-

Gloves off, Red run, vested interests: Singapore GP talking points

Gloves off, Red run, vested interests: Singapore GP talking points

-

Bills, Eagles lose unbeaten records in day of upsets

-

Muller on target as Vancouver thrash San Jose to go joint top

Muller on target as Vancouver thrash San Jose to go joint top

-

Tokyo soars, yen sinks after Takaichi win on mixed day for Asia

-

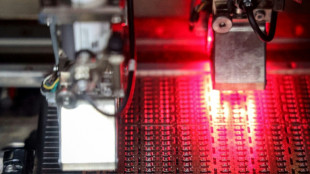

China's chip challenge: the race to match US tech

China's chip challenge: the race to match US tech

-

UN rights council to decide on creating Afghanistan probe

-

Indonesia sense World Cup chance as Asian qualifying reaches climax

Indonesia sense World Cup chance as Asian qualifying reaches climax

-

ICC to give war crimes verdict on Sudan militia chief

-

Matthieu Blazy to step out as Coco's heir in Chanel debut

Matthieu Blazy to step out as Coco's heir in Chanel debut

-

Only man to appeal in Gisele Pelicot case says not a 'rapist'

-

Appetite-regulating hormones in focus as first Nobel Prizes fall

Appetite-regulating hormones in focus as first Nobel Prizes fall

-

Gisele Pelicot: French rape survivor and global icon

-

Negotiators due in Egypt for Gaza talks as Trump urges quick action

Negotiators due in Egypt for Gaza talks as Trump urges quick action

-

'My heart sank': Surging scams roil US job hunters

-

Competition heats up to challenge Nvidia's AI chip dominance

Competition heats up to challenge Nvidia's AI chip dominance

-

UK police to get greater powers to restrict demos

-

Guerrero grand slam fuels Blue Jays in 13-7 rout of Yankees

Guerrero grand slam fuels Blue Jays in 13-7 rout of Yankees

-

Five-try Bayonne stun champions Toulouse to go top in France

-

Fisk reels in Higgo to win maiden PGA Tour title in Mississippi

Fisk reels in Higgo to win maiden PGA Tour title in Mississippi

-

Aces overpower Mercury for 2-0 lead in WNBA Finals

-

Bayonne stun champions Toulouse to go top in France

Bayonne stun champions Toulouse to go top in France

-

Greta Thunberg among Gaza flotilla detainees to leave Israel

-

Atletico draw at Celta Vigo after Lenglet red card

Atletico draw at Celta Vigo after Lenglet red card

-

Ethan Mbappe returns to haunt PSG as Lille force draw with Ligue 1 leaders

-

Hojlund fires Napoli into Serie A lead as AC Milan held at Juve

Hojlund fires Napoli into Serie A lead as AC Milan held at Juve

-

Vampires, blood and dance: Bollywood horror goes mainstream

-

Broncos rally snaps Eagles unbeaten record, Ravens slump deepens

Broncos rally snaps Eagles unbeaten record, Ravens slump deepens

-

Former NFL QB Sanchez charged after allegedly attacking truck driver

-

France unveils new government amid political deadlock

France unveils new government amid political deadlock

-

Child's play for Haaland as Man City star strikes again

-

India crush Pakistan by 88 runs amid handshake snub, umpiring drama

India crush Pakistan by 88 runs amid handshake snub, umpiring drama

-

Hojlund fires Napoli past Genoa and into Serie A lead

-

Sevilla rout 'horrendous' Barca in Liga thrashing

Sevilla rout 'horrendous' Barca in Liga thrashing

-

Haaland fires Man City to win at Brentford, Everton end Palace's unbeaten run

-

Haaland extends hot streak as Man City sink Brentford

Haaland extends hot streak as Man City sink Brentford

-

Italy working hard to prevent extra US tariffs on pasta

-

Sinner out of Shanghai Masters as Djokovic battles into last 16

Sinner out of Shanghai Masters as Djokovic battles into last 16

-

Swift rules N. America box office with 'Showgirl' event

-

Ryder Cup hero MacIntyre wins Alfred Dunhill Links on home soil

Ryder Cup hero MacIntyre wins Alfred Dunhill Links on home soil

-

Republicans warn of pain ahead as US shutdown faces second week

-

Sevilla rout champions Barca in shock Liga thrashing

Sevilla rout champions Barca in shock Liga thrashing

-

Norris-Piastri clash overshadows McLaren constructors' title win

-

Trump administration declares US cities war zones

Trump administration declares US cities war zones

-

Bad Bunny takes aim at Super Bowl backlash in 'SNL' host gig

-

El Khannouss fires Stuttgart into Bundesliga top four

El Khannouss fires Stuttgart into Bundesliga top four

-

Insatiable Pogacar romps to European title

-

Newcastle inflict more pain on Postecoglou, Everton end Palace's unbeaten run

Newcastle inflict more pain on Postecoglou, Everton end Palace's unbeaten run

-

Daryz wins Prix de l'Arc de Triomphe thriller

-

Russell wins Singapore GP as McLaren seal constructors' title

Russell wins Singapore GP as McLaren seal constructors' title

-

Landslides and floods kill 64 in Nepal, India

Oil prices jump on report of Israel prepping Iran strike

Crude prices rallied Wednesday following a report that US intelligence suggested Israel was planning a strike on Iranian nuclear facilities, which would send geopolitical tensions into overdrive and fuel regional conflict fears.

While safe haven gold pushed almost two percent higher, the news from CNN appeared to be having little detrimental effect on Asian equities, with most extending the previous day's rally.

Still, investors are keeping tabs on China-US relations after Beijing hit out at Washington's "bullying" over chip export controls, just over a week after the two sides dialled down trade tensions by temporarily slashing eye-watering tit-for-tat tariffs.

Both main crude contracts jumped more than one percent after CNN reported multiple US officials as saying the government had received intelligence indicating Israel was preparing to target Iranian atomic facilities.

There are fears that such a sharp escalation could tip the Middle East into a war, with tensions already high over Israel's strikes on Gaza.

US President Donald Trump said last week that "I think we're getting close to maybe doing a deal" on Tehran's nuclear programme and then a day later called on the Islamic republic to "move quickly or something bad is going to happen".

But Iran's supreme leader Ayatollah Ali Khamenei warned Tuesday that nuclear talks with Washington were unlikely to yield any results after four rounds of Omani-mediated nuclear talks with the United States since April 12.

"This is the clearest sign yet of how high the stakes are in the US Iran nuclear talks and the lengths Israel may go to if Iran insists on maintaining its commercial nuclear capabilities," Robert Rennie, at Westpac Banking Corp, said.

"Crude will maintain a risk premium as long as the current talks appear to be going nowhere."

Crude prices have risen around 15 percent since the start of the month on softening worries about the economic outlook as tariff tensions grow relatively calmer.

Equities mostly built on Monday's gains in Asia on trade talk hopes.

Hong Kong, Shanghai, Sydney, Seoul, Wellington, Taipei and Manila, Mumbai and Bangkok all outshone Tokyo and Singapore.

But London dipped and the pound strengthened against the dollar after UK inflation data come in well above forecasts in April.

The dollar also lost pace against the euro and yen ahead of an upcoming G7 finance ministers meeting this week, with speculation growing that Trump is open to a weaker greenback to help US exporters.

Paris and Frankfurt also fell.

The recent detente between China and the United States suffered a jolt Wednesday when Beijing slammed Washington's "bullying" chip export controls.

It also warned it would take steps against measures aimed at restricting Chinese access to high-tech semiconductors and supply chains.

The remarks came after US officials last week unveiled guidelines warning firms that using Chinese-made high-tech AI semiconductors, most notably tech giant Huawei's Ascend chips, would put them at risk of violating US export controls.

Several Federal Reserve members appeared to dampen hopes they will cut US interest rates anytime soon as they warned over the effects of Trump's tariffs on the economy and inflation.

St. Louis Fed chief Alberto Musalem warned the measures would likely hurt growth and jobs, even as countries look to dial down the blistering tariffs the president proposed.

"Even after the de-escalation of May 12 (with China), they seem likely to have a significant impact on the near-term economic outlook," Musalem said.

"On balance, tariffs are likely to dampen economic activity and lead to some further softening of the labour market."

He added that "committing now to ignoring higher inflation from tariffs, or to easing policy, runs the risk of underestimating the level and persistence of inflation".

Atlanta Fed chief Raphael Bostic said Moody's ratings cut and Trump's proposed tax cuts could compound uncertainty and force officials to keep rates elevated.

- Key figures at around 0715 GMT -

West Texas Intermediate: UP 1.1 percent at $63.73 per barrel

Brent North Sea Crude: UP 1.1 percent at $66.08 per barrel

Tokyo - Nikkei 225: DOWN 0.6 percent at 37,298.98 (close)

Hong Kong - Hang Seng Index: UP 0.3 percent at 23,757.72

Shanghai - Composite: UP 0.2 percent at 3,387.57 (close)

London - FTSE 100: UP 0.1 percent at 8,776.34

Euro/dollar: UP at $1.1340 from $1.1284 on Tuesday

Pound/dollar: UP at $1.3454 from $1.3391

Dollar/yen: DOWN at 143.60 yen from 144.47 yen

Euro/pound: UP at 84.27 pence from 84.26 pence

New York - Dow: DOWN 0.3 percent at 42,677.24 (close)

P.Vogel--VB