-

Dozens of French towns flout government warning to fly Palestinian flag

Dozens of French towns flout government warning to fly Palestinian flag

-

Nvidia to invest up to $100 bn in OpenAI data centers

-

US mulls economic lifeline for ally Argentina

US mulls economic lifeline for ally Argentina

-

France to recognize Palestinian state at contentious UN

-

Museum or sheikh? World's second largest diamond awaits home

Museum or sheikh? World's second largest diamond awaits home

-

UK charities axe Prince Andrew's ex-wife over Epstein email

-

Google fights breakup of ad tech business in US court

Google fights breakup of ad tech business in US court

-

US pleads for new beefed-up multi-national force in Haiti

-

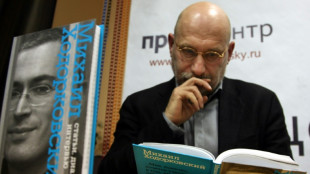

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

-

Jews flock to Ukraine for New Year pilgrimage despite travel warning

-

Trump autism 'announcement' expected Monday

Trump autism 'announcement' expected Monday

-

Over 60,000 Europeans died from heat during 2024 summer: study

-

Clashes as tens of thousands join pro-Palestinian demos in Italy

Clashes as tens of thousands join pro-Palestinian demos in Italy

-

UK charity axes Prince Andrew's ex-wife over Epstein email

-

France, others to recognize Palestinian state at UN

France, others to recognize Palestinian state at UN

-

IAEA says Iran nuclear diplomacy at a 'difficult juncture'

-

Merz tasks banker with luring investment to Germany

Merz tasks banker with luring investment to Germany

-

Russia offers to extend nuclear arms limits with US by one year

-

Stocks turn lower ahead of key US inflation data

Stocks turn lower ahead of key US inflation data

-

Gavi to undergo knee operation on meniscus injury: Barcelona

-

Frenchman denies killing wife in case that captivated France

Frenchman denies killing wife in case that captivated France

-

Bavuma out of Test series in Pakistan as De Kock back for ODIs

-

Bavuma out of Test series as De Kock back for white-ball games

Bavuma out of Test series as De Kock back for white-ball games

-

French town halls defy government warning to fly Palestinian flags

-

French zoo returns poorly panda and partner to China

French zoo returns poorly panda and partner to China

-

IEA feels the heat as Washington pushes pro-oil agenda

-

Three things we learned from the Azerbaijan Grand Prix

Three things we learned from the Azerbaijan Grand Prix

-

Spanish bank BBVA raises offer for rival Sabadell

-

Tens of thousands join pro-Palestinian demos, strikes in Italy

Tens of thousands join pro-Palestinian demos, strikes in Italy

-

Man City's Silva fumes over lack of respect in schedule row

-

Israeli army operations stir fears in Syria's Quneitra

Israeli army operations stir fears in Syria's Quneitra

-

Chelsea's Palmer likely to avoid groin surgery: Maresca

-

Horner formally leaves Red Bull after agreeing exit from F1 team

Horner formally leaves Red Bull after agreeing exit from F1 team

-

Newcastle sign Wales full-back Williams

-

Nigerian women protest for reserved seats in parliament

Nigerian women protest for reserved seats in parliament

-

Stocks mixed ahead of week's key US inflation data

-

Experts question Albania's AI-generated minister

Experts question Albania's AI-generated minister

-

Philippine protest arrests leave parents seeking answers

-

New boss of Germany's crisis-hit railways vows 'new start'

New boss of Germany's crisis-hit railways vows 'new start'

-

Just not cricket: how India-Pakistan tensions spill onto the pitch

-

PSG star Dembele expected to beat Yamal to Ballon d'Or

PSG star Dembele expected to beat Yamal to Ballon d'Or

-

Burberry returns to London's top shares index

-

French town halls fly Palestinian flag despite government warning

French town halls fly Palestinian flag despite government warning

-

China prepares to evacuate 400,000 as super typhoon makes landfall in Philippines

-

Japan PM candidate vows 'Nordic' gender balance

Japan PM candidate vows 'Nordic' gender balance

-

Climate goals and fossil fuel plans don't add up, experts say

-

Amazon faces US trial over alleged Prime subscription tricks

Amazon faces US trial over alleged Prime subscription tricks

-

Google faces court battle over breakup of ad tech business

-

France, others to recognize Palestinian state as UN week gets underway

France, others to recognize Palestinian state as UN week gets underway

-

Burkina's LGBTQ community fears 'witch hunt' after anti-gay law

| RBGPF | -0.79% | 76 | $ | |

| CMSC | 0.04% | 24.26 | $ | |

| RYCEF | 2.17% | 15.67 | $ | |

| CMSD | -0.74% | 24.4 | $ | |

| SCS | -0.15% | 16.855 | $ | |

| RIO | 2.46% | 63.955 | $ | |

| NGG | 1.21% | 70.95 | $ | |

| RELX | -0.11% | 46.98 | $ | |

| GSK | 0.68% | 40.95 | $ | |

| BCC | -0.61% | 78.99 | $ | |

| BTI | -1.19% | 54.055 | $ | |

| AZN | 1.69% | 77.595 | $ | |

| VOD | -0.04% | 11.405 | $ | |

| BCE | -0.45% | 23.115 | $ | |

| JRI | 0.27% | 13.957 | $ | |

| BP | 1.22% | 34.54 | $ |

Stocks steady ahead of key US inflation data

Wall Street saw off an early bout of profit-taking on Monday as investors looked for clues to the US Federal Reserve's next interest rate move.

Stock indices pulled back at the start of trading in New York after setting fresh records yet again on Friday following the Fed's resumption of interest rate cuts.

The stock market is "likely experiencing a profit-taking breather", Briefing.com analyst Patrick O'Hare said ahead of the opening bell, noting that the S&P 500 index had gained 3.2 percent in September and the Nasdaq Composite 5.5 percent in a streak of record-setting sessions.

But investors only briefly needed to catch their breath, with stocks climbing into positive territory in morning trading as the S&P 500 and Nasdaq Composite set fresh all-time highs.

Global equities have enjoyed a healthy run-up in recent months on optimism that the US central bank will lower borrowing costs several times before the end of 2025 over worries about a softening labour market.

On the heels of recent economic reports showing weaker US jobs growth, the Fed last week lowered borrowing costs by 25 basis points, its first reduction this year.

Investors will be listening for what Fed policymakers have to say during public appearances this week.

They will also be waiting for the release on Friday of the personal consumption expenditures (PCE) price index, which is the Fed's preferred measure of inflation.

"The big market moving announcement is likely to be the US PCE inflation report," said AJ Bell investment director Russ Mould.

The dollar fell against major rivals as the US interest rate cut weighed on the greenback, while the price of gold hit a fresh high.

Crude oil prices fell around one percent as traders focused on concerns that production will outstrip demand.

In European trading, London edged out a gain, but Frankfurt and Paris ended the day lower.

- 'US-China detente' -

As the new trading week kicked off, investors took some heart from talks between US President Donald Trump and Chinese leader Xi Jinping on Friday.

Trump said progress was made "on many very important issues", including a deal to sell blockbuster social media app TikTok.

He added that the pair would meet on the sidelines of an Asia-Pacific Economic Cooperation summit in South Korea at the end of next month and that he would travel to China next year.

"While lacking apparent substance... (the meeting) does look to have helped create a positive atmosphere to enable extension of the ongoing US-China detente," said National Australia Bank's Ray Attrill.

Mumbai edged down as India's $283-billion tech sector took a hit after Trump on Friday ordered an annual $100,000 fee be added to new H-1B skilled worker visas, creating potentially major repercussions for the tech industry where such permits are prolific.

Shares in Amazon and Microsoft, two major users of H-1B visas, were lower on Monday.

"We believe that the tech giants will be able to afford the visas, and this selloff in tech shares will be temporary, in the same way that tariff concerns weighed on stocks before dying down," said Kathleen Brooks, research director at XTB trading platform.

Shares in Porsche fell eight percent following news that it will dramatically slow its shift to electric vehicles amid weak demand. That prompted parent company Volkswagen to warn of a multibillion-euro hit and saw its shares close nearly seven percent lower.

- Key figures at around 1530 GMT -

New York - Dow: FLAT at 46,330.56 points

New York - S&P 500: UP 0.2 percent at 6,676.10

New York - Nasdaq Composite: UP 0.3 percent at 22,698.77

London - FTSE 100: UP 0.1 percent at 9,226.68

Paris - CAC 40: DOWN 0.3 percent at 7,830.11

Frankfurt - DAX: DOWN 0.5 percent at 23,527.05

Tokyo - Nikkei 225: UP 1.0 percent at 45,493.66 (close)

Hong Kong - Hang Seng Index: DOWN 0.8 percent at 26,344.14 (close)

Shanghai - Composite: UP 0.2 percent at 3,828.58 (close)

Euro/dollar: UP at $1.1772 from $1.1745 on Friday

Pound/dollar: UP at $1.3502 from $1.3472

Dollar/yen: DOWN at 147.83 yen from 147.90 yen

Euro/pound: UP at 87.19 pence from 87.18 pence

West Texas Intermediate: DOWN 0.4 percent at $62.15 per barrel

Brent North Sea Crude: DOWN 0.4 percent at $66.43 per barrel

burs-rl/sbk

M.Betschart--VB