-

Pakistan military says conducts training launch of missile

Pakistan military says conducts training launch of missile

-

Lives on hold in India's border villages with Pakistan

-

Musk's dreams for Starbase city in Texas hang on vote

Musk's dreams for Starbase city in Texas hang on vote

-

Rockets down Warriors to stay alive in NBA playoffs

-

Garcia beaten by Romero in return from doping ban

Garcia beaten by Romero in return from doping ban

-

Inflation, hotel prices curtail Japanese 'Golden Week' travels

-

Trump's next 100 days: Now comes the hard part

Trump's next 100 days: Now comes the hard part

-

Mexican mega-port confronts Trump's tariff storm

-

Trump's tariffs bite at quiet US ports

Trump's tariffs bite at quiet US ports

-

Ryu stretches lead at LPGA Black Desert Championship

-

Singapore votes with new PM seeking strong mandate amid tariff turmoil

Singapore votes with new PM seeking strong mandate amid tariff turmoil

-

Five things to know about the Australian election

-

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

Scheffler fires 63 despite long delay to lead CJ Cup Byron Nelson

-

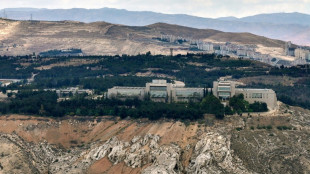

Israel launches new Syria strikes amid Druze tensions

-

Finke grabs 400m medley victory over world record-holder Marchand

Finke grabs 400m medley victory over world record-holder Marchand

-

Apple eases App Store rules under court pressure

-

Polls open in Australian vote swayed by inflation, Trump

Polls open in Australian vote swayed by inflation, Trump

-

Russell clocks second fastest 100m hurdles in history at Miami meeting

-

Germany move against far-right AfD sets off US quarrel

Germany move against far-right AfD sets off US quarrel

-

Billionaire-owned Paris FC win promotion and prepare to take on PSG

-

Teenager Antonelli grabs pole for Miami sprint race

Teenager Antonelli grabs pole for Miami sprint race

-

Man City climb to third as De Bruyne sinks Wolves

-

Mercedes' Wolff backs Hamilton to come good with Ferrari

Mercedes' Wolff backs Hamilton to come good with Ferrari

-

'Devastated' Prince Harry says no UK return but seeks reconciliation

-

Elway agent death likely accidental: report

Elway agent death likely accidental: report

-

Turkish Cypriots protest new rule allowing hijab in school

-

Germany's AfD dealt blow with right-wing extremist label

Germany's AfD dealt blow with right-wing extremist label

-

Trump NASA budget prioritizes Moon, Mars missions over research

-

Hard-right romps through UK polls slapping aside main parties

Hard-right romps through UK polls slapping aside main parties

-

Rangers hire two-time NHL champion Sullivan as coach

-

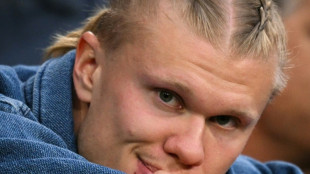

Haaland on bench for Man City as striker returns ahead of schedule

Haaland on bench for Man City as striker returns ahead of schedule

-

US designates two Haitian gangs as terror groups

-

Lower profits at US oil giants amid fall in crude prices

Lower profits at US oil giants amid fall in crude prices

-

NBA icon Popovich stepping down as Spurs coach after 29 seasons

-

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

'Devastated' Prince Harry says no return to UK but seeks royal reconciliation

-

Grande scratched from Kentucky Derby

-

Carney vows to transform Canada economy to withstand Trump

Carney vows to transform Canada economy to withstand Trump

-

Prince Harry says he would 'love' to reconcile with family

-

Major offshore quake causes tsunami scare in Chile, Argentina

Major offshore quake causes tsunami scare in Chile, Argentina

-

GM cuts shift at Canada plant over 'evolving trade environment'

-

F1 extends deal to keep Miami GP until 2041

F1 extends deal to keep Miami GP until 2041

-

Popovich mixed toughness and spirit to make NBA history

-

US asks judge to break up Google's ad tech business

US asks judge to break up Google's ad tech business

-

Trump eyes huge 'woke' cuts in budget blueprint

-

Ruud downs Cerundolo to book spot in Madrid Open final

Ruud downs Cerundolo to book spot in Madrid Open final

-

Gregg Popovich stepping down as San Antonio Spurs coach after 29 seasons: team

-

Guardiola to take break from football when he leaves Man City

Guardiola to take break from football when he leaves Man City

-

Vine escapes to Tour of Romandie 3rd stage win as Baudin keeps lead

-

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

Olympic 100m medalist Kerley arrested, out of Miami Grand Slam meet

-

Chile, Argentina order evacuations over post-quake tsunami threat

Stock markets mixed as uncertainty rules ahead of Trump tariffs

Equity markets were mixed Wednesday as nervous investors brace for Donald Trump's wave of tariffs later in the day, with speculation about what he has in store stoking uncertainty on trading floors.

Equities have been battered leading up to the US president's announcement -- which he has dubbed "Liberation Day" -- with warnings that friend and foe are in the crosshairs after what he says is years of "ripping off" the United States.

He has trailed the measures for weeks, initially suggesting they would match whatever levies other countries impose.

But US media reported he has also considered either blanket 20 percent levies or another plan where some countries get preferential treatment.

Sweeping auto tariffs of 25 percent announced last week are also due to come into effect on Thursday.

The White House has said Trump will unveil his decision at 4:00 pm in Washington (2000 GMT), after Wall Street markets close, with the Republican promising a new "golden age" of US industry.

However, officials admitted he was still ironing out the details late Tuesday.

Analysts said the ongoing uncertainty was spooking markets.

"Investors and company management dislike uncertainty, and the piecemeal, unreliable way in which tariff announcements are being delivered is creating plenty of it," said Oliver Blackbourn and Adam Hetts at Janus Henderson Investments in a commentary.

"Estimates on what the average tariff rate will look like range from a few percentage points in moderate outcomes to double-digit levels in more forceful scenarios," they added.

"What does seem less uncertain is that tariffs are, without much exception, likely to be bad for economic growth, consumers, and markets."

Pepperstone Group's Chris Weston said the suggestion that the tariffs would be effective immediately would provide some sort of certainty, even if it limited the scope for talks.

"This scenario -- while hardly a positive for economics or earnings assumptions -- would increase the conviction behind how we respond to the 'facts'," he explained.

"That said, life is never straightforward, and we will still need to consider the counter response from other countries."

The planned duties have ramped up fears of a global trade war after several countries warned they were lining up their responses.

With that in mind, economists have warned that economic growth could take a hit and inflation reignite, dealing a blow to hopes that central banks would continue cutting interest rates.

Asian markets skitted between gains and losses through the day.

Tokyo, Shanghai, Sydney, Wellington, Taipei, Mumbai and Bangkok rose, while Hong Kong, Singapore Manila and Seoul slipped.

London, Paris and Frankfurt fell at the open.

Safe haven gold held above $3,100 after touching a record high $3,149.00 on Tuesday.

And HSBC strategists led by Max Kettner warned Wednesday might not mark the end of the tariff uncertainty.

"We'd argue the potential is in fact higher for the 2 April deadline to introduce even more uncertainty -- and hence prolonged broad-based weakness in leading indicators," they said.

Chinese tech giant Xiaomi dropped three percent in Hong Kong, extending Tuesday's fall of more than five percent after the firm confirmed one of its electric vehicles was involved in an accident in China that reportedly left three people dead.

- Key figures around 0715 GMT -

Tokyo - Nikkei 225: UP 0.3 percent at 35,725.87 (close)

Hong Kong - Hang Seng Index: DOWN 0.1 percent at 23,174.59

Shanghai - Composite: UP 0.1 percent at 3,350.13 (close)

London - FTSE 100: DOWN 0.3 percent at 8,609.85

Euro/dollar: UP at $1.0795 from $1.0793 on Tuesday

Pound/dollar: DOWN at $1.2914 from $1.2920

Dollar/yen: UP at 149.77 yen from 149.53 yen

Euro/pound: UP at 83.57 pence from 83.51 pence

West Texas Intermediate: DOWN 0.3 percent at $71.01 per barrel

Brent North Sea Crude: DOWN 0.3 percent at $74.30 per barrel

New York - Dow: FLAT at 41,989.96 (close)

G.Haefliger--VB