Kuti: first African to get Grammys Lifetime Achievement Award

-

'Schitt's Creek' star Catherine O'Hara dead at 71

'Schitt's Creek' star Catherine O'Hara dead at 71

-

Curran hat-trick seals 11 run DLS win for England over Sri Lanka

-

Cubans queue for fuel as Trump issues energy ultimatum

Cubans queue for fuel as Trump issues energy ultimatum

-

France rescues over 6,000 UK-bound Channel migrants in 2025

-

Surprise appointment Riera named Frankfurt coach

Surprise appointment Riera named Frankfurt coach

-

Maersk to take over Panama Canal port operations from HK firm

-

US arrests prominent journalist after Minneapolis protest coverage

US arrests prominent journalist after Minneapolis protest coverage

-

Analysts say Kevin Warsh a safe choice for US Fed chair

-

Trump predicts Iran will seek deal to avoid US strikes

Trump predicts Iran will seek deal to avoid US strikes

-

US oil giants say it's early days on potential Venezuela boom

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

-

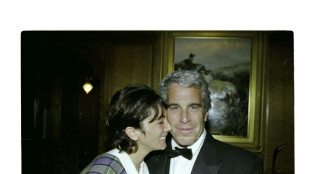

US Justice Dept releases new batch of documents, images, videos from Epstein files

US Justice Dept releases new batch of documents, images, videos from Epstein files

-

Four memorable showdowns between Alcaraz and Djokovic

-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

Shell profit tumbles on falling oil and gas prices

British energy giant Shell on Thursday said its net profit more than halved to $19.4 billion last year as oil and gas prices weakened.

Profit after tax slumped 54 percent after reaching an all-time high of $42.3 billion in 2022, when energy producer Russia's invasion of Ukraine sent prices of fossil fuels soaring.

"Full year 2023 income... reflected lower realised oil and gas prices, lower volumes, and lower refining margins," Shell added in the earnings release.

It was slammed also by impairment and other accounting charges totalling $7.5 billion.

Revenue dived almost a fifth to $316.6 billion.

Despite the declines, Shell said it was returning $3.5 billion to shareholders and ramping up its fourth-quarter dividend.

- 'Obscene profits' -

"As we enter 2024 we are continuing to simplify our organisation with a focus on delivering more value with less emissions," chief executive Wael Sawan said in the earnings statement.

Environmentalists were not convinced, however, with Greenpeace activists dressed as Shell board members protesting outside the company's London headquarters on Thursday.

"Shell is posting yet more obscene profits from climate-wrecking fossil fuels," said Greenpeace campaigner Maja Darlington.

"While customers struggle with the cost-of-living crisis, Shell shovels over billions to shareholders and drills for yet more oil and gas. Climate disasters are multiplying and hitting hardest those who have done the least to cause the crisis."

Sawan, former head of renewable energy at Shell, plans in March to update the company's strategy on transitioning to cleaner fuels.

"What you should expect coming in March is real clarity on what are the areas that we will continue to go forward with, not a whole bunch of new targets," Sawan told a conference call listened to by analysts and media.

The fossil fuels giant insists that its overall goal to achieve net zero carbon emissions by 2050 remains intact.

This as the energy sector still looks to profit from the relatively high cost of oil and gas.

Prices are currently benefitting from concerns that the Israel-Hamas conflict could spread into a broader conflict in the crude-rich Middle East.

The group's share price closed up 2.41 percent at £25.06 on London's benchmark FTSE 100 index, which ended slightly down overall.

Shell on Thursday added that net profit tumbled 93 percent to $474 million in the fourth quarter on large impairments, particularly linked to chemical assets in Singapore.

Net profit excluding exceptional items sank nearly a third to $28.3 billion last year -- but this beat market expectations.

"A wavering oil price was inevitably the main culprit for the reduced full-year result," noted Richard Hunter, head of markets at trading firm Interactive Investor.

"From a broader perspective, and despite the current geopolitical tensions which have provided a base for the oil price, the uncertain economic environment globally has left the demand situation unclear."

Hunter added: "The industry is the focus of some debate from an environmental perspective, with the ever-increasing possibility that some investors will be unwilling or unable to invest in the sector on ethical grounds."

D.Bachmann--VB