-

ICJ backs France in Equatorial Guinea mansion row

ICJ backs France in Equatorial Guinea mansion row

-

Amorim keeps faith with Bayindir for Manchester derby

-

England captain Aldcroft back for Women's Rugby World Cup quarter-final

England captain Aldcroft back for Women's Rugby World Cup quarter-final

-

Rubio to offer Israel support despite Qatar strike

-

France risks credit downgrade as new PM tackles budget

France risks credit downgrade as new PM tackles budget

-

Guardiola puts Haaland above Isak in list of world's top strikers

-

US sprinter Knighton banned after losing doping appeal

US sprinter Knighton banned after losing doping appeal

-

Sole-searching: Man Utd probe mystery of missing boots

-

Trump says Charlie Kirk shooting suspect in custody

Trump says Charlie Kirk shooting suspect in custody

-

Armani's will lays path to potential buyout by rival

-

Afghan deputy PM visits earthquake hit area

Afghan deputy PM visits earthquake hit area

-

Russian central bank cuts interest rate as economy slows

-

India hardliners give Nepal protests baseless religious twist

India hardliners give Nepal protests baseless religious twist

-

Chelsea's Delap out for up to three months: Maresca

-

Microsoft avoids EU antitrust fine with Teams commitments

Microsoft avoids EU antitrust fine with Teams commitments

-

Stocks, dollar diverge with focus on rates

-

Norway sovereign wealth fund drops French miner over environmental fears

Norway sovereign wealth fund drops French miner over environmental fears

-

Ukrainian athletes show true grit to be at world championships, says federation chief

-

S. Koreans greeted with applause at home after US detention

S. Koreans greeted with applause at home after US detention

-

Newcastle's Howe says Isak relationship was 'difficult' before Liverpool move

-

South Africa jailbreak fugitive loses bid to block Netflix documentary

South Africa jailbreak fugitive loses bid to block Netflix documentary

-

Rojas targets fifth world triple jump title on injury return

-

Japan athletics chief fights back tears over memory of Covid-hit Olympics

Japan athletics chief fights back tears over memory of Covid-hit Olympics

-

Pacific leaders agree new summit rules after China, Taiwan bans

-

Nepalis assess damage after terror of deadly protests

Nepalis assess damage after terror of deadly protests

-

Newcastle's Wissa to see specialist over knee injury

-

Jackson happy to be 'where I'm wanted' after joining Bayern

Jackson happy to be 'where I'm wanted' after joining Bayern

-

Liverpool's Slot urges patience with 'best striker' Isak after record move

-

Board of Spain's Sabadell bank rejects BBVA takeover bid

Board of Spain's Sabadell bank rejects BBVA takeover bid

-

Hunt for shooter of Charlie Kirk enters third day in US

-

'Volatile': Londoners and asylum seekers on edge due to protests

'Volatile': Londoners and asylum seekers on edge due to protests

-

New David Bowie museum unmasks the man behind the make up

-

Man Utd keeper Onana joins Trabzonspor on loan

Man Utd keeper Onana joins Trabzonspor on loan

-

Nepal seeks new leader as army reclaims streets after protest violence

-

Indonesia seizes part of nickel site over forest violations

Indonesia seizes part of nickel site over forest violations

-

Springboks, Pumas out to keep Rugby Championship hopes alive

-

Scrutiny on Thai zoo grows after lion attack

Scrutiny on Thai zoo grows after lion attack

-

UK economy stalls in July

-

Charlie Kirk's killing: what we know

Charlie Kirk's killing: what we know

-

S. Korean workers arrive home after US detention

-

US tariffs deal stokes 'monster' pick-up fears in Europe

US tariffs deal stokes 'monster' pick-up fears in Europe

-

Saint Lucia's Alfred says Olympic gold shows talent counts, not your passport

-

Springboks hard man Wiese to take the All Blacks head-on

Springboks hard man Wiese to take the All Blacks head-on

-

Tinch's journey to be hurdles title contender sparked by stepdad's joke

-

Russia, Belarus start military drills as West watches warily

Russia, Belarus start military drills as West watches warily

-

UN General Assembly to vote on a Hamas-free Palestinian state

-

For theatre legend John Kani, art must 'speak truth to power'

For theatre legend John Kani, art must 'speak truth to power'

-

Ukraine's energy strikes hit Russians at the pump

-

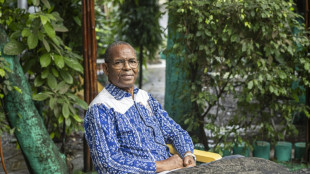

Guinea's Tierno Monenembo: stolen words and diehard critic of military rule

Guinea's Tierno Monenembo: stolen words and diehard critic of military rule

-

Norman says 'we changed the game' as he officially departs LIV Golf

Stocks, dollar diverge with focus on rates

European stock markets mostly retreated Friday after gains among Asia's main indices, ahead of a likely cut to US interest rates next week.

Wall Street reached fresh record highs Thursday after US inflation and jobless claims data cemented expectations that the Federal Reserve will trim borrowing costs.

"Stock markets (are) at record highs on hopes for falling interest rates," noted Derren Nathan, head of equity research at stockbroker Hargreaves Lansdown.

There were fresh records this week also for the Tokyo and Seoul stock markets, while London on Friday neared a new all-time high.

London's benchmark FTSE 100 was a rare gainer among European stock markets as the British pound weakened on data showing the UK economy stalled in July.

"While the data underscores the fragile state of the UK economy, sterling weakness and continued strength in energy and financial names are helping the index outperform broader European peers," said Joshua Mahony, chief market analyst at traders Scope Markets.

Hong Kong led the way among Asia's top stock markets on Friday, closing up more than one percent thanks to a surge of more than five percent in the share price of Alibaba.

The e-commerce titan's New York stock had spiked eight percent Thursday, helped by its latest moves in the artificial intelligence sector.

This week saw also more record highs for the price of gold, viewed as a safe haven investment, following escalating tensions over the Israel-Gaza and Russia-Ukraine conflicts.

Russia's central bank on Friday trimmed its key interest rate to 17 percent as the country risks an economic slowdown.

The Bank of England is next week widely expected to keep its key rate on hold as elevated UK inflation offsets stagnant growth.

The European Central Bank on Thursday held interest rates steady with eurozone inflation under control and trade tensions having eased, even as France's political crisis presents policymakers with a fresh challenge.

- Key figures at around 1045 GMT -

London - FTSE 100: UP 0.3 percent at 9,328.87 points

Paris - CAC 40: DOWN 0.5 percent at 7,788.08

Frankfurt - DAX: DOWN 0.2 percent at 23,648.27

Tokyo - Nikkei 225: UP 0.9 percent at 44,768.12 (close)

Hong Kong - Hang Seng Index: UP 1.2 percent at 26,388.16 (close)

Shanghai - Composite: DOWN 0.1 percent at 3,870.60 (close)

New York - Dow: UP 1.4 percent at 46,108.00 points (close)

Euro/dollar: UP at $1.1740 from $1.1732 on Thursday

Pound/dollar: DOWN at $1.3553 from $1.3580

Dollar/yen: UP at 147.81 from 147.18 yen

Euro/pound: UP at 86.56 pence from 86.43 pence

Brent North Sea Crude: UP 0.8 percent at $66.90 per barrel

West Texas Intermediate: UP 0.7 percent at $62.78 per barrel

burs-bcp/rl

L.Stucki--VB