-

Singapore votes with new PM seeking strong mandate amid tariff turmoil

Singapore votes with new PM seeking strong mandate amid tariff turmoil

-

Five things to know about the Australian election

-

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

-

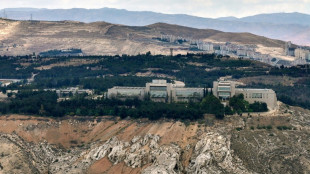

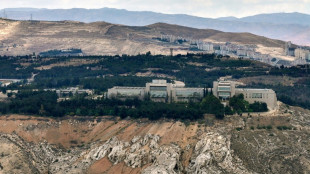

Israel launches new Syria strikes amid Druze tensions

-

Finke grabs 400m medley victory over world record-holder Marchand

Finke grabs 400m medley victory over world record-holder Marchand

-

Apple eases App Store rules under court pressure

-

Polls open in Australian vote swayed by inflation, Trump

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

-

Haaland on bench for Man City as striker returns ahead of schedule

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

-

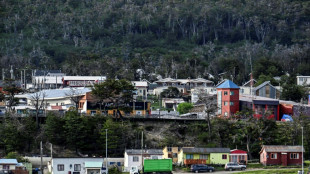

Major offshore quake causes tsunami scare in Chile, Argentina

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

Australians vote in election swayed by inflation, Trump

-

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

Stocks gain on US jobs data, tariff talks hopes

Global stock markets rose on Friday as jobs data reassured investors on the US economy as did indications Beijing and Washington may begin to talk about resolving their tariff standoff.

Data showed that US hiring slowed much less than expected last month, with the world's largest economy adding 177,000 jobs.

European equities and US stock futures both jumped following the release of the data. Wall Street's main indices gained around one percent at the opening bell.

"The April jobs report may reassure investors that the labor market is holding up, giving them more confidence that the economy can hold up too," said Bret Kenwell, analyst at eToro trading platform.

Data released Thursday showed the US economy unexpectedly contracted in the first three months of the year on an import surge triggered by US Donald Trump's tariff plans.

Falling US consumer confidence and rising jobless numbers have also caused angst among investors.

The monthly US jobs data is also important for investors looking for indications of the US central bank's path for interest rates, and a smaller-than-expected monthly increases in wages should reassure the Federal Reserve on inflationary pressures in the labour market.

Meanwhile, China's commerce ministry on Friday said it was evaluating a US offer for negotiations on tariffs, but insisted Washington must be ready to scrap levies that have roiled global markets and supply chains.

Trump's levies reached 145 percent on many Chinese products in April, while Beijing has responded with fresh 125 percent duties on imports from the United States.

Trump has repeatedly claimed that China has reached out for talks on the tariffs, and this week said he believed there was a "very good chance we're going to make a deal".

The US president has also imposed 10 percent tariffs on imports from around the world. Dozens of countries face a 90-day deadline expiring in July to strike an agreement with Washington and avoid higher, country-specific rates.

Deutsche Bank managing director Jim Reid said the Chinese statement "is outweighing concerns about the effect of tariffs, which were initially triggered by disappointing earnings from Apple and Amazon".

US tech giants Apple and Amazon both reported disappointing outlooks, as tariffs knock business confidence, after markets closed on Thursday.

Shares in Apple slumped around five percent and Amazon around one percent as trading got underway in New York on Friday.

In Europe, Paris and Frankfurt rose over two percent as markets brushed off official data showing eurozone inflation remained unchanged at slightly above the European Central Bank's two-percent target.

London also gained, with mining and commodity stocks -- sensitive to Chinese demand -- performing particularly well amid optimism for potential China-US talks, according to analysts.

In Asia on Friday, Hong Kong was up more than 1.7 percent at the close, while Tokyo rose one percent.

Mainland Chinese markets were closed for a holiday.

Japan's envoy for US tariff talks said in Washington on Thursday that a second round of negotiations between the two countries had been "frank and constructive".

The Bank of Japan warned earlier that tariffs were fuelling global economic uncertainty and revised down its growth forecasts while keeping its key interest rate steady.

In company news, oil majors ExxonMobil and Shell reported lower profit on weaker crude prices.

But Shell managed to be one of the biggest risers in London on Friday as it pushed ahead with shareholder returns.

- Key figures at around 1330 GMT -

New York - Dow: UP 1.0 percent at 41,177.76 points

New York - S&P 500: UP 1.0 percent at 5,658.07

New York - Nasdaq Composite: UP 0.9 percent at 17,870.34

London - FTSE 100: UP 1.3 percent at 8,603.07

Paris - CAC 40: UP 2.1 percent at 7,751.40

Frankfurt - DAX: UP 2.4 percent at 23.026.35

Tokyo - Nikkei 225: UP 1.0 percent at 36,830.69 (close)

Hong Kong - Hang Seng Index: UP 1.7 percent at 22,504.68 (close)

Shanghai - Composite: closed for holiday

Euro/dollar: UP at $1.1348 from $1.1289 on Thursday

Pound/dollar: UP at $1.3315 from $1.3277

Dollar/yen: DOWN at 144.14 yen from 145.44 yen

Euro/pound: UP at 85.28 pence from 85.02 pence

West Texas Intermediate: DOWN 0.6 percent at $58.86 per barrel

Brent North Sea Crude: DOWN 0.6 percent at $61.78 per barrel

burs-rl/lth

P.Keller--VB