-

Paris to allow swimming in Seine from July in Olympic legacy

Paris to allow swimming in Seine from July in Olympic legacy

-

Germany's Merz urges Europe-US unity on Ukraine war

-

Tom Cruise nearly met his end on 'The Final Reckoning'

Tom Cruise nearly met his end on 'The Final Reckoning'

-

No new burdens for McIlroy, living the dream after career Slam

-

Sean Combs's ex Cassie to face defense grilling at second day in court

Sean Combs's ex Cassie to face defense grilling at second day in court

-

Ageless beauty contest: South African grannies strut the catwalk

-

Trump says 'possibility' of meeting Putin for Ukraine talks in Turkey

Trump says 'possibility' of meeting Putin for Ukraine talks in Turkey

-

Gauff sees off Andreeva to reach Italian Open semis

-

Merz vows to rev up German economic 'growth engine'

Merz vows to rev up German economic 'growth engine'

-

Strikes kill 29 in Gaza, amid hostage release talks

-

Tennis champ Sinner meets Pope Leo, offers quick rally

Tennis champ Sinner meets Pope Leo, offers quick rally

-

England sees driest spring since 1956: government agency

-

Trump presses Syria leader on Israel ties after lifting sanctions

Trump presses Syria leader on Israel ties after lifting sanctions

-

Rare blue diamond fetches $21.5 mn at auction in Geneva

-

Stock markets fluctuate as China-US trade euphoria fades

Stock markets fluctuate as China-US trade euphoria fades

-

Ousted Myanmar envoy charged with trespass in London residence row

-

Russia jails prominent vote monitor for five years

Russia jails prominent vote monitor for five years

-

Umbro owner in joint bid for Le Coq Sportif

-

Tom Cruise has world guessing as he unleashes 'Mission: Impossible' at Cannes

Tom Cruise has world guessing as he unleashes 'Mission: Impossible' at Cannes

-

China's Tencent posts forecast-beating Q1 revenue on gaming growth

-

Trump presses Syria leader on Israel relations after lifting sanctions

Trump presses Syria leader on Israel relations after lifting sanctions

-

FA appoint former Man Utd sporting director Dan Ashworth as chief football officer

-

Stop holding opponents incommunicado, UN experts tell Venezuela

Stop holding opponents incommunicado, UN experts tell Venezuela

-

Indonesian filmmakers aim to impress at Cannes

-

Trump presses Syria leader on Israel after lifting sanctions

Trump presses Syria leader on Israel after lifting sanctions

-

French PM to testify on child abuse scandal

-

Players stuck in middle with IPL, national teams on collision course

Players stuck in middle with IPL, national teams on collision course

-

Peru PM quits ahead of no-confidence vote

-

Strikes kill 29 in Gaza as hostage release talks ongoing

Strikes kill 29 in Gaza as hostage release talks ongoing

-

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

-

France summons cryptocurrency businesses after kidnappings

France summons cryptocurrency businesses after kidnappings

-

Pakistan returns Indian border guard captured after Kashmir attack

-

Baidu plans self-driving taxi tests in Europe this year

Baidu plans self-driving taxi tests in Europe this year

-

Trump meets new Syria leader after lifting sanctions

-

Equity markets swing as China-US trade euphoria fades

Equity markets swing as China-US trade euphoria fades

-

Burberry warns 1,700 jobs at risk after annual loss

-

Trump to meet new Syrian leader after offering sanctions relief

Trump to meet new Syrian leader after offering sanctions relief

-

'Children are innocent': Myanmar families in grief after school air strike

-

Colombia joins Belt and Road initiative as China courts Latin America

Colombia joins Belt and Road initiative as China courts Latin America

-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

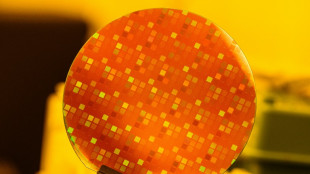

Protection racket? Asian semiconductor giants fear looming tariffs

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

-

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

| CMSC | -0.38% | 21.977 | $ | |

| BCC | -1.11% | 92.68 | $ | |

| BTI | -0.56% | 40.465 | $ | |

| JRI | -0.39% | 12.83 | $ | |

| NGG | -0.04% | 67.505 | $ | |

| GSK | 0.15% | 36.405 | $ | |

| BCE | -2.42% | 21.46 | $ | |

| SCS | -0.89% | 10.615 | $ | |

| RYCEF | -0.19% | 10.68 | $ | |

| RIO | -0.23% | 62.13 | $ | |

| RBGPF | 1.27% | 63.81 | $ | |

| CMSD | -0.25% | 22.335 | $ | |

| BP | -1.06% | 30.24 | $ | |

| VOD | -0.28% | 9.035 | $ | |

| AZN | -1.26% | 66.88 | $ | |

| RELX | 1.4% | 53.145 | $ |

ECB lowers rates again but hints more cuts in doubt

The European Central Bank cut interest rates again Thursday to boost the struggling eurozone but suggested easing could be nearing an end and warned of "rising uncertainty" amid massive German spending plans and US tariff threats.

It was the central bank's six reduction since June last year, with its focus having shifted from tackling inflation to providing relief for the single currency area, which has been eking out meagre growth.

The quarter-percentage-point reduction brought the Frankfurt-based institution's benchmark deposit rate to 2.5 percent.

The rate reached a record of four percent in late 2023 after the ECB launched a furious hiking cycle to tame energy and food costs that surged in the wake of Russia's invasion of Ukraine.

In a statement announcing the decision, the ECB said the process of inflation coming down was "well on track" and it believed that it would settle around the central bank's two-percent target.

Eurozone inflation eased slightly to 2.4 percent in February.

But it a sign of continuing price pressures, the ECB raised its inflation forecast for this year to 2.3 percent from a previous prediction of 2.1 percent.

Crucially, the ECB tweaked guidance to say that rates were becoming "meaningfully less restrictive", suggesting they were no longer having a major impact on bringing down inflation.

The change in language is a signal markets had been on the lookout for, and which they believe suggests that policymakers are gearing up to halt rate cuts.

Highlighting the continued economic woes for the 20 countries that use the euro, the central bank trimmed its growth forecast for 2025 and 2026, to 0.9 percent and 1.2 respectively.

The bank also warned about "current conditions of rising uncertainty," insisting it would make its decisions based on incoming data.

Uncertainty about the fallout from potential US tariffs -- President Donald Trump has threatened a 25-percent duty on all EU goods -- was already clouding the outlook and potentially pushing rate-setters towards hitting pause.

- German spending plans -

New plans announced Tuesday by Germany's likely next chancellor Friedrich Merz to spend several hundred billion euros more on defence and infrastructure in the coming years could impact policymakers' considerations, observers said.

The dramatic move was driven by fears that long-standing US security guarantees for Europe will be weakened under Trump amid a rush to end the war in Ukraine.

The proposals still need to be rushed through the German parliament, and their impacts are for now uncertain, although some analysts believe such a spending surge has the potential to stoke inflation and discourage further rate cuts.

Investors are now awaiting comments by ECB President Christine Lagarde at the post-meeting press conference.

Even before the German announcement, ECB policymakers were already asking how much further it should continue on the path to lower interest rates.

Isabel Schnabel, an influential ECB board member, told The Financial Times last month that policymakers were getting "closer to the point where we may have to pause or halt our rate cuts".

"We can no longer say with confidence that our monetary policy is still restrictive," she said.

- Trump effect -

In the United States, where the economy is in more robust health than in the eurozone, the Federal Reserve paused rate cuts recently after inflation rose and amid uncertainty about the future direction of Trump's policy.

Lagarde has so far sought to avoid tipping the ECB's hand and could stick with her mantra of making decisions "meeting-by-meeting" in her remarks after the rates announcement, observers said.

"Global uncertainties have increased significantly in recent weeks," said Felix Schmidt, an economist from Berenberg bank, pointing to Trump's tariff threats.

Given this "Lagarde will refrain from giving any clear forward guidance and will try to maintain maximum flexibility," he added.

M.Schneider--VB