-

Sunset for Windows 10 updates leaves users in a bind

Sunset for Windows 10 updates leaves users in a bind

-

Hopes of Western refuge sink for Afghans in Pakistan

-

'Real' Greek farmers fume over EU subsidies scandal

'Real' Greek farmers fume over EU subsidies scandal

-

Trump to see Zelensky and lay out dark vision of UN

-

US lawmaker warns of military 'misunderstanding' risk with China

US lawmaker warns of military 'misunderstanding' risk with China

-

Emery seeks Europa League lift with Villa as Forest end long absence

-

Egypt frees activist Alaa Abdel Fattah after Sisi pardon

Egypt frees activist Alaa Abdel Fattah after Sisi pardon

-

Gibbs, Montgomery doubles as Lions rampage over Ravens

-

Asian markets struggle as focus turns to US inflation

Asian markets struggle as focus turns to US inflation

-

Schools shut, flights cancelled as Typhoon Ragasa nears Hong Kong

-

Maverick Georgian designer Demna debuts for Gucci in Milan

Maverick Georgian designer Demna debuts for Gucci in Milan

-

What do some researchers call disinformation? Anything but disinformation

-

Jimmy Kimmel show to return Tuesday

Jimmy Kimmel show to return Tuesday

-

Singapore firm rejects $1bn Sri Lankan pollution damages

-

Chile presidential contender vows to deport 'all' undocumented migrants

Chile presidential contender vows to deport 'all' undocumented migrants

-

China may strengthen climate role amid US fossil fuel push

-

Ryder Cup captains play upon emotions as practice begins

Ryder Cup captains play upon emotions as practice begins

-

Bradley defends US Ryder Cup player payments as charity boost

-

Trump ties autism risk to Tylenol as scientists urge caution

Trump ties autism risk to Tylenol as scientists urge caution

-

Dembele beats Yamal to Ballon d'Or as Bonmati retains women's award

-

Strength in Nvidia, Apple helps lift US equities to new records

Strength in Nvidia, Apple helps lift US equities to new records

-

Man City 'keeper Donnarumma says would have stayed at PSG

-

49ers ace Bosa to miss season after knee injury: reports

49ers ace Bosa to miss season after knee injury: reports

-

Canada wildlife decline 'most severe' in decades: WWF

-

PSG star Dembele wins men's Ballon d'Or

PSG star Dembele wins men's Ballon d'Or

-

Napoli beat battling Pisa to maintain perfect Serie A start

-

Spain's Aitana Bonmati wins Women's Ballon d'Or

Spain's Aitana Bonmati wins Women's Ballon d'Or

-

Jimmy Kimmel show to return Tuesday: Disney

-

Marseille inflict first defeat of season on PSG in Ligue 1

Marseille inflict first defeat of season on PSG in Ligue 1

-

White House promises US-controlled TikTok algorithm

-

Trump expected to tie autism risk to Tylenol as scientists urge caution

Trump expected to tie autism risk to Tylenol as scientists urge caution

-

Macron recognizes Palestinian state at landmark UN summit

-

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

Hong Kong prepares for 'serious threat' from Super Typhoon Ragasa

-

S. Korea court issues arrest warrant for Unification Church leader: Yonhap

-

New US Fed governor says rates should be around 'mid-2%'

New US Fed governor says rates should be around 'mid-2%'

-

14 killed as rival Ecuadoran inmates fight with guns, explosives

-

Dozens of French towns flout government warning to fly Palestinian flag

Dozens of French towns flout government warning to fly Palestinian flag

-

Nvidia to invest up to $100 bn in OpenAI data centers

-

US mulls economic lifeline for ally Argentina

US mulls economic lifeline for ally Argentina

-

France to recognize Palestinian state at contentious UN

-

Museum or sheikh? World's second largest diamond awaits home

Museum or sheikh? World's second largest diamond awaits home

-

UK charities axe Prince Andrew's ex-wife over Epstein email

-

Google fights breakup of ad tech business in US court

Google fights breakup of ad tech business in US court

-

US pleads for new beefed-up multi-national force in Haiti

-

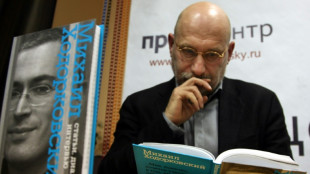

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

'Don't repeat our mistakes' - Russian writer Akunin warns against creeping repression

-

Jews flock to Ukraine for New Year pilgrimage despite travel warning

-

Trump autism 'announcement' expected Monday

Trump autism 'announcement' expected Monday

-

Over 60,000 Europeans died from heat during 2024 summer: study

-

Clashes as tens of thousands join pro-Palestinian demos in Italy

Clashes as tens of thousands join pro-Palestinian demos in Italy

-

UK charity axes Prince Andrew's ex-wife over Epstein email

Stocks rise as US-China reach trade deal framework

European stocks rose Friday as the United States and China moved closer to a trade deal and as hopes of a further delay to reciprocal tariffs were boosted.

With the Israel-Iran ceasefire holding, investors turned attention back to the wider economy and the US president's trade war.

"The key theme for markets in the next week and a half will be US trade agreements," ahead of the July 9 deadline ending reciprocal tariff reprieves, said Kathleen Brooks, research director at trading group XTB.

President Donald Trump on Thursday said the United States had signed a deal relating to trade with China, without providing further details.

China said Friday that Washington would lift "restrictive measures", while Beijing would "review and approve" items under export controls.

Adding to positive market sentiment, US Treasury Secretary Scott Bessent said a "revenge tax" on foreign-owned companies would be dropped from Trump's tax bill as he signalled a forthcoming agreement with G7 nations to exempt US firms from certain taxes.

European stock markets rose Friday, with the Paris CAC 40 leading the way around midday, boosted by a rise in luxury stocks.

Traders brushed off data showing that inflation edged up in France and Spain in June, even as it added to speculation that the European Central Bank may pause its interest rate-cut cycle.

Investor also awaited the release of the US Federal Reserve's preferred inflation measure for May due Friday.

In Asia, Tokyo rallied more than one percent to break 40,000 points for the first time since January, while Hong Kong and Shanghai equities closed lower.

Separately on Thursday, the White House indicated that Washington could extend a July deadline when steeper tariffs affecting dozens of economies are due to kick in.

The president imposed a 10-percent tariff on goods from nearly every country at start of April, but he put off higher rates on dozens of nations to allow for talks.

- Weaker dollar -

The dollar held around three-year lows Friday as traders ramp up bets on US interest rate cuts, especially after Trump hinted at replacing Fed chief Jerome Powell.

The prospect of lower borrowing costs sent the Dollar Index, which compares the greenback to a basket of major currencies, to its lowest level since March 2022.

Weak economic data on Thursday -- showing that the world's top economy contracted more than previous estimate in the first quarter and softer cosumer spending -- further fuelled rate cut expectations.

All three main equity indices on Wall Street rallied Thursday, with the Nasdaq hitting a record high and the S&P 500 within a whisker of a new closing peak.

In company news, shares in Chinese smartphone maker Xiaomi jumped more than three percent to a record high in Hong Kong as it enjoyed strong early orders for its YU7 sport utility vehicle, its second foray into the competitive electric vehicle market.

- Key figures at around 1040 GMT -

London - FTSE 100: UP 0.5 percent at 8,781.49 points

Paris - CAC 40: UP 1.3 percent at 7,654.06

Frankfurt - DAX: UP 0.7 percent at 23,806.46

Tokyo - Nikkei 225: UP 1.4 percent at 40,150.79 (close)

Hong Kong - Hang Seng Index: DOWN 0.2 percent at 24,284.15 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,424.23 (close)

New York - Dow: UP 0.9 percent at 43,386.84 (close)

Euro/dollar: UP at $1.1704 from $1.1701 on Thursday

Pound/dollar: DOWN at $1.3724 from $1.3725

Dollar/yen: UP at 144.59 yen from 144.44 yen

Euro/pound: UP at 85.29 pence from 85.22 pence

West Texas Intermediate: UP 0.7 percent at $65.70 per barrel

Brent North Sea Crude: UP 0.6 percent at $67.07 per barrel

L.Meier--VB