-

Polls open in Australian vote swayed by inflation, Trump

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

-

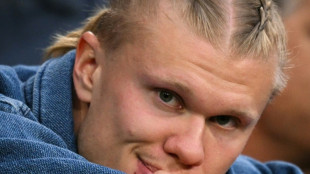

Haaland on bench for Man City as striker returns ahead of schedule

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

Australians vote in election swayed by inflation, Trump

-

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

Stocks tank, havens rally as Trump tariffs fan trade war

Equity markets suffered a bloodbath Thursday after Donald Trump delivered a "haymaker" blow with sweeping tariffs against US partners and rivals, fanning a global trade war that many fear will spark recessions and ramp up inflation.

Tokyo's Nikkei led an Asian selloff, collapsing more than four percent, while US futures plunged, safe haven gold hit a record high and the yen jumped one percent.

The panic came after the US president unveiled a blitz of levies aimed at correcting trade deficits with other countries following what he says has been years of the United States being "ripped off".

Against a White House backdrop of US flags, Trump announced that "for decades, our country has been looted, pillaged, raped and plundered by nations near and far, both friend and foe alike".

Trump reserved some of the heaviest blows for what he called the "nations that treat us badly," including 34 percent in new levies on rival China, 20 percent on key ally the European Union and 24 percent on Japan.

A number of other countries will face specifically tailored tariff levels, and for the rest, Trump said he would impose a "baseline" tariff of 10 percent. The US leader also reiterated a plan to enact auto tariffs of 25 percent on Thursday.

Investors are now steeling themselves for any retaliatory measures that could fan the crisis.

"President Trump walked into the Rose Garden and detonated the most aggressive trade shock the market’s seen in decades. This isn’t a jab -- it's a full-on haymaker," said SPI Asset Management's Stephen Innes.

Wall Street "had talked itself into a softer, more symbolic move. Instead, Trump carpet-bombed the global supply chain".

"This was a 'shock and awe' tariffs campaign, dressed up in 'reciprocity' language but designed to throttle the trade deficit through brute force."

He said the measures meant that inflation risks had surged and economic growth expectations would be cut, with the US Federal Reserve "pinned between a hawkish rock and a deflationary hard place".

As well as Tokyo's hefty drop, Hong Kong shed more than two percent, Sydney and Seoul gave up more than one percent and Wellington was one percent off.

Wall Street futures were also battered, with the Dow dropping 2.4 percent, the Nasdaq plunging more than four percent and the S&P 500 more than three percent off. European futures were also deep in the red.

Safe havens rallied as traders sought to dump risk assets.

Gold hit a new peak of $3,167.84 and the Japanese yen strengthened to 147.69 per dollar from 150.50 the day before.

US Treasury yields sank to their lowest level in five months -- yields and prices go in opposite directions.

Oil also suffered big losses, with both main contracts down more than two percent on fears that the shock to economies would hit demand.

Among the big losers on the corporate front, Japanese tech giant Sony shed five percent, while its South Korean rival Samsung was almost three percent down.

Car titan Toyota was also off about five percent, Nissan lost more than four percent and Honda was down 2.7 percent. Tokyo-listed tech investment firm SoftBank was off more than four percent.

- Key figures around 0150 GMT -

Tokyo - Nikkei 225: DOWN 3.4 percent at 34,525.18

Hong Kong - Hang Seng Index: DOWN 2.4 percent at 22,638.21

Shanghai - Composite: DOWN 0.5 percent at 3,33.52

Dollar/yen: DOWN at 147.81 yen from 149.39 yen

Euro/dollar: UP at $1.0918 from $1.0814 on Wednesday

Pound/dollar: UP at $1.3062 from $1.2985

Euro/pound: UP at 83.56 pence from 83.33 pence

West Texas Intermediate: DOWN 2.6 percent at $69.88 per barrel

Brent North Sea Crude: DOWN 2.3 percent at $73.20 per barrel

New York - Dow: UP 0.6 percent at 42,225.32 (close)

London - FTSE 100: DOWN 0.3 percent at 8,608.48 (close)

B.Baumann--VB