-

Ghana moves to rewrite mining laws for bigger share of gold revenues

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

South Africa drops 'Melania' just ahead of release

-

Senegal coach Thiaw banned, fined after AFCON final chaos

Senegal coach Thiaw banned, fined after AFCON final chaos

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Australian Open chief Tiley says 'fine line' after privacy complaints

Australian Open chief Tiley says 'fine line' after privacy complaints

-

Trump-era trade stress leads Western powers to China

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

-

China executes 11 linked to Myanmar scam compounds

China executes 11 linked to Myanmar scam compounds

-

Germany to harden critical infrastructure as Russia fears spike

-

Colombia plane crash investigators battle poor weather to reach site

Colombia plane crash investigators battle poor weather to reach site

-

Serena Williams refuses to rule out return to tennis

-

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

-

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

Deutsche Bank logs record profits, as new probe casts shadow

-

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

-

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

Phan Huy: the fashion prodigy putting Vietnam on the map

-

Hongkongers snap up silver as gold becomes 'too expensive'

-

Britain's Starmer meets China's Xi for talks on trade, security

Britain's Starmer meets China's Xi for talks on trade, security

-

Chinese quadriplegic runs farm with just one finger

-

Gold soars past $5,500 as Trump sabre rattles over Iran

Gold soars past $5,500 as Trump sabre rattles over Iran

-

China's ambassador warns Australia on buyback of key port

-

'Bombshell': What top general's fall means for China's military

'Bombshell': What top general's fall means for China's military

-

As US tensions churn, new generation of protest singers meet the moment

-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

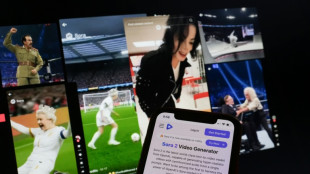

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

-

Rockets veteran Adams out for rest of NBA season

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Barcelona rout Copenhagen to reach Champions League last 16

-

Liverpool, Man City and Barcelona ease into Champions League last 16

Liverpool, Man City and Barcelona ease into Champions League last 16

-

Tesla profits tumble on lower EV sales, AI spending surge

-

Real Madrid face Champions League play-off after Benfica loss

Real Madrid face Champions League play-off after Benfica loss

-

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

Reliable European demand fuels US natural gas boom

Rising demand from Europe has added to a US natural gas investment boom even as the industry struggles to overcome opposition to pipeline construction.

Production of the fuel reached 3.1 trillion cubic feet for the month of October, according to the most recently available US data, an all-time high and up almost 50 percent from the level a decade ago.

The industry has been in growth mode since the summer of 2021 when Russia began trimming shipments to Europe, according to Steven Miles, a fellow at Rice University's Banker Institute in Houston.

That comes on the heels of the US shale revolution in the first decade of the 21st century that ultimately led to the United States becoming a net exporter of the fuel in 2017.

The progression has not been continuous, with plummeting natural gas prices crimping investment and leading to the bankruptcy of one of industry's biggest players, Chesapeake Energy, in June 2020.

But energy companies have become more confident in the long-term demand outlook for the fuel in light of shifting geopolitical dynamics.

Five years ago, the long-term demand "was not nearly as clear as it is today," said Eli Rubin of EBW AnalyticsGroup, a consultancy.

"Especially after Russia invaded Ukraine, we have a healthy new respect for natural gas' role in providing energy security, for its role in helping to tame consumer pricing."

Even before the invasion, there was heavy investment in facilities to transform gas into liquefied natural gas (LNG). In recent years, some 14 new liquefaction terminals have been approved, with the first set to begin operating in 2024.

"Over the next five years, we could potentially double US LNG exports," Rubin said.

The push comes as big energy companies enjoy rich cashflow courtesy of lofty commodity prices that have enabled the industry to invest aggressively even as they boost share buybacks and dividends.

- Pipeline blockage -

While the growth of LNG has globalized the natural gas market to a limited extent, the dynamics remain heavily localized.

Prices on the benchmark European TTF contract are currently more than six times the level of comparable Henry Hub contract in the United States.

That gap means that LNG exports are priced more closely to the US level, setting the stage for "middlemen" who can move the cargoes to Europe and "sell them at European prices," said Miles.

Much higher exports of US natural gas could lead to more price consistency across regions -- but probably not for many years.

"Maybe in the long run ... (the United States will) export so much gas to Europe that prices between Europe, Asia and North America become more aligned," said Ryan Kellogg, a professor at the University of Chicago specializing in energy.

"But I think we're pretty far away from that right now."

One lingering challenge facing the industry is the lack of pipeline capacity, particularly in the northeastern part of the United States.

The nation's biggest natural gas basin, the Marcellus Shale, which is mostly in Pennsylvania, faces constraints due to lack of infrastructure.

A venture called the Mountain Valley Pipeline stands as a potential solution, but the project has been suspended for the last five years amid resistance from land owners and environmentalists.

Opposition by climate activists and elected officials to industry-backed projects is "certainly much stronger than it was," said Rubin.

But the lack of infrastructure can exacerbate price volatility during periods of peak demand.

New England, which is in northeastern United States, relies on LNG for a fraction of its heating.

But the region, which normally sees some of the coldest weather in the country, is also known for resisting new pipeline capacity.

During a cold snap, "New England is competing with Europe for a spot LNG cargo," said Rubin. "For the cargo to go to New England, they have to pay higher prices than Europe."

W.Lapointe--BTB