-

Germany's US exports hit four-year low as tariffs bite

Germany's US exports hit four-year low as tariffs bite

-

Israel warns Hamas to surrender or face 'annihilation'

-

Erasmus makes seven Springboks changes for All Blacks rematch

Erasmus makes seven Springboks changes for All Blacks rematch

-

French doctor accused of poisoning patients sounds defiant ahead of trial

-

Controversy stalks sparkling sprint talent Richardson

Controversy stalks sparkling sprint talent Richardson

-

Ariana Grande wins top MTV Video Music Award

-

'Last generation': Greek island's fading pistachio tradition

'Last generation': Greek island's fading pistachio tradition

-

China 'elephant in the room' at fraught Pacific Islands summit

-

Sweden's Sami fear for future amid rare earth mining plans

Sweden's Sami fear for future amid rare earth mining plans

-

'Trump Whisperer' ex-minister joins Japan PM race

-

Bills rally to stun Ravens, Stafford hits milestone in Rams win

Bills rally to stun Ravens, Stafford hits milestone in Rams win

-

ICC to hear war crimes charges against fugitive warlord Kony

-

Trump warns foreign companies after S.Korean workers detained

Trump warns foreign companies after S.Korean workers detained

-

Asian shares rise as Japan politics weigh on yen

-

Norway votes in election influenced by wars and tariff threats

Norway votes in election influenced by wars and tariff threats

-

French parliament set to eject PM in blow to Macron

-

ECB set to hold rates steady with eye on France crisis

ECB set to hold rates steady with eye on France crisis

-

Russell Crowe shaken by Nazi role in festival hit 'Nuremberg'

-

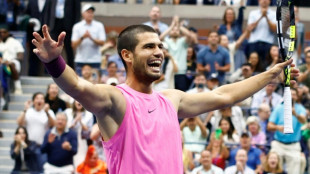

Alcaraz says completing career Slam his 'first goal'

Alcaraz says completing career Slam his 'first goal'

-

New Zealand fugitive father dead after nearly four years on the run: police

-

Alcaraz outshines rival Sinner to win second US Open

Alcaraz outshines rival Sinner to win second US Open

-

Australia's 'mushroom murderer' handed life in prison with parole

-

Racing betting tax hike will bring 'communities to their knees': Gosden

Racing betting tax hike will bring 'communities to their knees': Gosden

-

'Predictable' Sinner vows change

-

'Blood Moon' rises during total lunar eclipse

'Blood Moon' rises during total lunar eclipse

-

Rodgers wins in Steelers debut, Stafford hits milestone in Rams win

-

Australian judge to hand down sentence for 'mushroom murderer'

Australian judge to hand down sentence for 'mushroom murderer'

-

Chloe Zhao tackles Shakespeare's true tragedy in 'Hamnet'

-

Most EU carmakers on track to meet emission targets: study

Most EU carmakers on track to meet emission targets: study

-

Alcaraz beats Sinner to win US Open and reclaim No.1 ranking

-

Tatum says earned his place as an actor after 'Roofman'

Tatum says earned his place as an actor after 'Roofman'

-

'Blood Moon' rises as Kenya looks to the stars for tourism

-

Phillies shortstop Turner, NL batting leader, strains hamstring

Phillies shortstop Turner, NL batting leader, strains hamstring

-

Super Spain hit six as Germany get first World Cup qualifying win

-

Trump booed at US Open after visit delays final

Trump booed at US Open after visit delays final

-

Captain Jelonch leads champions Toulouse to winning Top 14 start

-

Wirtz stunner helps Germany bounce back against Northern Ireland

Wirtz stunner helps Germany bounce back against Northern Ireland

-

Rodgers wins in Steelers debut while Bucs win on Koo miss

-

Merino at the treble as Spain thump Turkey

Merino at the treble as Spain thump Turkey

-

Tuchel warns England to beware Serbia threat

-

Vienna State Opera opens season with free, all-star gala concert

Vienna State Opera opens season with free, all-star gala concert

-

Trump issues 'last warning' to Hamas over hostages

-

Tens of thousands march for Palestinians in Belgian capital

Tens of thousands march for Palestinians in Belgian capital

-

Sorensen-McGee hat-trick as World Cup holders New Zealand thump Ireland

-

Nawaz hat-trick helps Pakistan down Afghanistan in tri-series final

Nawaz hat-trick helps Pakistan down Afghanistan in tri-series final

-

Trump visit delays US Open as president returns to Democratic hometown

-

Bolsonaro supporters pack Brazil streets ahead of coup verdict

Bolsonaro supporters pack Brazil streets ahead of coup verdict

-

'Something went horribly wrong' in record loss, says S. Africa's Bavuma

-

Depay becomes Netherlands' top scorer in World Cup qualifying win

Depay becomes Netherlands' top scorer in World Cup qualifying win

-

Pedersen wins Vuelta stage 15 as protesters again impact race

ECB set to hold rates steady with eye on France crisis

The European Central bank is expected to hold interest rates steady again this week with inflation under control and US tariff tensions easing, even as France's political crisis presents a new headache.

It would mark the second straight meeting in which the central bank for the 20 countries that use the euro keeps its key deposit rate on hold at two percent.

The pause follows more than a year of cuts as the ECB pivoted from tackling a surge in inflation to seeking to support the beleaguered eurozone.

Inflation has stabilised in the bloc, hovering around the central bank's two-percent target in recent months.

"Any change in policy rates would be a big surprise," analysts at HSBC said in a note on Thursday's meeting.

In the United States, meanwhile, the Federal Reserve is widely expected to cut rates this month after a long period on hold as it seeks to support the job market, and following sustained pressure from President Donald Trump.

- Lagarde worried about France -

But for the Frankfurt-based ECB, while US tariff tensions have eased after a recent deal, policymakers now face a new headache due to a crisis in France, the eurozone's second-biggest economy.

Prime Minister Francois Bayrou is set to face a confidence vote Monday over an austerity budget that aims to slash France's mounting debt, with chances high that he will lose.

ECB President Christine Lagarde last week voiced concern about the risks of the government collapsing, warning that political turmoil in any eurozone country weighs on markets.

"Political developments, and the emergence of political risks, have an obvious impact on the economy, on how financial markets assess country risk, and are therefore a concern for us," she said in a radio interview.

Last week the turmoil pushed up France's long-term borrowing costs to their highest level since 2011, when the eurozone was rocked by a debt crisis.

Lagarde is likely to face questions about whether policymakers might use a special mechanism aimed at combating disorderly movements in bond markets.

But ECB officials have so far downplayed this possibility.

Andrew Kenningham, chief Europe economist at Capital Economics, told AFP that he did not expect Lagarde to "say anything meaningful" related to France, and that the crisis was unlikely to impact their rate decisions for now.

An increasingly bleak outlook in Germany, where recent data has dashed hopes of a strong rebound for the eurozone's biggest economy, may also factor into the ECB's calculations as they mull their next rate move.

- Deal gives 'clarity' -

Meanwhile the tariff uncertainty that kept the ECB on its toes for months has subsided after Trump struck a deal with the EU in July, with most goods from the bloc facing a levy of 15 percent.

The deal "provides some clarity", HSBC said.

ECB policymakers will remain vigilant about impacts on the export-dependent eurozone however -- negotiations on the details are continuing while some sectors complain they face higher levies than expected.

The impact of the euro's recent strengthening against the dollar could also be in focus at the meeting.

A stronger euro makes imports cheaper and could further suppress inflation -- adding to concerns that consumer price rises could end up falling below the two-percent target for a long period.

The ECB will release new growth and inflation forecasts on Thursday but analysts expect little change from its last predictions in June.

At her post-meeting press conference, there is little expectation Lagarde will give indications about the future path of rates -- though some analysts think the ECB could stay on hold for the rest of 2025.

C.Kreuzer--VB