-

Polls open in Australian vote swayed by inflation, Trump

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

-

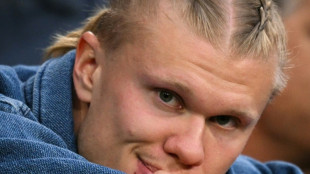

Haaland on bench for Man City as striker returns ahead of schedule

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

-

Arteta 'pain' as Arsenal fall short in Premier League title race

Arteta 'pain' as Arsenal fall short in Premier League title race

-

Hard-right romps across UK local elections slapping down main parties

-

US ends duty-free shipping loophole for low-cost goods from China

US ends duty-free shipping loophole for low-cost goods from China

-

Renewables sceptic Peter Dutton aims for Australian PM's job

-

Australians vote in election swayed by inflation, Trump

Australians vote in election swayed by inflation, Trump

-

Syria slams Israeli Damascus strike as 'dangerous escalation'

-

Grand Theft Auto VI release postponed to May 2026

Grand Theft Auto VI release postponed to May 2026

-

Lawyers probe 'dire' conditions for Meta content moderators in Ghana

-

Maresca confident Chelsea can close gap to Liverpool

Maresca confident Chelsea can close gap to Liverpool

-

Watchdog accuses papal contenders of ignoring sex abuse

-

Berlin culture official quits after funding cut backlash

Berlin culture official quits after funding cut backlash

-

US hiring better than expected despite Trump uncertainty

-

EU fine: TikTok's latest setback

EU fine: TikTok's latest setback

-

Stocks gain on US jobs data, tariff talks hopes

-

Barca's Ter Stegen to return from long lay-off for Valladolid trip

Barca's Ter Stegen to return from long lay-off for Valladolid trip

-

US hiring slows less than expected, unemployment unchanged

Financial markets tumble after Trump tariff announcement

Global financial markets were rocked on Wednesday by Donald Trump's announcement of sweeping tariffs, targeting China and the European Union in particular, with the risk of undermining the international economy.

The US president laid out the new measures after Wall Street stock markets had closed. But his announcement still rippled through the markets that were open at the time, sending stock futures and bond yields lower, while gold surged to a new record high.

- Stocks struggle -

As the evening progressed, US futures fell sharply, with the Dow Jones dropping 2.4 percent at around 2345 GMT, the Nasdaq index plunging 4.2 percent, and the broader futures index for the S&P 500 falling 3.5 percent.

Wall Street has largely suffered from Trump's various trade announcements in recent weeks.

"The silver lining for investors could be that this is only a starting point for negotiations with other countries and ultimately tariff rates will come down across the board," Northlight Asset Management's Chris Zaccarelli wrote in a note to clients.

"But for now traders are shooting first and asking questions later," he added.

The share price of technology companies whose components are produced abroad also fell sharply, with Apple losing 7.4 percent after-hours, Nvidia falling 5.2 percent and TSMC declining 5.9 percent.

Futures markets are typically much more volatile than the regular indices.

The clothing sector was also hit especially hard, with a particularly heavy bill for China, where products will be hit by an additional duty of 34 percent from April 9, and Vietnam, where the new "reciprocal" rate will be 46 percent.

Brands whose clothes are partly made in China or Vietnam were sharply lower, with Gap down 8.5 percent after hours, Ralph Lauren falling 7.3 percent, and Nike losing 7.1 percent.

- Safe-haven assets in demand -

Investors flocked to gold, which has been setting new records in the face of trade uncertainties.

The yellow metal blew past its previous day's record high after Donald Trump's new announcements, and was trading at roughly $3,160 an ounce at around 2345 GMT.

The price of gold has jumped by close to 20 percent since the start of 2025.

The bond market also played its role as a safe haven, with the yield on the benchmark ten-year US Treasury, easing to 4.10 percent after Donald Trump's announcement.

Bond yields move in the opposite direction to prices, with yields typically falling in the face of increased demand for bonds.

- Weaker dollar -

Within minutes of Trump's first words on Wednesday, the dollar plunged by over one percent against the euro.

"The increased tariffs have been a negative factor for the US dollar," Forex.com's Matthew Weller told AFP.

One euro was equivalent to 1.04 dollars on the day Trump was inaugurated to his second term.

By 2345 GMT on Wednesday, it was worth around 1.09 dollars.

Bitcoin, the most popular cryptocurrency, also suffered from the White House announcements, falling more than three percent on Wednesday evening.

H.Weber--VB