-

Strikes kill 29 in Gaza, amid hostage release talks

Strikes kill 29 in Gaza, amid hostage release talks

-

Tennis champ Sinner meets Pope Leo, offers quick rally

-

England sees driest spring since 1956: government agency

England sees driest spring since 1956: government agency

-

Trump presses Syria leader on Israel ties after lifting sanctions

-

Rare blue diamond fetches $21.5 mn at auction in Geneva

Rare blue diamond fetches $21.5 mn at auction in Geneva

-

Stock markets fluctuate as China-US trade euphoria fades

-

Ousted Myanmar envoy charged with trespass in London residence row

Ousted Myanmar envoy charged with trespass in London residence row

-

Russia jails prominent vote monitor for five years

-

Umbro owner in joint bid for Le Coq Sportif

Umbro owner in joint bid for Le Coq Sportif

-

Tom Cruise has world guessing as he unleashes 'Mission: Impossible' at Cannes

-

China's Tencent posts forecast-beating Q1 revenue on gaming growth

China's Tencent posts forecast-beating Q1 revenue on gaming growth

-

Trump presses Syria leader on Israel relations after lifting sanctions

-

FA appoint former Man Utd sporting director Dan Ashworth as chief football officer

FA appoint former Man Utd sporting director Dan Ashworth as chief football officer

-

Stop holding opponents incommunicado, UN experts tell Venezuela

-

Indonesian filmmakers aim to impress at Cannes

Indonesian filmmakers aim to impress at Cannes

-

Trump presses Syria leader on Israel after lifting sanctions

-

French PM to testify on child abuse scandal

French PM to testify on child abuse scandal

-

Players stuck in middle with IPL, national teams on collision course

-

Peru PM quits ahead of no-confidence vote

Peru PM quits ahead of no-confidence vote

-

Strikes kill 29 in Gaza as hostage release talks ongoing

-

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

-

France summons cryptocurrency businesses after kidnappings

-

Pakistan returns Indian border guard captured after Kashmir attack

Pakistan returns Indian border guard captured after Kashmir attack

-

Baidu plans self-driving taxi tests in Europe this year

-

Trump meets new Syria leader after lifting sanctions

Trump meets new Syria leader after lifting sanctions

-

Equity markets swing as China-US trade euphoria fades

-

Burberry warns 1,700 jobs at risk after annual loss

Burberry warns 1,700 jobs at risk after annual loss

-

Trump to meet new Syrian leader after offering sanctions relief

-

'Children are innocent': Myanmar families in grief after school air strike

'Children are innocent': Myanmar families in grief after school air strike

-

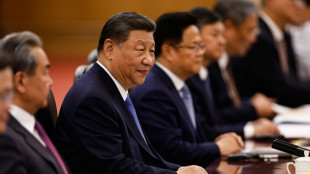

Colombia joins Belt and Road initiative as China courts Latin America

-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

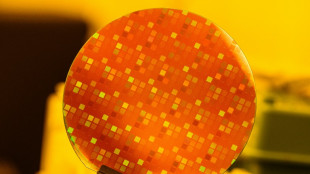

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

Eurovision stage a dynamic 3D 'playground': producer

-

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

From critic to investor: Trump welcomes crypto leaders to White House

Donald Trump on Friday hosted top cryptocurrency players at the White House, a political boost for an industry that has struggled to gain legitimacy -- and where the Republican president faces conflict of interest concerns.

US crypto investors were major supporters of Trump's presidential campaign, contributing millions of dollars toward his victory in hopes of ending the deep skepticism of Democrat Joe Biden administration toward digital currencies.

"I think it's safe to say the administration wants to end the war on crypto. We promise to do that," the president's "crypto czar," Silicon Valley investor David Sacks, told reporters as he entered the meeting.

Trump now has significant financial ties to the sector, partnering with exchange platform World Liberty Financial and launching the "Trump" memecoin in January.

First Lady Melania Trump announced a memecoin of her own, $MELANIA, one day before her husband's January 20 inauguration.

Sacks invited prominent founders, CEOs and investors, along with members of a Trump working group, to craft policies aimed at accelerating crypto growth and providing legitimacy that the industry has long sought.

On Thursday, Trump signed an executive order establishing a "Strategic Bitcoin Reserve," a move Sacks said made good on a campaign promise to an increasingly important component of his supporters.

Summit guests included twins Cameron and Tyler Winklevoss, founders of crypto platform Gemini, as well as Brian Armstrong of Coinbase and Michael Saylor, the boss of major Bitcoin investor MicroStrategy.

- 'Innovation framework' -

For believers, cryptocurrencies represent a financial revolution that reduces dependence on centralized authorities while offering individuals an alternative to traditional banking systems.

Bitcoin, the world's most traded cryptocurrency, is heralded by advocates as a substitute for gold or a hedge against currency devaluation and political instability.

Critics meanwhile maintain that these assets function primarily as speculative investments with questionable real-world utility that could leave taxpayers on the hook for cleaning up if the market crashes.

Asked about the risky nature of crypto investing, Sacks said that the government's embrace of the industry did not amount to investment advice and warned that digital currencies were highly volatile, encouraging Americans to talk to an advisor before entering the market.

"My job is not to encourage people to buy crypto. My job is to create an innovation framework for the United States," he added.

The proliferation of "memecoins" — cryptocurrencies based on celebrities, internet memes, or pop culture items rather than technical utility — presents another challenge.

Much of the crypto industry frowns upon these tokens, fearing they tarnish the sector's credibility, amid reports of quick pump-and-dump schemes that leave unwitting buyers paying for assets that end up worthless.

Once hostile to the crypto industry, Trump has already taken significant steps to clear regulatory hurdles.

Under Thursday's executive order, the bitcoin stockpile will be composed of digital currency seized in US criminal proceedings.

Sacks said that if previous administrations had held onto their digital holdings over the past decade, rather than selling them, they would be worth $17 billion today.

Trump has appointed crypto advocate Paul Atkins to head the Securities and Exchange Commission.

Under Atkins, the SEC has dropped legal proceedings against major platforms like Coinbase and Kraken that were initiated during Biden's term.

The previous Democratic administration had implemented restrictions on banks holding cryptocurrencies — which have since been lifted — and allowed former SEC chairman Gary Gensler to pursue aggressive enforcement.

Sacks said the Biden administration treated the industry "like criminals" and launched investigations when there were no clear rules of the road.

"Crypto founders would tell me over and over and over again, we just want to know what the rules are... And they were never told those rules," he said.

However, setting those rules will likely require action by Congress, where crypto legislation has remained stalled despite intense lobbying efforts led by investors.

L.Meier--VB