-

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

China's Xi heads to Moscow to beef up 'no limits' Putin partnership

-

World energy methane emissions near record high in 2024: IEA

-

White smoke: signalling a new pope down the ages

White smoke: signalling a new pope down the ages

-

What's a cardinal? The 'princes' of the Church electing a new pope

-

Papal conclave by the numbers

Papal conclave by the numbers

-

The Vatican: a papal powerhouse, world's smallest state

-

Trump, Ukraine propel EU and UK towards defence pact

Trump, Ukraine propel EU and UK towards defence pact

-

Syrian leader to meet Macron in first European visit

-

History beckons as cardinals gather to elect new pope

History beckons as cardinals gather to elect new pope

-

China's Xi aims to beef up 'no limits' Putin partnership

-

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

Hit by Trump cuts, journalists at Dubai-based US channel face uncertain future

-

Roglic gunning for Giro as Pogacar's absence leaves door open

-

Trump's White House creates own media universe

Trump's White House creates own media universe

-

Sotheby's postpones historical gems auction after India backlash

-

Taiwan bicycle makers in limbo as US tariff threat looms

Taiwan bicycle makers in limbo as US tariff threat looms

-

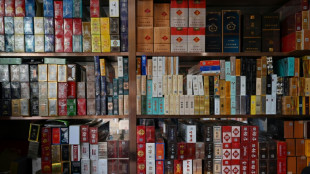

Tobacco town thrives as China struggles to kick the habit

-

Venezuelan opposition figures 'rescued', now in US: Rubio

Venezuelan opposition figures 'rescued', now in US: Rubio

-

China eases monetary policy to boost ailing economy

-

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

Haliburton stunner sinks Cavs as Pacers take 2-0 series lead

-

No rate cuts expected from US Fed facing 'unfavorable' conditions

-

'No one is illegal': Mormon women stage patchwork protest in Washington

'No one is illegal': Mormon women stage patchwork protest in Washington

-

Indonesia's silvermen beg to make ends meet

-

Toronto festival head says Trump tariffs would hurt film quality

Toronto festival head says Trump tariffs would hurt film quality

-

Trump talks tough on China, but early focus elsewhere

-

China vows to defend 'justice' in looming trade talks with US

China vows to defend 'justice' in looming trade talks with US

-

Man Utd seek to finish off Athletic Bilbao in chase for Europa glory

-

AP to continue crediting 'Napalm Girl' photo to Nick Ut after probe

AP to continue crediting 'Napalm Girl' photo to Nick Ut after probe

-

Colombia moves to join China's Belt and Road

-

Martinez cried 'for two days' after nearly missing Barca triumph with injury

Martinez cried 'for two days' after nearly missing Barca triumph with injury

-

US, Chinese officials to hold trade talks in Switzerland

-

Barca 'will be back' after painful Champions League exit to Inter, says Flick

Barca 'will be back' after painful Champions League exit to Inter, says Flick

-

US jury awards WhatsApp $168 mn in NSO Group cyberespionage suit

-

India launches strikes on Pakistan, Islamabad vows to 'settle the score'

India launches strikes on Pakistan, Islamabad vows to 'settle the score'

-

Trump vows 'seamless' experience for 2026 World Cup fans

-

Motown legend Smokey Robinson sued for sexual assault

Motown legend Smokey Robinson sued for sexual assault

-

Trump hopes India-Pakistan clashes end 'very quickly'

-

Frattesi shoots Inter into Champions League final after Barcelona epic

Frattesi shoots Inter into Champions League final after Barcelona epic

-

India launches strikes on Pakistan, Islamabad vows retaliation

-

India launches strikes on Pakistan as Islamabad vows retaliation

India launches strikes on Pakistan as Islamabad vows retaliation

-

Alpine shock as F1 team principal Oakes resigns

-

Merz elected German chancellor after surprise setback

Merz elected German chancellor after surprise setback

-

Gujarat edge Mumbai in last-ball thriller to top IPL table

-

Israel's plan for Gaza draws international criticism

Israel's plan for Gaza draws international criticism

-

SpaceX gets US approval to launch more Starship flights from Texas

-

Alpine F1 team principal Oakes resigns

Alpine F1 team principal Oakes resigns

-

Colombia's desert north feels the pain of Trump's cuts

-

Arsenal determined 'to make a statement' against PSG in Champions League semi-final

Arsenal determined 'to make a statement' against PSG in Champions League semi-final

-

Top US court allows Trump's ban on trans troops to take effect

-

Whole lotta legal argument: Led Zeppelin guitarist Page sued

Whole lotta legal argument: Led Zeppelin guitarist Page sued

-

US, Yemen's Huthis agree ceasefire: mediator Oman

Global markets slide as fears over US tariffs intensify

Stock markets plunged Friday as a closely watched US inflation reading heated up amid intensifying concerns over fallout from President Donald Trump's incoming wave of tariffs.

Shares in automakers fell further as they brace for 25 percent US tariffs due to kick in next week along with a raft of "reciprocal" surcharges tailored to different countries.

The market mood has soured over fears that Trump's plans will trigger tit-for-tat measures that would rekindle inflation, which could put the brakes on interest rate cuts and spark a recession.

"Investors remain nervous over the economic repercussions from President Trump's tariff threats, just days before he unleashes his 'reciprocal tariffs'" on April 2, said David Morrison, senior market analyst at financial services provider Trade Nation.

In Europe, London just about held the line, closing barely off in the week's final session. But Paris, Frankfurt and Milan all slid around one percent.

On Wall Street, all three major indexes closed sharply lower, with the Dow tumbling 1.7 percent, the S&P 500 losing 2.0 percent and Nasdaq diving 2.7 percent.

The slide came after official data showed the Federal Reserve's preferred inflation measure, the personal consumption expenditures (PCE) price index, remained unchanged last month at 2.5 percent.

But another key figure, core inflation, which strips out volatile food and energy costs, rose more than expected at 2.8 percent in February on an annual basis, up from the month before.

"The (PCE) report isn't devastating, but given the current economic uncertainty and market volatility, investors were looking for reassurance in this report -- not something to fan the flames," said Bret Kenwell, US investment analyst at trading platform eToro.

In Europe, automakers Volkswagen, Renault and Stellantis, whose brands include Jeep, Peugeot and Fiat, fared particularly badly. Shares in General Motors and Ford also slumped on Wall Street.

Tokyo's stock market sank 1.8 percent as the world's biggest carmaker Toyota fell, along with Honda, Nissan and Mazda.

Seoul was off 1.9 percent as Hyundai gave up 2.6 percent.

Uncertainty over Trump's plans and long-term intentions has led investors to rush into safe havens such as gold, which hit a new record high of $3,085.96 an ounce on Friday.

Governments around the world have pushed back on Trump's tariffs, and could announce more countermeasures next week.

On Friday, Canadian Prime Minister Mark Carney told Trump that Ottawa will implement retaliatory tariffs to protect its workers and economy, after Washington announces added trade actions on April 2.

Tariff worries also led to falls on stock markets in Hong Kong and Shanghai.

Bangkok was in the red when trading was suspended as a powerful earthquake in neighboring Myanmar shook the Thai capital.

Investors also kept tabs on Beijing, where Chinese President Xi Jinping met business leaders, pledging the country's door would "open wider and wider" but also warning of "severe challenges" to the world trading system.

- Key figures around 2035 GMT -

New York - Dow: DOWN 1.7 percent at 41,583.90 points (close)

New York - S&P 500: DOWN 2.0 percent at 5,580.94 (close)

New York - Nasdaq: DOWN 2.7 percent at 17,322.99 (close)

London - FTSE 100: DOWN 0.1 percent at 8,658.85 (close)

Paris - CAC 40: DOWN 0.9 percent at 7,916.08 (close)

Frankfurt - DAX: DOWN 1.0 percent at 22,461.52 (close)

Tokyo - Nikkei 225: DOWN 1.8 percent at 37,120.33 (close)

Hong Kong - Hang Seng Index: DOWN 0.7 percent at 23,426.60 (close)

Shanghai - Composite: DOWN 0.7 percent at 3,351.31 (close)

Euro/dollar: UP at $1.0838 from $1.0796 on Thursday

Pound/dollar: FLAT at $1.2947 from $1.2947

Dollar/yen: DOWN at 149.72 yen from 151.04 yen

Euro/pound: UP at 83.68 pence from 83.38 pence

West Texas Intermediate: DOWN 0.8 percent at $69.36 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $73.63 per barrel

dan-ajb-lth-bys/sst

L.Wyss--VB