-

Paris to allow swimming in Seine from July in Olympic legacy

Paris to allow swimming in Seine from July in Olympic legacy

-

Germany's Merz urges Europe-US unity on Ukraine war

-

Tom Cruise nearly met his end on 'The Final Reckoning'

Tom Cruise nearly met his end on 'The Final Reckoning'

-

No new burdens for McIlroy, living the dream after career Slam

-

Sean Combs's ex Cassie to face defense grilling at second day in court

Sean Combs's ex Cassie to face defense grilling at second day in court

-

Ageless beauty contest: South African grannies strut the catwalk

-

Trump says 'possibility' of meeting Putin for Ukraine talks in Turkey

Trump says 'possibility' of meeting Putin for Ukraine talks in Turkey

-

Gauff sees off Andreeva to reach Italian Open semis

-

Merz vows to rev up German economic 'growth engine'

Merz vows to rev up German economic 'growth engine'

-

Strikes kill 29 in Gaza, amid hostage release talks

-

Tennis champ Sinner meets Pope Leo, offers quick rally

Tennis champ Sinner meets Pope Leo, offers quick rally

-

England sees driest spring since 1956: government agency

-

Trump presses Syria leader on Israel ties after lifting sanctions

Trump presses Syria leader on Israel ties after lifting sanctions

-

Rare blue diamond fetches $21.5 mn at auction in Geneva

-

Stock markets fluctuate as China-US trade euphoria fades

Stock markets fluctuate as China-US trade euphoria fades

-

Ousted Myanmar envoy charged with trespass in London residence row

-

Russia jails prominent vote monitor for five years

Russia jails prominent vote monitor for five years

-

Umbro owner in joint bid for Le Coq Sportif

-

Tom Cruise has world guessing as he unleashes 'Mission: Impossible' at Cannes

Tom Cruise has world guessing as he unleashes 'Mission: Impossible' at Cannes

-

China's Tencent posts forecast-beating Q1 revenue on gaming growth

-

Trump presses Syria leader on Israel relations after lifting sanctions

Trump presses Syria leader on Israel relations after lifting sanctions

-

FA appoint former Man Utd sporting director Dan Ashworth as chief football officer

-

Stop holding opponents incommunicado, UN experts tell Venezuela

Stop holding opponents incommunicado, UN experts tell Venezuela

-

Indonesian filmmakers aim to impress at Cannes

-

Trump presses Syria leader on Israel after lifting sanctions

Trump presses Syria leader on Israel after lifting sanctions

-

French PM to testify on child abuse scandal

-

Players stuck in middle with IPL, national teams on collision course

Players stuck in middle with IPL, national teams on collision course

-

Peru PM quits ahead of no-confidence vote

-

Strikes kill 29 in Gaza as hostage release talks ongoing

Strikes kill 29 in Gaza as hostage release talks ongoing

-

Court raps Brussels for lack of transparency on von der Leyen vaccine texts

-

France summons cryptocurrency businesses after kidnappings

France summons cryptocurrency businesses after kidnappings

-

Pakistan returns Indian border guard captured after Kashmir attack

-

Baidu plans self-driving taxi tests in Europe this year

Baidu plans self-driving taxi tests in Europe this year

-

Trump meets new Syria leader after lifting sanctions

-

Equity markets swing as China-US trade euphoria fades

Equity markets swing as China-US trade euphoria fades

-

Burberry warns 1,700 jobs at risk after annual loss

-

Trump to meet new Syrian leader after offering sanctions relief

Trump to meet new Syrian leader after offering sanctions relief

-

'Children are innocent': Myanmar families in grief after school air strike

-

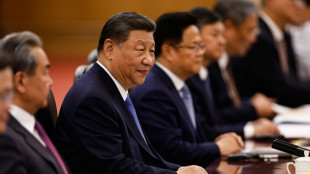

Colombia joins Belt and Road initiative as China courts Latin America

Colombia joins Belt and Road initiative as China courts Latin America

-

Australian champion cyclist Dennis gets suspended sentence after wife's road death

-

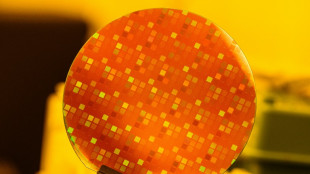

Protection racket? Asian semiconductor giants fear looming tariffs

Protection racket? Asian semiconductor giants fear looming tariffs

-

S. Korea Starbucks in a froth over presidential candidates names

-

NATO hatches deal on higher spending to keep Trump happy

NATO hatches deal on higher spending to keep Trump happy

-

Eurovision stage a dynamic 3D 'playground': producer

-

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

Cruise unleashes 'Mission: Impossible' juggernaut at Cannes

-

Suaalii in race to be fit for Lions Tests after fracturing jaw

-

Pacers oust top-seeded Cavs, Nuggets on brink

Pacers oust top-seeded Cavs, Nuggets on brink

-

Sony girds for US tariffs after record annual net profit

-

China, US slash sweeping tariffs in trade war climbdown

China, US slash sweeping tariffs in trade war climbdown

-

Human Rights Watch warns of migrant worker deaths in 2034 World Cup host Saudi Arabia

| CMSC | -0.38% | 21.977 | $ | |

| BCC | -1.11% | 92.68 | $ | |

| BTI | -0.56% | 40.465 | $ | |

| JRI | -0.39% | 12.83 | $ | |

| NGG | -0.04% | 67.505 | $ | |

| GSK | 0.15% | 36.405 | $ | |

| BCE | -2.42% | 21.46 | $ | |

| SCS | -0.89% | 10.615 | $ | |

| RYCEF | -0.19% | 10.68 | $ | |

| RIO | -0.23% | 62.13 | $ | |

| RBGPF | 1.27% | 63.81 | $ | |

| CMSD | -0.25% | 22.335 | $ | |

| BP | -1.06% | 30.24 | $ | |

| VOD | -0.28% | 9.035 | $ | |

| AZN | -1.26% | 66.88 | $ | |

| RELX | 1.4% | 53.145 | $ |

7-Eleven owner seeks to fend off takeover with buyback, US IPO

The Japanese owner of 7-Eleven announced on Thursday a raft of new measures to fend off a takeover by a Canadian rival, including a huge share buyback and an IPO of its US unit.

The announcements are the latest twist in a saga that began last year, when Seven & i rebuffed a takeover offer worth nearly $40 billion from Canada's Alimentation Couche-Tard (ACT).

"We're convinced that now is the time to take our initiatives to the next level, and our leadership will further pursue the improvement of shareholder value and implement transformative policies," outgoing company president Ryuichi Isaka said in a statement.

"We have decided to conduct an initial public offering (IPO) of our SEI shares that operate the North American convenience store business, 7-Eleven, on one of the major US stock exchanges by the second half of 2026," Seven & i said.

It said it plans to buy back two trillion yen ($13.2 billion) of its own shares, using funds generated by that IPO and other restructuring measures.

The company also plans to sell its non-convenience-store business -- comprising supermarkets, restaurants and other assets -- to US private investment firm Bain Capital for $5.4 billion.

Seven & i, which operates some 85,000 convenience stores worldwide, also named Stephen Dacus as its first foreign chief executive to replace Isaka.

Reports of the raft of measures, that appeared before the retailer's announcement, caused its shares to surge as much as 10 percent in afternoon trade.

They later trimmed those gains and were trading up 6.5 percent before the market closed.

- Behemoth -

ACT's takeover would be the biggest foreign buyout of a Japanese firm, merging the 7-Eleven, Circle K and other franchises to create a global convenience store behemoth.

Japan's Yomiuri daily reported this week that a special committee scrutinising ACT's raised offer of reportedly around $47 billion had decided formally to reject that too.

Isaka told a news conference on Thursday that an ACT takeover would pose "serious US antitrust challenges", and that there had been "no meaningful progress" towards resolving them.

"Hence the proposal has no assurance that it would be in the best interest of group shareholders and other stakeholders," Isaka said through an interpreter.

He added however: "We will continue to examine and consider all strategic options, including the proposal from ACT, in order to realize the unlocking of our share value for our shareholders."

- Rice balls -

7-Eleven, the world's biggest convenience store brand, began in the United States but has been wholly owned by Seven & i since 2005.

Its stores are a beloved institution in Japan, selling everything from concert tickets to pet food and fresh rice balls, although sales have been flagging.

ACT, which began with one store in Quebec in 1980, runs nearly 17,000 convenience store outlets worldwide, including Circle K.

Dacus told the news conference that his father was a 7-Eleven franchisee in the United States and that he worked weekend night shifts as a teenager.

"I had no way of knowing that nearly 50 years later, I would be selected to run the global parent company of my father's small store," Dacus said in Japanese.

"As you all know, recently we have lost some momentum. We have to humbly face the fact that we have lost some market share," he added through an interpreter.

T.Egger--VB