-

Mexico City to host F1 races until 2028

Mexico City to host F1 races until 2028

-

Morales vows no surrender in bid to reclaim Bolivian presidency

-

Ukraine, US sign minerals deal, tying Trump to Kyiv

Ukraine, US sign minerals deal, tying Trump to Kyiv

-

Phenomenons like Yamal born every 50 years: Inter's Inzaghi

-

Ukraine, US say minerals deal ready as Kyiv hails sharing

Ukraine, US say minerals deal ready as Kyiv hails sharing

-

Global stocks mostly rise following mixed economic data

-

O'Sullivan says he must play better to win eighth snooker world title after seeing off Si Jiahui

O'Sullivan says he must play better to win eighth snooker world title after seeing off Si Jiahui

-

Sabalenka eases past Kostyuk into Madrid Open semis

-

Netflix's 'The Eternaut' echoes fight against tyranny: actor Ricardo Darin

Netflix's 'The Eternaut' echoes fight against tyranny: actor Ricardo Darin

-

US economy unexpectedly shrinks, Trump blames Biden

-

Barca fight back against Inter in sensational semi-final draw

Barca fight back against Inter in sensational semi-final draw

-

Meta quarterly profit climbs despite big cloud spending

-

US Supreme Court weighs public funding of religious charter school

US Supreme Court weighs public funding of religious charter school

-

Climate change made fire conditions twice as likely in South Korea blazes: study

-

Amorim says not even Europa League glory can save Man Utd's season

Amorim says not even Europa League glory can save Man Utd's season

-

Syria reports Israeli strikes as clashes with Druze spread

-

Ukraine, US say minerals deal ready as suspense lingers

Ukraine, US say minerals deal ready as suspense lingers

-

Everything is fine: Trump's cabinet shrugs off shrinking economy

-

Chelsea boss Maresca adamant money no guarantee of success

Chelsea boss Maresca adamant money no guarantee of success

-

Wood warns England cricketers against 'dumb' public comments

-

US economy shrinks, Trump blames Biden

US economy shrinks, Trump blames Biden

-

Caterpillar so far not hiking prices to offset tariff hit

-

Japan's Kawasaki down Ronaldo's Al Nassr to reach Asian Champions League final

Japan's Kawasaki down Ronaldo's Al Nassr to reach Asian Champions League final

-

Trump praises Musk as chief disruptor eyes exit

-

Chahal hat-trick helps Punjab eliminate Chennai from IPL playoff race

Chahal hat-trick helps Punjab eliminate Chennai from IPL playoff race

-

Pope Francis saw clergy's lack of humility as a 'cancer': author

-

Weinstein accuser recounts alleged rape at assault retrial in NY

Weinstein accuser recounts alleged rape at assault retrial in NY

-

Piastri heads into Miami GP as the man to beat

-

US economy unexpectedly shrinks in first quarter, Trump blames Biden

US economy unexpectedly shrinks in first quarter, Trump blames Biden

-

Maxwell likely to miss rest of IPL with 'fractured finger'

-

Syria reports Israeli strikes after warning over Druze as sectarian clashes spread

Syria reports Israeli strikes after warning over Druze as sectarian clashes spread

-

Despite war's end, Afghanistan remains deep in crisis: UN relief chief

-

NFL fines Falcons and assistant coach over Sanders prank call

NFL fines Falcons and assistant coach over Sanders prank call

-

British teen Brennan takes stage 1 of Tour de Romandie

-

Swedish reporter gets suspended term over Erdogan insult

Swedish reporter gets suspended term over Erdogan insult

-

Renewable energy in the dock in Spain after blackout

-

South Africa sets up inquiry into slow apartheid justice

South Africa sets up inquiry into slow apartheid justice

-

Stocks retreat as US GDP slumps rattles confidence

-

Migrants' dreams buried under rubble after deadly strike on Yemen centre

Migrants' dreams buried under rubble after deadly strike on Yemen centre

-

Trump blames Biden's record after US economy shrinks

-

UK scientists fear insect loss as car bug splats fall

UK scientists fear insect loss as car bug splats fall

-

Mexico avoids recession despite tariff uncertainty

-

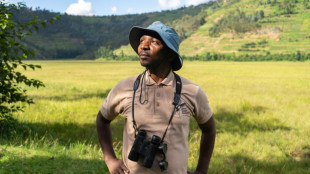

Rwandan awarded for saving grey crowned cranes

Rwandan awarded for saving grey crowned cranes

-

Spurs have 'unbelievable opportunity' for European glory: Postecoglou

-

Microsoft president urges fast 'resolution' of transatlantic trade tensions

Microsoft president urges fast 'resolution' of transatlantic trade tensions

-

Poppies flourish at Tower of London for WWII anniversary

-

US economy unexpectedly shrinks on import surge before Trump tariffs

US economy unexpectedly shrinks on import surge before Trump tariffs

-

Stocks drop after US economy contracts amid tariffs turmoil

-

US economy unexpectedly shrinks on import surge ahead of Trump tariffs

US economy unexpectedly shrinks on import surge ahead of Trump tariffs

-

Dravid says Suryavanshi, 14, needs support from fame

Stocks, oil recover slightly awaiting Trump's next tariffs moves

Stock markets and oil prices recovered slightly Tuesday after a huge sell-off, but analysts warned of more turmoil as US President Donald Trump charges ahead in his escalating trade war.

After trillions of dollars were wiped from the combined value of global equity markets since last week, share prices across Asia and Europe battled back awaiting Wall Street's reopening.

Investors clawed back some ground as they assess the possibility of Washington tempering some of levies.

The dollar dipped against main rivals.

"After multiple punishing sessions, stock markets appear to have started their road to recovery," noted Russ Mould, investment director at AJ Bell trading group.

He warned, however, that "it's dangerous to think a massive rally will definitely happen, given how Trump is unpredictable".

Europe's main indices were up by an average of about 1.5 percent approaching the half-way stage.

European Union chief Ursula von der Leyen warned against escalating a trade conflict during a phone call with Chinese Premier Li Qiang on Tuesday.

The EU plans tariffs of up to 25 percent on US goods in retaliation for levies on metals, but will spare bourbon to shield European wine and spirits from reprisals, according to a document seen by AFP.

- Asia bounce -

Tokyo's stock market closed up more than six percent -- recovering much of Monday's drop -- after Japanese Prime Minister Shigeru Ishiba held talks with Trump.

The share price of Nippon Steel rallied by around the same amount after Trump launched a review of its proposed takeover of US Steel that was blocked by his predecessor Joe Biden.

However, the US leader's threat to hit China with an extra 50 percent tariffs -- in response to its 34 percent retaliation in kind -- ramped up the chances of a catastrophic stand-off between the two economic superpowers.

Trump said he would impose the additional levies if Beijing did not heed his warning not to push back against his barrage of tariffs.

China fired back that it would "never accept" such a move and called the potential escalation "a mistake on top of a mistake".

Hong Kong's stock market closed up by more than one percent, having plunged over 13 percent Monday, its biggest one-day retreat since 1997.

Trading in Jakarta was briefly suspended after it plunged more than nine percent in exaggerated moves following a long holiday weekend in Indonesia.

The advances followed less pain Monday on Wall Street, with the Nasdaq edging up.

The trade war has put the Federal Reserve in the spotlight as economists said escalation could send prices surging.

US central bank officials are now having to decide whether to cut interest rates to support the economy, or keep them elevated to keep a lid on inflation.

"Because the tariffs announced thus far are higher than previously expected, we think the risk is now skewed toward more rate cuts by year-end," said Nuveen chief investment officer Saira Malik.

- Key figures around 1030 GMT -

London - FTSE 100: UP 1.6 percent at 7,827.99 points

Paris - CAC 40: UP 1.0 percent at 6,998.74

Frankfurt - DAX: UP 1.2 percent at 20,021.15

Tokyo - Nikkei 225: UP 6.0 percent at 33,012.58 (close)

Hong Kong - Hang Seng Index: UP 1.5 percent at 20,127.68 (close)

Shanghai - Composite: UP 1.6 percent at 3,145.55 (close)

New York - Dow: DOWN 0.9 percent at 37,965.60 (close)

Euro/dollar: UP at $1.0934 from $1.0904 on Monday

Pound/dollar: UP at $1.2752 from $1.2723

Dollar/yen: DOWN at 146.89 yen from 147.83 yen

Euro/pound: UP at 85.73 pence from 85.68 pence

West Texas Intermediate: UP 0.4 percent at $60.95 per barrel

Brent North Sea Crude: UP 0.3 percent at $64.39 per barrel

burs-bcp/ajb/lth

L.Wyss--VB