-

Tennis champ Sinner meets Pope Leo, offers quick rally

Tennis champ Sinner meets Pope Leo, offers quick rally

-

England sees driest spring since 1956: government agency

-

Trump presses Syria leader on Israel ties after lifting sanctions

Trump presses Syria leader on Israel ties after lifting sanctions

-

Rare blue diamond fetches $21.5 mn at auction in Geneva

-

Stock markets fluctuate as China-US trade euphoria fades

Stock markets fluctuate as China-US trade euphoria fades

-

Ousted Myanmar envoy charged with trespass in London residence row

-

Russia jails prominent vote monitor for five years

Russia jails prominent vote monitor for five years

-

Umbro owner in joint bid for Le Coq Sportif

-

Tom Cruise has world guessing as he unleashes 'Mission: Impossible' at Cannes

Tom Cruise has world guessing as he unleashes 'Mission: Impossible' at Cannes

-

China's Tencent posts forecast-beating Q1 revenue on gaming growth

-

Trump presses Syria leader on Israel relations after lifting sanctions

Trump presses Syria leader on Israel relations after lifting sanctions

-

FA appoint former Man Utd sporting director Dan Ashworth as chief football officer

-

Stop holding opponents incommunicado, UN experts tell Venezuela

Stop holding opponents incommunicado, UN experts tell Venezuela

-

Indonesian filmmakers aim to impress at Cannes

-

Trump presses Syria leader on Israel after lifting sanctions

Trump presses Syria leader on Israel after lifting sanctions

-

French PM to testify on child abuse scandal

-

Players stuck in middle with IPL, national teams on collision course

Players stuck in middle with IPL, national teams on collision course

-

Peru PM quits ahead of no-confidence vote

-

Strikes kill 29 in Gaza as hostage release talks ongoing

Strikes kill 29 in Gaza as hostage release talks ongoing

-

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

-

France summons cryptocurrency businesses after kidnappings

France summons cryptocurrency businesses after kidnappings

-

Pakistan returns Indian border guard captured after Kashmir attack

-

Baidu plans self-driving taxi tests in Europe this year

Baidu plans self-driving taxi tests in Europe this year

-

Trump meets new Syria leader after lifting sanctions

-

Equity markets swing as China-US trade euphoria fades

Equity markets swing as China-US trade euphoria fades

-

Burberry warns 1,700 jobs at risk after annual loss

-

Trump to meet new Syrian leader after offering sanctions relief

Trump to meet new Syrian leader after offering sanctions relief

-

'Children are innocent': Myanmar families in grief after school air strike

-

Colombia joins Belt and Road initiative as China courts Latin America

Colombia joins Belt and Road initiative as China courts Latin America

-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

Protection racket? Asian semiconductor giants fear looming tariffs

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

-

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

-

Sony logs 18% annual net profit jump, forecast cautious

Sony logs 18% annual net profit jump, forecast cautious

-

China, US to lift sweeping tariffs in trade war climbdown

-

Asian markets swing as China-US trade euphoria fades

Asian markets swing as China-US trade euphoria fades

-

Australian seaweed farm tackles burps to help climate

-

Judgment day in EU chief's Covid vaccine texts case

Judgment day in EU chief's Covid vaccine texts case

-

Trump set to meet Syrian leader ahead of Qatar visit

-

Misinformation clouds Sean Combs's sex trafficking trial

Misinformation clouds Sean Combs's sex trafficking trial

-

'Panic and paralysis': US firms fret despite China tariff reprieve

-

Menendez brothers resentenced, parole now possible

Menendez brothers resentenced, parole now possible

-

'Humiliated': Combs's ex Cassie gives searing testimony of abuse

Stock markets, bitcoin down as Trump policies roil markets

Global stock markets tumbled and the dollar retreated Friday as uncertainty over US President Donald Trump's trade policies roiled markets and traders awaited key US jobs data.

Bitcoin plunged as much as 5.7 percent after Trump signed an executive order to establish a "Strategic Bitcoin Reserve" without planning any public purchases of the cryptocurrency.

The unit recovered somewhat to trade down around one percent lower.

European and Asian equities were in the red despite Trump's move Thursday to delay tariffs on Canadian and Mexican goods covered under a North American trade agreement until April 2.

The halt offers temporary relief to automakers.

But Trump has said he will not modify broad tariffs for steel and aluminium imports, which are due to take effect next week.

"Even though Donald Trump has made more goods exempt from tariffs on Canada and Mexico, it's the constant tinkering that's upset investors," noted AJ Bell investment director Russ Mould.

"The fact Trump keeps changing his mind confuses matters as companies have no idea what's going on from one day to the next," he added.

The euro continued to win strong support as a planned spike in Germany's defence and infrastructure spending fuels inflation concerns and puts pressure on the European Central Bank to pause cuts to interest rates.

The ECB on Thursday reduced borrowing costs for a fifth meeting in a row amid a struggling eurozone economy.

There was brighter news Friday, however, as official data showed the eurozone economy grew by 0.9 percent last year, higher than thought.

German stocks receded Friday after data showed that Germany's industrial orders in January posted their biggest monthly fall in a year.

Investors were awaiting Friday's US jobs report for February, a key indicator of the health of the world's largest economy.

Weekly jobless claims figures released Thursday were better than expected, while Wednesday's private payroll report from ADP lagged estimates.

"Today's US jobs report wraps up a week that has brought plenty of concern around the jobs market," said Joshua Mahony, chief market analyst at Scope Markets.

He added that tariff threats and federal cutbacks are "adding up to provide a picture of economic weakness".

Japan's Nikkei shares index led losses in Asia, closing down more than two percent.

Chinese markets, which had been riding a wave of stimulus-induced optimism, ended the week modestly lower.

Chinese stocks had jumped earlier in the week after Beijing announced a growth target of around five percent at its annual meeting of the National People's Congress.

China has vowed to make domestic demand its main economic driver despite facing persistent economic headwinds and an escalating trade war with the United States.

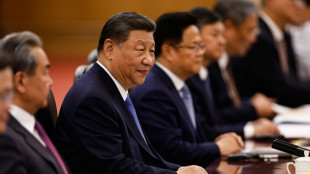

Foreign Minister Wang Yi on Friday warned that Beijing will "firmly counter" US pressure on trade.

"China-US economic and trade ties are mutual. If you choose to cooperate, you can achieve mutually beneficial and win-win results. If you use only pressure, China will firmly counter," he said.

- Key figures around 1045 GMT -

London - FTSE 100: DOWN 0.5 percent at 8,640.01 points

Paris - CAC 40: DOWN 1.0 percent at 8,112.97

Frankfurt - DAX: DOWN 1.6 percent at 23,042.73

Tokyo - Nikkei 225: DOWN 2.2 percent at 36,887.17 (close)

Hong Kong - Hang Seng Index: DOWN 0.6 percent at 24,238 (close)

Shanghai - Composite: DOWN 0.3 percent at 3,372.55 (close)

New York - Dow: DOWN 1.0 percent at 42,579.08 (close)

Euro/dollar: UP at 1.0865 from 1.0787 on Thursday

Pound/dollar: UP at 1.2925 from 1.2882

Dollar/yen: DOWN 147.51 from 147.97

Euro/pound: UP at 84.06 pence from 83.72 pence

Brent North Sea Crude: UP 1.5 percent at 70.45 per barrel

West Texas Intermediate: UP 1.4 percent at $67.28 per barrel

M.Betschart--VB