-

Zverev survives scare to kickstart Paris Masters title defence

Zverev survives scare to kickstart Paris Masters title defence

-

Rabat to host 2026 African World Cup play-offs

-

WHO urges Sudan ceasefire after alleged massacres in El-Fasher

WHO urges Sudan ceasefire after alleged massacres in El-Fasher

-

Under-fire UK govt deports migrant sex offender with £500

-

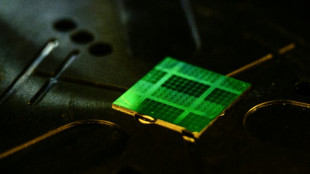

AI chip giant Nvidia becomes world's first $5 trillion company

AI chip giant Nvidia becomes world's first $5 trillion company

-

Arsenal depth fuels Saka's belief in Premier League title charge

-

Startup Character.AI to ban direct chat for minors after teen suicide

Startup Character.AI to ban direct chat for minors after teen suicide

-

132 killed in massive Rio police crackdown on gang: public defender

-

Pedri joins growing Barcelona sickbay

Pedri joins growing Barcelona sickbay

-

Zambia and former Chelsea manager Grant part ways

-

Russia sends teen who performed anti-war songs back to jail

Russia sends teen who performed anti-war songs back to jail

-

Caribbean reels from hurricane as homes, streets destroyed

-

Boeing reports $5.4-bn loss on large hit from 777X aircraft delays

Boeing reports $5.4-bn loss on large hit from 777X aircraft delays

-

Real Madrid's Vinicius says sorry for Clasico substitution huff

-

Dutch vote in snap election seen as test for Europe's far-right

Dutch vote in snap election seen as test for Europe's far-right

-

Jihadist fuel blockade makes daily life a struggle for Bamako residents

-

De Bruyne goes under the knife for hamstring injury

De Bruyne goes under the knife for hamstring injury

-

Wolvaardt's 169 fires South Africa to 319-7 in World Cup semis

-

EU seeks 'urgent solutions' with China over chipmaker Nexperia

EU seeks 'urgent solutions' with China over chipmaker Nexperia

-

Paris prosecutor promises update in Louvre heist probe

-

Funds for climate adaptation 'lifeline' far off track: UN

Funds for climate adaptation 'lifeline' far off track: UN

-

Record Vietnam rains kill seven and flood 100,000 homes

-

Markets extend record run as trade dominates

Markets extend record run as trade dominates

-

Sudan govt accuses RSF of attacking mosques in El-Fasher takeover

-

Rain washes out 1st Australia-India T20 match

Rain washes out 1st Australia-India T20 match

-

Spain's Santander bank posts record profit

-

FIA taken to court to block Ben Sulayem's uncontested candidacy

FIA taken to court to block Ben Sulayem's uncontested candidacy

-

Chemicals firm BASF urges EU to cut red tape as profit dips

-

Romania says US will cut some troops in Europe

Romania says US will cut some troops in Europe

-

Israel hits dozens of targets as Gaza sees deadliest night since truce

-

Mercedes-Benz reassures on Nexperia chips as profit plunges

Mercedes-Benz reassures on Nexperia chips as profit plunges

-

France tries Bulgarians over defacing memorial in Russia-linked case

-

BBC says journalist questioned and blocked from leaving Vietnam

BBC says journalist questioned and blocked from leaving Vietnam

-

UK drugmaker GSK lifts 2025 guidance despite US tariffs

-

Mercedes-Benz profit plunges on China slump and US tariffs

Mercedes-Benz profit plunges on China slump and US tariffs

-

South Korea gifts Trump replica of ancient golden crown

-

Record Vietnam rains kill four and flood 100,000 homes

Record Vietnam rains kill four and flood 100,000 homes

-

Norway's energy giant Equinor falls into loss

-

Asia stocks join Wall Street records as tech bull run quickens

Asia stocks join Wall Street records as tech bull run quickens

-

New Zealand hammer reckless England despite Archer's brilliance

-

Record potato harvest is no boon in fries-mad Belgium

Record potato harvest is no boon in fries-mad Belgium

-

Deutsche Bank posts record profit on strong trading

-

UBS beats expectations as claws backs provisions

UBS beats expectations as claws backs provisions

-

German neo-Nazi rappers push hate speech, disinfo on TikTok

-

US aid flows to Nigeria anti-landmine efforts - for now

US aid flows to Nigeria anti-landmine efforts - for now

-

Low turnout as Tanzania votes without an opposition

-

Monarch-loving Trump gifted golden crown once worn by South Korean kings

Monarch-loving Trump gifted golden crown once worn by South Korean kings

-

Dutch vote in test for Europe's far right

-

Fugitive ex-PM says Bangladesh vote risks deepening divide

Fugitive ex-PM says Bangladesh vote risks deepening divide

-

On board the Cold War-style sealed train from Moscow to Kaliningrad

| CMSD | -0.12% | 24.61 | $ | |

| CMSC | 0.13% | 24.292 | $ | |

| RBGPF | -0.11% | 79 | $ | |

| SCS | -2.27% | 16.31 | $ | |

| NGG | -0.67% | 76.14 | $ | |

| RIO | 1.74% | 73.264 | $ | |

| BTI | -1.01% | 51.937 | $ | |

| BCC | -0.63% | 71.92 | $ | |

| RYCEF | -0.72% | 15.35 | $ | |

| GSK | 5.68% | 46.33 | $ | |

| BP | 1.54% | 34.999 | $ | |

| JRI | -0.61% | 13.965 | $ | |

| RELX | -2.71% | 45.01 | $ | |

| AZN | 0.19% | 82.765 | $ | |

| BCE | -0.52% | 23.448 | $ | |

| VOD | -2.16% | 11.976 | $ |

Wall Street stocks hit fresh records on easing US-China worries

Wall Street stocks ended at fresh records again on Monday over optimism that the US-China trade war was about to ease, with a possible deal in view when presidents Donald Trump and Xi Jinping meet later this week.

Major indices in New York charged higher, with the Dow, S&P 500 and Nasdaq all finishing at records on the improved sentiment on trade talks. Monday's buoyant session also featured heady gains by Microsoft, Facebook parent Meta and other tech giants ahead of earnings later this week.

Argentina's stocks soared more than 20 percent on the back of President Javier Milei's midterm victory, which saw his party win the biggest amount of votes in weekend legislative elections. The peso also jumped.

European stock markets were muted, reined in by anticipation of interest-rate decisions this week from the Federal Reserve and European Central Bank, although Spain's index reached a record high from strong growth and corporate earnings.

Overall the positive sentiment was "buoyed by weekend chatter suggesting that Washington and Beijing may finally be finding some common ground" and pulling back from painful tit-for-tat trade measures, said Fawad Razaqzada, market analyst at Forex.com.

"All eyes now turn to Thursday's meeting between US President Donald Trump and Chinese President Xi Jinping, which could see these tentative understandings formalized," he said.

Gold prices retreated on easing risk sentiment.

Trump arrived in Japan on Monday as part of a tour of Asia that could see the US president and Xi end their bruising trade war.

Speaking on Air Force One, Trump said he was hopeful of a deal when he sees Xi Thursday, while also indicating he was willing to extend his trip to meet North Korean leader Kim Jong Un.

China's vice commerce minister, Li Chenggang, said a "preliminary consensus" had been reached.

The progress paves the way for Trump and Xi to meet Thursday in South Korea on the sidelines of the Asia-Pacific Economic Cooperation summit, their first face-to-face meeting since the US leader returned to office.

Chinese stock indices closed up more than one percent Monday.

The advances followed a strong finish Friday on Wall Street, after benign US inflation data set the stage for a Federal Reserve interest-rate cut on Wednesday, despite a lack of clarity over the health of the US economy as a government shutdown churns on.

On Thursday, the European Central Bank is expected to hold borrowing costs steady for its third straight meeting, with eurozone inflation largely under control.

In corporate news, shares in US chipmaker Qualcomm soared 11.2 percent after the company unveiled two new AI processors designed for data centers, pushing into a market dominated by rivals Nvidia and AMD.

Keurig Dr. Pepper jumped 7.6 percent after lifting its full-year sales forecast and as it announced it had received $7 billion in investment agreements from affiliates of Apollo and KKR.

- Key figures at around 1630 GMT -

New York - Dow: UP 0.5 percent at 47,435.81 points

New York - S&P: UP 1.0 percent at 6,857.90

New York - Nasdaq: UP 1.6 percent at 23,580.33

London - FTSE 100: UP 0.1 percent at 9,653.82 (close)

Paris - CAC 40: UP 0.2 percent at 8,239.18 (close)

Frankfurt - DAX: UP 0.3 percent at 24,308.78 (close)

Tokyo - Nikkei 225: UP 2.5 percent at 50,512.32 (close)

Shanghai - Composite: UP 1.2 percent at 3,996.94 (close)

Hong Kong - Hang Seng Index: UP 1.1 percent at 26,433.70 (close)

Euro/dollar: UP at $1.1646 from $1.1627 on Friday

Pound/dollar: UP at $1.3333 from $1.3311

Dollar/yen: UP at 152.90 yen from 152.86 yen

Euro/pound: FLAT at 87.35 pence

Brent North Sea Crude: DOWN 0.5 percent at $65.62 per barrel

West Texas Intermediate: DOWN 0.3 percent at $61.31 per barrel

R.Kloeti--VB