-

Japan boxing to hold emergency meeting following deaths

Japan boxing to hold emergency meeting following deaths

-

Chinese vessels collide while pursuing Philippine boat in South China Sea: Manila

-

Australia to recognise Palestinian state

Australia to recognise Palestinian state

-

Liverpool spend big to hold off Arsenal, City in Premier League title fight

-

Four days left to square the circle on global plastic pollution treaty

Four days left to square the circle on global plastic pollution treaty

-

'My boss raped me': Japanese prosecutor's fight for justice

-

Asian markets waver to start key week for trade, US data

Asian markets waver to start key week for trade, US data

-

Marcos says Philippines would be dragged 'kicking and screaming' into Taiwan war

-

China's Gen Z women embrace centuries-old script

China's Gen Z women embrace centuries-old script

-

With poetry and chants, Omanis strive to preserve ancient language

-

Australia women's rugby team lose trump card Caslick for World Cup

Australia women's rugby team lose trump card Caslick for World Cup

-

New tensions trouble small town America in Trump's second term

-

Al Jazeera says 5 journalists killed in Israeli strike in Gaza

Al Jazeera says 5 journalists killed in Israeli strike in Gaza

-

31 Concept to Debut Patent-Pending Technology at ISS Asia 2025 in Singapore

-

Rose tops Spaun in playoff to win PGA St. Jude as Fleetwood falters again

Rose tops Spaun in playoff to win PGA St. Jude as Fleetwood falters again

-

Pioneering MLB umpire Pawol debuts behind plate in Braves win

-

West Indies level ODI series with Pakistan as Chase stars

West Indies level ODI series with Pakistan as Chase stars

-

Spain's Alex Palou wins third consecutive IndyCar season title

-

Barcelona look smooth in Como demolition as Ter Stegen buries hatchet

Barcelona look smooth in Como demolition as Ter Stegen buries hatchet

-

Erratic Alcaraz battles through in Cincinnati opening match

-

One killed, dozens injured, as quake hits western Turkey

One killed, dozens injured, as quake hits western Turkey

-

Burmester wins playoff to capture LIV Golf Chicago crown

-

Course owner Trump hails Forrest's 'brilliant' Scottish Championship win

Course owner Trump hails Forrest's 'brilliant' Scottish Championship win

-

Eight dead in shooting outside Ecuador nightclub: police

-

NASCAR driver breaks collarbone in fall as he celebrates win

NASCAR driver breaks collarbone in fall as he celebrates win

-

Swiatek advances by walkover into Cincinnati fourth round

-

Hundreds march in London against UK recognising a Palestinian state

Hundreds march in London against UK recognising a Palestinian state

-

Moscow strikes kill six in Ukraine; refineries hit in Russia

-

Firefighters bring huge blaze in France under control

Firefighters bring huge blaze in France under control

-

Swiss pilot takes big step closer to solar plane altitude record

-

Slot seeks Liverpool balance for Premier League defence

Slot seeks Liverpool balance for Premier League defence

-

Mali arrests dozens of soldiers over alleged bid to topple junta

-

After busy first 100 days, Germany's Merz faces discord at home

After busy first 100 days, Germany's Merz faces discord at home

-

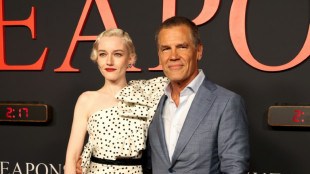

'Weapons' battles to top of North American box office

-

Local hero Forrest wins Scottish Championship golf

Local hero Forrest wins Scottish Championship golf

-

Trump says to move homeless people 'far' from Washington

-

New-look Liverpool humbled by Crystal Palace in Community Shield

New-look Liverpool humbled by Crystal Palace in Community Shield

-

Italy's Mount Vesuvius closed to tourists over wildfire

-

Europe pushes for Ukraine role in Trump-Putin talks

Europe pushes for Ukraine role in Trump-Putin talks

-

Israel's Gaza plan risks 'another calamity': UN official

-

Israel PM says new plan for Gaza 'best way to end the war'

Israel PM says new plan for Gaza 'best way to end the war'

-

Indigenous communities plead for action at plastic pollution talks

-

Power-packed David slams 83 as Australia beat South Africa in 1st T20

Power-packed David slams 83 as Australia beat South Africa in 1st T20

-

Italy's Mount Vesuvius closed to tourists as wildfire rages

-

'Challenging day' for firefighters battling huge blaze in France

'Challenging day' for firefighters battling huge blaze in France

-

Antonio Banderas rules out retirement as he turns 65

-

Israel far right presses Netanyahu for decisive win against Hamas

Israel far right presses Netanyahu for decisive win against Hamas

-

Salah criticises UEFA for 'Palestinian Pele' tribute: 'Tell us how he died'

-

Italian Brainrot: the AI memes only kids know

Italian Brainrot: the AI memes only kids know

-

Son Heung-min makes instant impact in LAFC debut

| SCU | 0% | 12.72 | $ | |

| JRI | 0.19% | 13.435 | $ | |

| BCC | -1.34% | 82.09 | $ | |

| CMSD | 0.25% | 23.58 | $ | |

| BCE | 2.34% | 24.35 | $ | |

| NGG | -1.51% | 71.01 | $ | |

| RBGPF | 1.7% | 73.08 | $ | |

| CMSC | 0.39% | 23.05 | $ | |

| RIO | 1.76% | 61.86 | $ | |

| SCS | -0.76% | 15.88 | $ | |

| AZN | -0.71% | 73.535 | $ | |

| GSK | 0.58% | 37.8 | $ | |

| RELX | -2.2% | 48 | $ | |

| VOD | 0.88% | 11.36 | $ | |

| BP | -0.15% | 34.14 | $ | |

| RYCEF | -0.14% | 14.42 | $ | |

| BTI | 0.96% | 57.24 | $ |

Asian markets waver to start key week for trade, US data

Asian markets mostly rose Monday as investors eyed a week dominated by speculation about US inflation data and a prolonged pause for Washington's tariffs on China.

Observers expect Donald Trump to announce an extension of a trade war truce reached with China last month, ahead of a 90-day deadline due to expire Tuesday.

Meanwhile, a key US consumer price index report is set up for Tuesday and could shape future policy decisions by the Federal Reserve, which has come under increasing pressure from the president to cut rates.

Investors have ramped up their bets on the central bank lowering borrowing costs at its next meeting in September following a series of reports -- particularly on jobs -- indicating the world's number one economy was slowing.

Also in view is a high-stakes summit between Trump and Russian counterpart Vladimir Putin on Friday in Alaska, which could pave the way for a deal to resolve the Ukraine war that involves an easing of tough sanctions on Moscow.

In early trade, Hong Kong, Shanghai, Sydney, Seoul, Wellington, Taipei and Jakarta all rose though there were losses in Singapore and Manila. Tokyo was closed for a public holiday.

With Tuesday's US-China tariff truce deadline looming, investors are bullish about the prospects of another extension.

"The market has fully subscribed to the high probability of the tariff truce being rolled over for another 90 days" said Chris Weston of Pepperstone.

"As such, unless diplomatic talks fully break down, news of extension shouldn’t move markets too intently," he added.

Gold futures edged down after hitting a record high Friday following reports of an unexpected tariff on the precious metal.

Despite protracted uncertainty about trade, investors remain optimistic about artificial intelligence -- an area of fierce competition between Beijing and Washington.

Reports Monday said that US chip giants Nvidia and Advanced Micro Devices (AMD) had agreed to pay Washington 15 percent of their revenue from selling AI chips to China.

Investors are betting that AI will transform the global economy, and last month Nvidia -- the world's leading semiconductor producer -- became the first company ever to hit $4 trillion in market value.

- Key figures at 0300 GMT -

Hong Kong - Hang Seng Index: UP 0.2 percent at 24,896.02

Shanghai - Composite: UP 0.3 percent at 3,644.73

Tokyo - Nikkei 225: Closed for a holiday

Pound/dollar: UP at $1.3457 from $1.3451 on Friday

Euro/dollar: UP at $1.1667 from $1.1643

Dollar/yen: DOWN at 147.56 yen from 147.79 yen

Euro/pound: UP at 86.70 pence from 86.54 pence

West Texas Intermediate: DOWN 0.6 percent at $63.50 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $66.27 per barrel

New York - Dow: UP 0.5 percent at 44,175.61 (close)

London - FTSE 100: DOWN 0.1 percent at 9,095.73 (close)

I.Stoeckli--VB