-

Trump presses Syria leader on Israel after lifting sanctions

Trump presses Syria leader on Israel after lifting sanctions

-

French PM to testify on child abuse scandal

-

Players stuck in middle with IPL, national teams on collision course

Players stuck in middle with IPL, national teams on collision course

-

Peru PM quits ahead of no-confidence vote

-

Strikes kill 29 in Gaza as hostage release talks ongoing

Strikes kill 29 in Gaza as hostage release talks ongoing

-

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

-

France summons cryptocurrency businesses after kidnappings

France summons cryptocurrency businesses after kidnappings

-

Pakistan returns Indian border guard captured after Kashmir attack

-

Baidu plans self-driving taxi tests in Europe this year

Baidu plans self-driving taxi tests in Europe this year

-

Trump meets new Syria leader after lifting sanctions

-

Equity markets swing as China-US trade euphoria fades

Equity markets swing as China-US trade euphoria fades

-

Burberry warns 1,700 jobs at risk after annual loss

-

Trump to meet new Syrian leader after offering sanctions relief

Trump to meet new Syrian leader after offering sanctions relief

-

'Children are innocent': Myanmar families in grief after school air strike

-

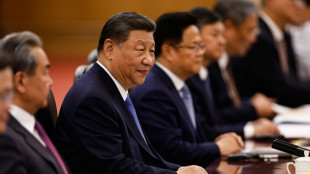

Colombia joins Belt and Road initiative as China courts Latin America

Colombia joins Belt and Road initiative as China courts Latin America

-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

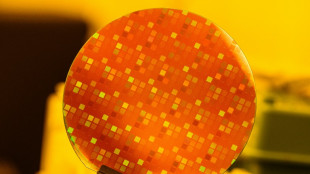

Protection racket? Asian semiconductor giants fear looming tariffs

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

-

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

UN relief chief urges action 'to prevent genocide' in Gaza

-

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

Stock markets mainly lower on China, US economy fears

European and Asian stock markets mostly fell Monday, as investors feared the impact of President Donald Trump's trade policy on the economic growth of the United States and China, the world's biggest economies.

A weak reading on Chinese consumer prices, showing they slipped back into deflation, added to growth concerns.

The London, Paris and Frankfurt stock markets were all lower nearing the half-way stage, tracking losses in Hong Kong and Shanghai. Tokyo ended higher.

"Unease about the effect of Trump's tariffs hangs over financial markets at the start of the week," said Susannah Streeter, head of money and markets at Hargreaves Lansdown.

"The prospect of a recession in the US is lurking, with consumer confidence falling, companies facing increasing trade complexity and investors turning more nervous," she added.

Trump raised worries about a recession Sunday when asked by Fox News if a downturn was possible this year by replying: "I hate to predict things like that."

He added: "There is a period of transition, because what we're doing is very big -- we're bringing wealth back to America," noting: "It takes a little time".

Traders kept tabs also on Beijing as Chinese leaders wrap up their annual gathering where they set a 2025 annual growth target of around five percent, vowed to make domestic demand their main economic driver, and unveiled a rare hike in fiscal funding.

The need for more measures to boost China's faltering economy was highlighted at the weekend by figures showing consumer prices fell 0.7 percent in February, the first drop in 13 months.

"The data only reinforces what's been clear for months -- deflationary pressures remain firmly entrenched in the world's second-largest economy," said Stephen Innes at SPI Asset Management.

"The property sector remains stuck in the mud, domestic demand is weak, and despite a bounce in tech stocks, the broader wealth effect just isn't filtering through to consumers."

- Key figures around 1100 GMT -

London - FTSE 100: DOWN 0.5 percent at 8,637.70 points

Paris - CAC 40: DOWN 0.5 percent at 8,084.09

Frankfurt - DAX: DOWN 0.9 percent at 22,810.93

Tokyo - Nikkei 225: UP 0.4 percent at 37,028.27 (close)

Hong Kong - Hang Seng Index: DOWN 1.9 percent at 23,783.49 (close)

Shanghai - Composite: DOWN 0.2 percent at 3,366.16 (close)

New York - Dow: UP 0.5 percent at 42,801.72 (close)

Euro/dollar: UP at $1.0862 from $1.0844 on Friday

Pound/dollar: DOWN at $1.2924 from $1.2925

Dollar/yen: DOWN 146.99 yen from 147.97 yen

Euro/pound: UP at 84.06 pence from 83.87 pence

Brent North Sea Crude: UP 0.1 percent at $70.45 per barrel

West Texas Intermediate: UP 0.1 percent at $67.12 per barrel

L.Stucki--VB