-

All hands on deck: British Navy sobers up alcohol policy

All hands on deck: British Navy sobers up alcohol policy

-

Sabalenka says Serena return would be 'cool' after great refuses to rule it out

-

Rybakina plots revenge over Sabalenka in Australian Open final

Rybakina plots revenge over Sabalenka in Australian Open final

-

Irish Six Nations hopes hit by Aki ban

-

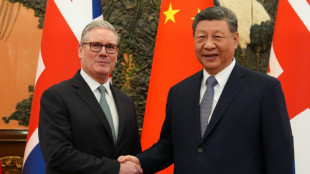

Britain's Starmer hails 'good progress' after meeting China's Xi

Britain's Starmer hails 'good progress' after meeting China's Xi

-

Parrots rescued as landslide-hit Sicilian town saves pets

-

Gold surges further, oil jumps on Trump's Iran threat

Gold surges further, oil jumps on Trump's Iran threat

-

No handshake as Sabalenka sets up repeat of 2023 Melbourne final

-

Iran's IRGC: the feared 'Pasdaran' set for EU terror listing

Iran's IRGC: the feared 'Pasdaran' set for EU terror listing

-

EU eyes migration clampdown with push on deportations, visas

-

Umpire call fired up Sabalenka in politically charged Melbourne clash

Umpire call fired up Sabalenka in politically charged Melbourne clash

-

Rybakina battles into Australian Open final against Sabalenka

-

Iran vows 'crushing response', EU targets Revolutionary Guards

Iran vows 'crushing response', EU targets Revolutionary Guards

-

Northern Mozambique: massive gas potential in an insurgency zone

-

Gold demand hits record high on Trump policy doubts: industry

Gold demand hits record high on Trump policy doubts: industry

-

Show must go on: London opera chief steps in for ailing tenor

-

UK drugs giant AstraZeneca announces $15 bn investment in China

UK drugs giant AstraZeneca announces $15 bn investment in China

-

US scrutiny of visitors' social media could hammer tourism: trade group

-

'Watch the holes'! Paris fashion crowd gets to know building sites

'Watch the holes'! Paris fashion crowd gets to know building sites

-

Power, pace and financial muscle: How Premier League sides are ruling Europe

-

'Pesticide cocktails' pollute apples across Europe: study

'Pesticide cocktails' pollute apples across Europe: study

-

Ukraine's Svitolina feels 'very lucky' despite Australian Open loss

-

Money laundering probe overshadows Deutsche Bank's record profits

Money laundering probe overshadows Deutsche Bank's record profits

-

Huge Mozambique gas project restarts after five-year pause

-

Britain's Starmer reports 'good progress' after meeting China's Xi

Britain's Starmer reports 'good progress' after meeting China's Xi

-

Sabalenka crushes Svitolina in politically charged Australian Open semi

-

Turkey to offer mediation on US–Iran tensions, weighs border measures

Turkey to offer mediation on US–Iran tensions, weighs border measures

-

Mali's troubled tourism sector crosses fingers for comeback

-

China issues 73 life bans, punishes top football clubs for match-fixing

China issues 73 life bans, punishes top football clubs for match-fixing

-

Ghana moves to rewrite mining laws for bigger share of gold revenues

-

South Africa drops 'Melania' just ahead of release

South Africa drops 'Melania' just ahead of release

-

Senegal coach Thiaw banned, fined after AFCON final chaos

-

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

Russia's sanctioned oil firm Lukoil to sell foreign assets to Carlyle

-

Australian Open chief Tiley says 'fine line' after privacy complaints

-

Trump-era trade stress leads Western powers to China

Trump-era trade stress leads Western powers to China

-

Gold soars towards $5,600 as Trump rattles sabre over Iran

-

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

Russia's Petrosian skates in Valieva shadow at Milan-Cortina Olympics

-

China executes 11 linked to Myanmar scam compounds

-

Germany to harden critical infrastructure as Russia fears spike

Germany to harden critical infrastructure as Russia fears spike

-

Colombia plane crash investigators battle poor weather to reach site

-

Serena Williams refuses to rule out return to tennis

Serena Williams refuses to rule out return to tennis

-

Vietnam, EU vow stronger ties as bloc's chief visits Hanoi

-

New glove, same fist: Myanmar vote ensures military's grip

New glove, same fist: Myanmar vote ensures military's grip

-

Deutsche Bank logs record profits, as new probe casts shadow

-

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

Thai foreign minister says hopes Myanmar polls 'start of transition' to peace

-

No white flag from Djokovic against Sinner as Alcaraz faces Zverev threat

-

Vietnam and EU upgrade ties as EU chief visits Hanoi

Vietnam and EU upgrade ties as EU chief visits Hanoi

-

Starmer, Xi stress need for stronger UK-China ties to face global headwinds

-

Senegal coach Thiaw gets five-match ban after AFCON final chaos

Senegal coach Thiaw gets five-match ban after AFCON final chaos

-

Phan Huy: the fashion prodigy putting Vietnam on the map

Gold demand hits record high on Trump policy doubts: industry

Gold demand surged to a record high in 2025 as investors and central banks flocked to the safe-haven asset as protection against US President Donald Trump's unpredictable policies and their potential economic impact, industry data showed Thursday.

The price of gold has surged in response, pushing on with a meteoric rise this year that saw it near $5,600 a troy ounce (31.1 grams) on Thursday.

Purchases hit all-time highs in both volume and value last year, the World Gold Council said in its annual report, with demand exceeding 5,000 tonnes and value reaching $555 billion -- a 45 percent increase year on year.

"Uncertainty" has been the key driver of gold's strong performance, said WGC analyst Krishan Gopaul.

"On a geopolitical front, there were obviously concerns about the actions of the new Trump administration," he said.

The year was marked by Trump's tariff onslaught against major trading partners including China, the European Union and India, upending longstanding global free trade tenets.

Adding to that, Trump's criticism of US monetary policy has fuelled concerns about the Federal Reserve's independence and contributed to a weakening dollar.

Those fears have led other central banks to significantly increase their gold reserves.

Although central bank purchases of gold fell slightly in volume from the previous year, their total value increased by 13 percent in 2025.

Gold now makes up more than 20 percent of central bank reserves, a level not seen since the early 1990s, the WGC said.

Demand was also boosted by enthusiasm for exchange-traded funds linked to the gold price.

"Gold ETFs have made gold more accessible to many investors" by making it as easy to buy as a company stock, Gopaul said.

A fresh surge in gold's price this week was driven by "safe-haven demand, geopolitical tensions and... as investors shift to hard assets from traditional currencies and bonds", Liam Fitzpatrick, head of metals and mining research at Deutsche Bank, said Thursday.

A.Zbinden--VB