-

Gaza mediators 'working very hard' to revive truce plan: Egypt

Gaza mediators 'working very hard' to revive truce plan: Egypt

-

Man City's Grealish joins Everton on season-long loan

-

Ukraine says fighting 'difficult' after reports of Russia's rapid gains

Ukraine says fighting 'difficult' after reports of Russia's rapid gains

-

US consumer inflation holds steady but tariff risks persist

-

S.Africa to offer US new deal to avoid 30% tariff

S.Africa to offer US new deal to avoid 30% tariff

-

Gambia baby death heightens alarm over female genital mutilation

-

Soldier dies battling Montenegro wildfire

Soldier dies battling Montenegro wildfire

-

Last Liverpool goal had special meaning for Jota

-

Mixed crews introduced for 2027 America's Cup

Mixed crews introduced for 2027 America's Cup

-

Stocks rise on restrained US inflation

-

US consumer inflation holds steady but tariff worries persist

US consumer inflation holds steady but tariff worries persist

-

Brevis smashes record ton as South Africa level T20 series

-

EU ready to do plastic pollution deal 'but not at any cost'

EU ready to do plastic pollution deal 'but not at any cost'

-

China Evergrande Group says to delist from Hong Kong

-

In China's factory heartland, warehouses weather Trump tariffs

In China's factory heartland, warehouses weather Trump tariffs

-

Palace claim sporting merit 'meaningless' after Europa League demotion

-

Former Premier League referee Coote given eight-week ban over Klopp comments

Former Premier League referee Coote given eight-week ban over Klopp comments

-

Council of Europe cautions on weapon sales to Israel

-

The Elders group of global leaders warns of Gaza 'genocide'

The Elders group of global leaders warns of Gaza 'genocide'

-

Man killed in Spain wildfire as European heatwave intensifies

-

US, China extend tariff truce for 90 days

US, China extend tariff truce for 90 days

-

Families mourn 40 years since deadly Japan Airlines crash

-

Thai soldier wounded in Cambodia border landmine blast

Thai soldier wounded in Cambodia border landmine blast

-

PSG sign Ukrainian defender Illia Zabarnyi

-

Five Premier League talking points

Five Premier League talking points

-

Five talking points as Spain's La Liga begins

-

Markets boosted by China-US truce extension, inflation in focus

Markets boosted by China-US truce extension, inflation in focus

-

Japan boxing to adopt stricter safety rules after deaths of two fighters

-

France adopts law upholding ban on controversial insecticide

France adopts law upholding ban on controversial insecticide

-

Most markets rise as China-US truce extended, inflation in focus

-

Toll of India Himalayan flood likely to be at least 70

Toll of India Himalayan flood likely to be at least 70

-

Taylor Swift announces 12th album for 'pre pre-order'

-

Italian athlete dies at World Games in China

Italian athlete dies at World Games in China

-

AI porn victims see Hong Kong unprepared for threat

-

Steely Sinner advances amid Cincinnati power-failure chaos

Steely Sinner advances amid Cincinnati power-failure chaos

-

Families forever scarred 4 years on from Kabul plane deaths

-

Scientists find 74-million-year-old mammal fossil in Chile

Scientists find 74-million-year-old mammal fossil in Chile

-

Spanish police bust 'spiritual retreat' offering hallucinogenic drugs

-

Jellyfish force French nuclear plant shutdown

Jellyfish force French nuclear plant shutdown

-

Formerra Becomes North American Distributor for Syensqo PVDF

-

One dead, 10 hospitalized in Pennsylvania steel plant explosions

One dead, 10 hospitalized in Pennsylvania steel plant explosions

-

Trump meets with Intel CEO after demanding he resign

-

Sabalenka survives massive Cincinnati struggle with Raducanu

Sabalenka survives massive Cincinnati struggle with Raducanu

-

Straka skips BMW but will play PGA Tour Championship

-

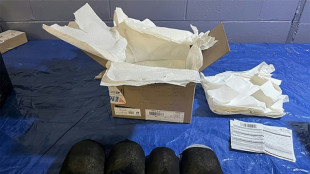

Chinese man pleads guilty in US to smuggling protected turtles

Chinese man pleads guilty in US to smuggling protected turtles

-

One dead, dozens injured in Pennsylvania steel plant explosions

-

Trump signs order to extend China tariff truce by 90 days: US media

Trump signs order to extend China tariff truce by 90 days: US media

-

Pollock earns first enhanced England contract as Farrell misses out

-

Iraq announces nationwide power outage amid 'record' heat

Iraq announces nationwide power outage amid 'record' heat

-

Harry and Meghan sign reduced deal with Netflix

| CMSC | 0.07% | 23.075 | $ | |

| RBGPF | 0% | 73.08 | $ | |

| RYCEF | 2.58% | 14.72 | $ | |

| VOD | 0.43% | 11.56 | $ | |

| BCC | 4.09% | 84.18 | $ | |

| NGG | -1.45% | 70.21 | $ | |

| GSK | 1.15% | 38.15 | $ | |

| RIO | 1.75% | 63.25 | $ | |

| SCU | 0% | 12.72 | $ | |

| SCS | 2% | 16.285 | $ | |

| RELX | -0.66% | 47.725 | $ | |

| BCE | 1.56% | 24.735 | $ | |

| CMSD | -0.02% | 23.565 | $ | |

| BTI | -0.59% | 57.985 | $ | |

| JRI | -0.04% | 13.385 | $ | |

| AZN | 1.12% | 74.91 | $ | |

| BP | 0.99% | 34.29 | $ |

China Evergrande Group says to delist from Hong Kong

Embattled property giant China Evergrande Group said Tuesday it will delist from Hong Kong Stock Exchange as a heavier-than-expected debt burden weighed on its liquidation process.

The Hong Kong bourse's listing committee decided to cancel Evergrande's listing as it had failed to meet a July deadline to resume trading, according to an exchange filing.

Once China's biggest real estate firm, Evergrande was worth more than $50 billion at its peak and helped propel the country's rapid economic growth in recent decades.

But it defaulted in 2021 and became emblematic of the years-long crisis in the country's property market.

A Hong Kong court issued a winding-up order for Evergrande in January 2024, ruling that the company had failed to come up with a debt repayment plan that suited its creditors.

Evergrande's shares on the Hong Kong stock exchange were suspended that month.

Liquidators have made moves to recover creditors' investments, including filing a lawsuit against PwC and its mainland Chinese arm for their role in auditing the debt-ridden developer.

Evergrande's share listing will be cancelled on August 25, according to Tuesday's filing, which was attributed to liquidators Edward Middleton and Tiffany Wong.

Middleton and Wong said in an attached progress report that Evergrande's debt load was bigger than the previously estimated $27.5 billion.

"As at 31 July 2025, this claims' discovery exercise had resulted in 187 proofs of debt being submitted, by which claims of approximately HK$350 billion (US$45 billion) in aggregate have been made," the document read.

This figure was not to be taken as final, Middleton and Wong added.

"The liquidators believe that a holistic restructuring will prove out of reach" at this stage, the duo wrote.

China Evergrande Group was a holding company and the liquidators said they had assumed control of more than 100 companies within the group.

They said in the report that they were not able to "estimate the amounts that may ultimately be realised from these entities".

The property behemoth's market value was only around $274 million when share trading was suspended, and its founder Xu Jiayin owned a roughly 60 percent stake at the time, Bloomberg News reported.

"Whether or not there's a delisting, Evergrande's shareholders will likely have to prepare for near-total loss," Bloomberg Intelligence analyst Kristy Hung told the news outlet before the delisting was announced.

"The developer's liquidation and substantial claims from creditors who are ahead in the order suggests equity holders face material risk of getting nothing," Hung said.

S.Spengler--VB