-

Venezuelans eye economic revival with hoped-for oil resurgence

Venezuelans eye economic revival with hoped-for oil resurgence

-

Online platforms offer filtering to fight AI slop

-

With Trump allies watching, Canada oil hub faces separatist bid

With Trump allies watching, Canada oil hub faces separatist bid

-

Samsung Electronics posts record profit on AI demand

-

Rockets veteran Adams out for rest of NBA season

Rockets veteran Adams out for rest of NBA season

-

Holders PSG happy to take 'long route' via Champions League play-offs

-

French Senate adopts bill to return colonial-era art

French Senate adopts bill to return colonial-era art

-

Allrounder Molineux named Australian women's cricket captain

-

Sabalenka faces Svitolina roadblock in Melbourne final quest

Sabalenka faces Svitolina roadblock in Melbourne final quest

-

Barcelona rout Copenhagen to reach Champions League last 16

-

Liverpool, Man City and Barcelona ease into Champions League last 16

Liverpool, Man City and Barcelona ease into Champions League last 16

-

Tesla profits tumble on lower EV sales, AI spending surge

-

Real Madrid face Champions League play-off after Benfica loss

Real Madrid face Champions League play-off after Benfica loss

-

LA mayor urges US to reassure visiting World Cup fans

-

Madrid condemned to Champions League play-off after Benfica loss

Madrid condemned to Champions League play-off after Benfica loss

-

Meta shares jump on strong earnings report

-

Haaland ends barren run as Man City reach Champions League last 16

Haaland ends barren run as Man City reach Champions League last 16

-

PSG and Newcastle drop into Champions League play-offs after stalemate

-

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

Salah ends drought as Liverpool hit Qarabag for six to reach Champions League last 16

-

Barca rout Copenhagen to reach Champions League last 16

-

Arsenal complete Champions League clean sweep for top spot

Arsenal complete Champions League clean sweep for top spot

-

Kolo Muani and Solanke send Spurs into Champions League last 16

-

Bayern inflict Kane-ful Champions League defeat on PSV

Bayern inflict Kane-ful Champions League defeat on PSV

-

Pedro double fires Chelsea into Champions League last 16, dumps out Napoli

-

US stocks move sideways, shruggging off low-key Fed meeting

US stocks move sideways, shruggging off low-key Fed meeting

-

US capital Washington under fire after massive sewage leak

-

Anti-immigration protesters force climbdown in Sundance documentary

Anti-immigration protesters force climbdown in Sundance documentary

-

US ambassador says no ICE patrols at Winter Olympics

-

Norway's Kristoffersen wins Schladming slalom

Norway's Kristoffersen wins Schladming slalom

-

Springsteen releases fiery ode to Minneapolis shooting victims

-

Brady latest to blast Belichick Hall of Fame snub

Brady latest to blast Belichick Hall of Fame snub

-

Trump battles Minneapolis shooting fallout as agents put on leave

-

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

SpaceX eyes IPO timed to planet alignment and Musk birthday: report

-

White House, Slovakia deny report on Trump's mental state

-

Iran vows to resist any US attack, insists ready for nuclear deal

Iran vows to resist any US attack, insists ready for nuclear deal

-

Colombia leader offers talks to end trade war with Ecuador

-

Former Masters champ Reed returning to PGA Tour from LIV

Former Masters champ Reed returning to PGA Tour from LIV

-

US Fed holds interest rates steady, defying Trump pressure

-

Norway's McGrath tops first leg of Schladming slalom

Norway's McGrath tops first leg of Schladming slalom

-

Iraq PM candidate Maliki denounces Trump's 'blatant' interference

-

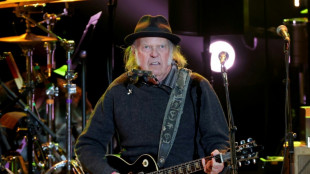

Neil Young gifts music to Greenland residents for stress relief

Neil Young gifts music to Greenland residents for stress relief

-

Rubio upbeat on Venezuela cooperation but wields stick

-

'No. 1 fan': Rapper Minaj backs Trump

'No. 1 fan': Rapper Minaj backs Trump

-

Fear in Sicilian town as vast landslide risks widening

-

'Forced disappearance' probe opened against Colombian cycling star Herrera

'Forced disappearance' probe opened against Colombian cycling star Herrera

-

Seifert, Santner give New Zealand consolation T20 win over India

-

King Charles III warns world 'going backwards' in climate fight

King Charles III warns world 'going backwards' in climate fight

-

Minneapolis activists track Trump's immigration enforcers

-

Court orders Dutch to protect Caribbean island from climate change

Court orders Dutch to protect Caribbean island from climate change

-

Sterling agrees Chelsea exit after troubled spell

'Enormously risky': How NFTs lost their lustre

A slew of celebrity endorsements helped inflate a multi-billion dollar bubble around digital tokens over the past year, but cryptocurrencies are crashing and some fear NFTs could be next.

NFTs are tokens linked to digital images, "collectable" items, avatars in games or property and objects in the burgeoning virtual world of the metaverse.

The likes of Paris Hilton, Gwyneth Paltrow and Serena Williams have boasted about owning NFTs and many under-30s have been enticed to gamble for the chance of making a quick profit.

But the whole sector is suffering a rout at the moment with all the major cryptocurrencies slumping in value, and the signs for NFTs are mixed at best.

The number of NFTs traded in the first quarter of this year slumped by almost 50 percent compared to the previous quarter, according to analysis firm Non-Fungible.

They reckoned the market was digesting the vast amount of NFTs created last year, with the resale market just getting off the ground.

Monitoring firm CryptoSlam reported a dramatic tail-off in May, with just $31 million spent on art and collectibles in the week to May 15, the lowest figure all year.

A symbol of the struggle is the forlorn attempt to re-sell an NFT of Twitter founder Jack Dorsey's first tweet.

Dorsey managed to sell the NFT for almost $3 million last year but the new owner cannot find anyone willing to pay more than $20,000.

- The year of scams -

Molly White, a prominent critic of the crypto sphere, told AFP there were many possible reasons for the downturn.

"It could be a general decrease in hype, it could be fear of scams after so many high-profile ones, or it could be people tightening their belts," she said.

The reputation of the industry has been hammered for much of the year.

The main exchange, OpenSea, admitted in January that more than 80 percent of the NFTs created with its free tool were fraudulent -- many of them copies of other NFTs or famous artworks reproduced without permission.

"There's a bit of everything on OpenSea," said Olivier Lerner, co-author of the book "NFT Mine d'Or" (NFT Gold Mine).

"It's a huge site and it's not curated, so you really have no idea what you're buying."

LooksRare, an NFT exchange that overtook OpenSea for volume of sales this year, got into similar problems as its rival.

As many as 95 percent of the transactions on its platform were found to be fake, according to CryptoSlam.

Users were selling NFTs to themselves because LooksRare was offering tokens with every transaction -- no matter what you were buying.

And the amounts lost to scams this year have been eye-watering.

The owners of Axie Infinity, a game played by millions in the Philippines and elsewhere and a key driver of the NFT market, managed to lose more than $500 million in a single swindle.

- 'Like the lottery' -

"As soon as you have a new technology, you immediately have fraudsters circling," lawyer Eric Barbry told AFP.

He pointed out that the NFT market had no dedicated regulation so law enforcement agencies are left to cobble together a response using existing frameworks.

Molly White said strong regulation could help eliminate the extreme speculation but that could, in turn, rob NFTs of their major appeal -- that they can bring quick profits.

"I think less hype would be a good thing -- in its current form, NFT trading is enormously risky and probably unwise for the average person," she said.

NFTs are often likened to the traditional art market because they have no inherent utility and their prices fluctuated wildly depending on trends and hype.

But Olivier Lerner suggested a different comparison.

"It's like the lottery," he said of those seeking big profits from NFTs. "You play, but you never win."

K.Brown--BTB