-

Germany hit by nationwide public transport strike

Germany hit by nationwide public transport strike

-

Barca coach Flick 'not happy' with Raphinha thigh strain

-

WHO chief says turmoil creates chance for reset

WHO chief says turmoil creates chance for reset

-

Rink issues resolved, NHL stars chase Olympic gold at Milan

-

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

S. Korea celebrates breakthrough K-pop Grammy win for 'Golden'

-

Rodri rages that officials 'don't want' Man City to win

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

African players in Europe: Ouattara dents Villa title hopes

-

Liverpool beat Chelsea to Rennes defender Jacquet - reports

Liverpool beat Chelsea to Rennes defender Jacquet - reports

-

S. Korea celebrates breakthrough Grammy win for K-pop's 'Golden'

-

Trump says US talking deal with 'highest people' in Cuba

Trump says US talking deal with 'highest people' in Cuba

-

Trump threatens legal action against Grammy host over Epstein comment

-

Olympic Games in northern Italy have German twist

Olympic Games in northern Italy have German twist

-

Bad Bunny: the Puerto Rican phenom on top of the music world

-

Snapchat blocks 415,000 underage accounts in Australia

Snapchat blocks 415,000 underage accounts in Australia

-

At Grammys, 'ICE out' message loud and clear

-

Dalai Lama's 'gratitude' at first Grammy win

Dalai Lama's 'gratitude' at first Grammy win

-

Stocks, oil, precious metals plunge on volatile start to the week

-

Steven Spielberg earns coveted EGOT status with Grammy win

Steven Spielberg earns coveted EGOT status with Grammy win

-

Knicks boost win streak to six by beating LeBron's Lakers

-

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga triumph at Grammys

-

Japan says rare earth found in sediment retrieved on deep-sea mission

-

San Siro prepares for last dance with Winter Olympics' opening ceremony

San Siro prepares for last dance with Winter Olympics' opening ceremony

-

France great Benazzi relishing 'genius' Dupont's Six Nations return

-

Grammy red carpet: black and white, barely there and no ICE

Grammy red carpet: black and white, barely there and no ICE

-

Oil tumbles on Iran hopes, precious metals hit by stronger dollar

-

South Korea football bosses in talks to avert Women's Asian Cup boycott

South Korea football bosses in talks to avert Women's Asian Cup boycott

-

Level playing field? Tech at forefront of US immigration fight

-

British singer Olivia Dean wins Best New Artist Grammy

British singer Olivia Dean wins Best New Artist Grammy

-

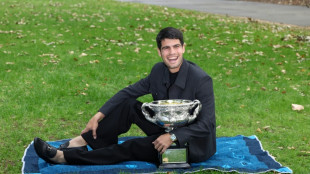

Hatred of losing drives relentless Alcaraz to tennis history

-

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

Kendrick Lamar, Bad Bunny, Lady Gaga win early at Grammys

-

Surging euro presents new headache for ECB

-

Djokovic hints at retirement as time seeps away on history bid

Djokovic hints at retirement as time seeps away on history bid

-

US talking deal with 'highest people' in Cuba: Trump

-

UK ex-ambassador quits Labour over new reports of Epstein links

UK ex-ambassador quits Labour over new reports of Epstein links

-

Trump says closing Kennedy Center arts complex for two years

-

Hans Vestberg, Former Verizon Chairman and CEO, Joins Digipower X As Senior Advisor

Hans Vestberg, Former Verizon Chairman and CEO, Joins Digipower X As Senior Advisor

-

Reigning world champs Tinch, Hocker among Millrose winners

-

Real Madrid scrape win over Rayo, Athletic claim derby draw

Real Madrid scrape win over Rayo, Athletic claim derby draw

-

PSG beat Strasbourg after Hakimi red to retake top spot in Ligue 1

-

NFL Cardinals hire Rams' assistant LaFleur as head coach

NFL Cardinals hire Rams' assistant LaFleur as head coach

-

Arsenal scoop $2m prize for winning FIFA Women's Champions Cup

-

Atletico agree deal to sign Lookman from Atalanta

Atletico agree deal to sign Lookman from Atalanta

-

Real Madrid's Bellingham set for month out with hamstring injury

-

Man City won't surrender in title race: Guardiola

Man City won't surrender in title race: Guardiola

-

Korda captures weather-shortened LPGA season opener

-

Czechs rally to back president locking horns with government

Czechs rally to back president locking horns with government

-

Prominent Venezuelan activist released after over four years in jail

-

Emery riled by 'unfair' VAR call as Villa's title hopes fade

Emery riled by 'unfair' VAR call as Villa's title hopes fade

-

Nigeria's president pays tribute to Fela Kuti after Grammys Award

European stocks rise as gold, oil prices tumble

European stock markets rose Monday but oil and gold prices tumbled as concerns eased over US monetary policy and the chances of an American attack on Iran.

"Many investors bought gold and silver as protection against the volatile geopolitical backdrop, yet they've learned the hard way these assets can also be volatile themselves," said Russ Mould, investment director at AJ Bell.

The London, Paris and Frankfurt equity indices edged higher despite heavy losses by heavyweight miners.

Major Asian stock markets closed lower as tech companies fell sharply.

Gold and silver began tumbling Friday as the dollar rebounded on news that US President Donald Trump had chosen Kevin Warsh to become new head of the US Federal Reserve.

Sharp losses continued Monday, with gold shedding 4.3 percent to $4,682 an ounce and silver sliding almost five percent to $81 an ounce.

That left both precious metals far below respective record highs of above $5,500 and $120 reached last week.

Trump has said that Warsh, a former Morgan Stanley investment banker and Fed governor, "will go down as one of the great Fed Chairmen, maybe the best".

Traders regard Warsh as the toughest inflation fighter among the final candidates, raising expectations that his monetary policy would underpin the greenback.

The choice also eased concerns about the Fed's independence following a series of attacks on incumbent Jerome Powell over his reticence to cut rates as quickly as the president wanted.

Oil prices meanwhile plunged on easing US-Iran tensions.

Both main crude contracts shed more than five percent at one point after Trump said he was hopeful of reaching a deal with Tehran.

Washington has hit out at the country's leadership in recent weeks over its deadly response to anti-government protests, with Trump threatening military action.

He has also pushed for an agreement over Iran's nuclear programme.

Monday's volatility across markets comes as investors look ahead to more big earnings due this week alongside interest-rate decisions and US jobs data.

After a strong January fuelled by artificial intelligence bets, stocks went into reverse last week as traders resumed questioning the wisdom of the vast sums pumped into the sector and when they will see returns.

That has also raised fears of a tech bubble that could soon pop.

The latest round of selling came after Microsoft last week announced a surge in spending on AI infrastructure, reviving concerns companies could take some time before seeing a return on their investments.

Seoul, which has hit multiple records this year thanks to its big tech weighting, plunged more than five percent on Monday, with chip giant SK hynix shedding eight percent and market heavyweight Samsung off more than six percent.

Tokyo, also home to several big-name tech firms, shed more than one percent, as did Taipei, where chip giant TSMC is listed.

- Key figures at around 1115 GMT -

London - FTSE 100: UP 0.3 percent at 10,252.04 points

Paris - CAC 40: UP 0.4 percent at 8,157.81

Frankfurt - DAX: UP 0.5 percent at 24,666.43

Tokyo - Nikkei 225: DOWN 1.3 percent at 52,655.18 (close)

Hong Kong - Hang Seng Index: DOWN 2.2 percent at 26,775.57 (close)

Shanghai - Composite: DOWN 2.5 percent at 4,015.75 (close)

New York - Dow: DOWN 0.4 percent at 48,892.47 (close)

Euro/dollar: UP at $1.1866 from $1.1856 on Friday

Pound/dollar: UP at $1.3701 from $1.3688

Dollar/yen: UP at 154.79 yen from 154.64 yen

Euro/pound: DOWN at 86.61 pence from 86.63 pence

Brent North Sea Crude: DOWN 4.8 percent at $66.00 per barrel

West Texas Intermediate: DOWN 5.1 percent at $61.8 per barrel

D.Bachmann--VB