-

US facing worsening flight delays as shutdown snarls airports

US facing worsening flight delays as shutdown snarls airports

-

Outgoing French PM sees new premier named in next 48 hours

-

Ratcliffe gives Amorim three years to prove himself at Man Utd

Ratcliffe gives Amorim three years to prove himself at Man Utd

-

Jane Goodall's final wish: blast Trump, Musk and Putin to space

-

Salah scores twice as Egypt qualify for 2026 World Cup

Salah scores twice as Egypt qualify for 2026 World Cup

-

New 'Knives Out' spotlights Trump-era US political landscape

-

Failed assassin of Argentina's Kirchner given 10-year prison term

Failed assassin of Argentina's Kirchner given 10-year prison term

-

Man arrested over deadly January fire in Los Angeles

-

La Liga confirm 'historic' Barcelona match in Miami

La Liga confirm 'historic' Barcelona match in Miami

-

France's Le Pen vows to block any government

-

Mooney ton rescues Australia in stunning World Cup win over Pakistan

Mooney ton rescues Australia in stunning World Cup win over Pakistan

-

Afghan mobile access to Facebook, Instagram intentionally restricted: watchdog

-

Medvedev to face De Minaur in Shanghai quarter-finals

Medvedev to face De Minaur in Shanghai quarter-finals

-

Conceicao named as new coach of Al Ittihad

-

Victoria Beckham reveals struggle to reinvent herself in Netflix series

Victoria Beckham reveals struggle to reinvent herself in Netflix series

-

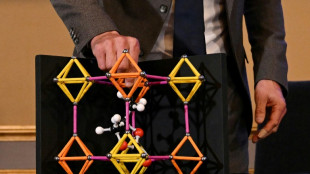

'Solids full of holes': Nobel-winning materials explained

-

Iran releases Franco-German accused of spying

Iran releases Franco-German accused of spying

-

Gisele Pelicot urges accused rapist to 'take responsibility'

-

BBVA, Sabadell clash heats up ahead of takeover deadline

BBVA, Sabadell clash heats up ahead of takeover deadline

-

World economy not doing as badly as feared, IMF chief says

-

Veggie 'burgers' face the chop as EU lawmakers back labeling ban

Veggie 'burgers' face the chop as EU lawmakers back labeling ban

-

Former FBI chief James Comey pleads not guilty in case pushed by Trump

-

Germany raises growth forecasts, but warns reforms needed

Germany raises growth forecasts, but warns reforms needed

-

Serie A chief blasts Rabiot's criticism of Milan match in Australia

-

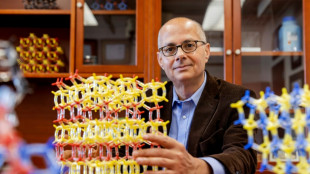

From refugee to Nobel: Yaghi hails science's 'equalising force'

From refugee to Nobel: Yaghi hails science's 'equalising force'

-

De Minaur, Auger-Aliassime through to Shanghai quarter-finals

-

Canal Istanbul stirs fear and uncertainty in nearby villages

Canal Istanbul stirs fear and uncertainty in nearby villages

-

Root backs England to end Ashes drought in Australia

-

British PM Starmer hails India opportunities after trade deal

British PM Starmer hails India opportunities after trade deal

-

England captain Kane could miss Wales friendly

-

Tennis increases support for players under corruption, doping investigation

Tennis increases support for players under corruption, doping investigation

-

Russia says momentum from Putin-Trump meeting 'gone'

-

EU wants key sectors to use made-in-Europe AI

EU wants key sectors to use made-in-Europe AI

-

De Minaur, Rinderknech through to Shanghai quarter-finals

-

Gisele Pelicot says 'never' gave consent to accused rapist

Gisele Pelicot says 'never' gave consent to accused rapist

-

Thousands stranded as record floods submerge Vietnam streets

-

Sabalenka battles to keep Wuhan record alive, Pegula survives marathon

Sabalenka battles to keep Wuhan record alive, Pegula survives marathon

-

Trio wins chemistry Nobel for new form of molecular architecture

-

Tarnished image and cheating claims in Malaysia football scandal

Tarnished image and cheating claims in Malaysia football scandal

-

Family affair as Rinderknech joins Vacherot in Shanghai quarters

-

New documentary shows life in Gaza for AFP journalists

New documentary shows life in Gaza for AFP journalists

-

Tennis stars suffer, wilt and quit in 'brutal' China heat

-

Wildlife flee as floods swamp Indian parks

Wildlife flee as floods swamp Indian parks

-

Record flooding hits Vietnam city, eight killed in north

-

Battling cancer made Vendee Globe win 'more complicated', says skipper Dalin

Battling cancer made Vendee Globe win 'more complicated', says skipper Dalin

-

England, Portugal, Norway closing in on 2026 World Cup

-

Child protection vs privacy: decision time for EU

Child protection vs privacy: decision time for EU

-

Bear injures two in Japan supermarket, man killed in separate attack

-

In Simandou mountains, Guinea prepares to cash in on iron ore

In Simandou mountains, Guinea prepares to cash in on iron ore

-

Morikawa says not to blame for 'rude' Ryder Cup fans

| RBGPF | -1.4% | 77.14 | $ | |

| CMSC | 0.04% | 23.75 | $ | |

| RYCEF | -0.91% | 15.4 | $ | |

| NGG | -0.63% | 73.42 | $ | |

| SCS | -0.33% | 16.805 | $ | |

| RIO | 2.03% | 67.625 | $ | |

| GSK | -0.22% | 43.405 | $ | |

| AZN | -0.8% | 85.185 | $ | |

| BTI | -1.06% | 51.435 | $ | |

| CMSD | -0.18% | 24.357 | $ | |

| BCC | 2.17% | 76.175 | $ | |

| VOD | -0.18% | 11.25 | $ | |

| RELX | 0.49% | 45.665 | $ | |

| BP | -1.32% | 34.515 | $ | |

| JRI | 0.33% | 14.116 | $ | |

| BCE | -0.39% | 23.2 | $ |

Equity markets swing as China-US trade euphoria fades

Stocks fluctuated Wednesday, with investors struggling to track a strong day on Wall Street as euphoria over the China-US trade detente petered out.

But while the days of breathtaking volatility seen through April appear to be over for now, analysts warned that more work was needed for Washington to reach tariff deals with countries and instill a sense of stability.

Data showing US inflation unexpectedly slowed last month provided some cheer, though observers pointed out that the real impact of Donald Trump's "Liberation Day" tolls will not likely be felt until May's readings.

The US president on Tuesday played up a deal with Beijing.

"We have the confines of a very, very strong deal with China. But the most exciting part of the deal... that's the opening up of China to US business," he told Fox News.

His remarks were made aboard Air Force One as he headed off on his Gulf tour, with Saudi Arabia on Tuesday pledging $600 billion worth of US investments in a range of sectors from defence to artificial intelligence.

The agreements -- including a huge chip deal for Nvidia and Advanced Micro Devices -- would boost US jobs, and the stock market is "gonna go a lot higher", Trump said, citing an "explosion of investment and jobs".

The tech-rich Nasdaq rallied with the S&P 500, which broke back into positive territory for the year, helped slightly by the inflation data.

Asia was mixed, though there were some standout performances.

Hong Kong and Shanghai rallied thanks to healthy buying of Chinese tech firms ahead of earnings releases from market heavyweights Alibaba and Tencent.

Investors are hoping the reports will provide an idea about how the sector's two biggest firms are coping with the trade upheaval and uncertainty in the world's number two economy. Both firms were up more than two percent.

There were also gains in Sydney, Seoul, Taipei, Mumbai and Jakarta but Singapore, Wellington, Manila and Bangkok fell.

Tokyo ended down even as electronics titan Sony surged 2.7 percent as it announced a $1.6 billion share buyback.

London and Paris were barely moved at the open, while Frankfurt edged up.

Oil edged down after enjoying a four-day rally on demand optimism and Trump's warnings to Iran over a nuclear deal.

Analysts said that while the China deal was welcome, investors were now bracing for the next developments in the US president's trade standoff with the world as countries look to strike deals with the White House to avert stiff tariffs.

"Remember it's an armistice not a peace treaty -- and the tariffs are still at these levels worse than we had before," Neil Wilson at Saxo Markets said.

"Let's be honest, the market knows this script by heart: Trump escalates. Markets tumble. Back-channels open. China blinks. A deal gets made. Risk rallies," added Stephen Innes at SPI Asset Management.

"The fog has lifted -- for now. Whether this cycle brings more sustainable upside or just sets up the next tantrum remains to be seen," he said.

Still, the dialling down of tensions with China saw JPMorgan Chase predict the US economy would grow this year, reversing its earlier forecast for a contraction caused by the tariffs.

- Key figures at around 0715 GMT -

Tokyo - Nikkei 225: DOWN 0.1 percent at 38,128.13 (close)

Hong Kong - Hang Seng Index: UP 2.0 percent at 23,560.45

Shanghai - Composite: UP 0.9 percent at 3,403.95 (close)

London - FTSE 100: FLAT at 8,603.27

Euro/dollar: UP at $1.1196 from $1.1189 on Tuesday

Pound/dollar: DOWN at $1.3303 from $1.3304

Dollar/yen: DOWN at 147.07 yen from 147.47 yen

Euro/pound: UP at 84.14 pence from 84.07 pence

West Texas Intermediate: DOWN 0.5 percent at $63.34 per barrel

Brent North Sea Crude: DOWN 0.5 percent at $66.30 per barrel

New York - Dow: DOWN 0.6 percent at 42,140.43 (close)

A.Ruegg--VB