-

Trump presses Syria leader on Israel after lifting sanctions

Trump presses Syria leader on Israel after lifting sanctions

-

French PM to testify on child abuse scandal

-

Players stuck in middle with IPL, national teams on collision course

Players stuck in middle with IPL, national teams on collision course

-

Peru PM quits ahead of no-confidence vote

-

Strikes kill 29 in Gaza as hostage release talks ongoing

Strikes kill 29 in Gaza as hostage release talks ongoing

-

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

-

France summons cryptocurrency businesses after kidnappings

France summons cryptocurrency businesses after kidnappings

-

Pakistan returns Indian border guard captured after Kashmir attack

-

Baidu plans self-driving taxi tests in Europe this year

Baidu plans self-driving taxi tests in Europe this year

-

Trump meets new Syria leader after lifting sanctions

-

Equity markets swing as China-US trade euphoria fades

Equity markets swing as China-US trade euphoria fades

-

Burberry warns 1,700 jobs at risk after annual loss

-

Trump to meet new Syrian leader after offering sanctions relief

Trump to meet new Syrian leader after offering sanctions relief

-

'Children are innocent': Myanmar families in grief after school air strike

-

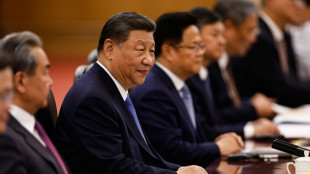

Colombia joins Belt and Road initiative as China courts Latin America

Colombia joins Belt and Road initiative as China courts Latin America

-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

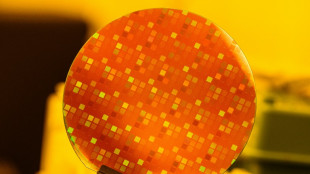

Protection racket? Asian semiconductor giants fear looming tariffs

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

-

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

-

Latin America mourns world's 'poorest president' Mujica, dead at 89

Latin America mourns world's 'poorest president' Mujica, dead at 89

-

Masters champion McIlroy to headline Australian Open

-

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

Sean Combs's ex Cassie says he coerced her into 'disgusting' sex ordeals

-

McIlroy, Scheffler and Schauffele together for rainy PGA battle

-

Uruguay's Mujica, world's 'poorest president,' dies aged 89

Uruguay's Mujica, world's 'poorest president,' dies aged 89

-

Lift-off at Eurovision as first qualifiers revealed

-

Forest striker Awoniyi placed in induced coma after surgery: reports

Forest striker Awoniyi placed in induced coma after surgery: reports

-

'Kramer vs Kramer' director Robert Benton dies: representative

-

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

Tatum suffered ruptured right Achilles in playoff defeat: Celtics

-

US stocks mostly rise on better inflation data while dollar retreats

-

Winning farewell for Orlando Pirates' Spanish coach Riveiro

Winning farewell for Orlando Pirates' Spanish coach Riveiro

-

Lift-off at Eurovision as first semi-final takes flight

-

UN relief chief urges action 'to prevent genocide' in Gaza

UN relief chief urges action 'to prevent genocide' in Gaza

-

Baseball pariahs Rose, Jackson eligible for Hall of Fame after league ruling

7-Eleven to explore sell-offs with Couche-Tard ahead of potential merger

The Japanese owner of 7-Eleven said Monday it had agreed to jointly explore store sell-offs with Alimentation Couche-Tard (ACT) to address antitrust concerns ahead of a potential merger.

It comes just days after Seven & i -- which has wholly owned 7-Eleven, the world's biggest convenience store brand, since 2005 -- announced a raft of new measures to fend off a takeover from its Canadian rival.

"Joint outreach by financial advisors to ACT and 7&i to potential buyers has begun," Seven & i said in a statement.

Couche-Tard has agreed to jointly "map out the viability of a divestiture process by defining operational, management, and financial characteristics of the group of stores to be sold and identifying potential buyers", it added.

"This would provide some insight into the prospects of success along terms that had a reasonable likelihood of satisfying US antitrust regulators," Seven & i said.

"We and our advisors believe we can now make progress towards determining whether a credible and actionable remedy and divestiture package can be achieved that would allow a realistic assessment of ACT's proposal."

On Thursday, the Tokyo-based company announced a huge share buyback and an IPO of its US unit -- the latest twist in a saga that began last year, when Seven & i rebuffed a takeover offer worth nearly $40 billion from ACT.

When Seven & i rejected the initial takeover offer from ACT in September, the company said it had "grossly" undervalued its business and could face regulatory hurdles.

Such a takeover would be the biggest foreign buyout of a Japanese firm, merging the 7-Eleven, Circle K and other franchises to create a global convenience store behemoth.

Japan's Yomiuri daily reported last week that a special committee scrutinising ACT's raised offer of reportedly around $47 billion had decided formally to reject that too.

Seven & i, which operates some 85,000 convenience stores worldwide, also named Stephen Dacus as its first foreign CEO on Thursday.

Around a quarter of 7-Eleven stores are in Japan where they are a beloved institution, selling everything from concert tickets to pet food and fresh rice balls.

ACT, which began with one store in Quebec in 1980, runs nearly 17,000 convenience store outlets worldwide, including Circle K.

P.Staeheli--VB