-

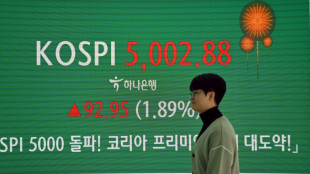

South Korea's economy grew just 1% in 2025, lowest in five years

South Korea's economy grew just 1% in 2025, lowest in five years

-

Snowboard champ Hirano suffers fractures ahead of Olympics

-

'They poisoned us': grappling with deadly impact of nuclear testing

'They poisoned us': grappling with deadly impact of nuclear testing

-

Keys blows hot and cold before making Australian Open third round

-

Philippine journalist found guilty of terror financing

Philippine journalist found guilty of terror financing

-

Greenlanders doubtful over Trump resolution

-

Real Madrid top football rich list as Liverpool surge

Real Madrid top football rich list as Liverpool surge

-

'One Battle After Another,' 'Sinners' tipped to top Oscar noms

-

Higher heating costs add to US affordability crunch

Higher heating costs add to US affordability crunch

-

Eight stadiums to host 2027 Rugby World Cup matches in Australia

-

Plastics everywhere, and the myth that made it possible

Plastics everywhere, and the myth that made it possible

-

Interim Venezuela leader to visit US

-

Australia holds day of mourning for Bondi Beach shooting victims

Australia holds day of mourning for Bondi Beach shooting victims

-

Liverpool cruise as Bayern reach Champions League last 16

-

Fermin Lopez brace leads Barca to win at Slavia Prague

Fermin Lopez brace leads Barca to win at Slavia Prague

-

Newcastle pounce on PSV errors to boost Champions League last-16 bid

-

Fermin Lopez brace hands Barca win at Slavia Prague

Fermin Lopez brace hands Barca win at Slavia Prague

-

Kane double fires Bayern into Champions League last 16

-

Newcastle pounce on PSV errors to close in on Champions League last 16

Newcastle pounce on PSV errors to close in on Champions League last 16

-

In Davos speech, Trump repeatedly refers to Greenland as 'Iceland'

-

Liverpool see off Marseille to close on Champions League last 16

Liverpool see off Marseille to close on Champions League last 16

-

Caicedo strikes late as Chelsea end Pafos resistance

-

US Republicans begin push to hold Clintons in contempt over Epstein

US Republicans begin push to hold Clintons in contempt over Epstein

-

Trump says agreed 'framework' for US deal over Greenland

-

Algeria's Zidane and Belghali banned over Nigeria AFCON scuffle

Algeria's Zidane and Belghali banned over Nigeria AFCON scuffle

-

Iran says 3,117 killed during protests, activists fear 'far higher' toll

-

Atletico frustrated in Champions League draw at Galatasaray

Atletico frustrated in Champions League draw at Galatasaray

-

Israel says struck Syria-Lebanon border crossings used by Hezbollah

-

Snapchat settles to avoid social media addiction trial

Snapchat settles to avoid social media addiction trial

-

'Extreme cold': Winter storm forecast to slam huge expanse of US

-

Jonathan Anderson reimagines aristocrats in second Dior Homme collection

Jonathan Anderson reimagines aristocrats in second Dior Homme collection

-

Former England rugby captain George to retire in 2027

-

Israel launches wave of fresh strikes on Lebanon

Israel launches wave of fresh strikes on Lebanon

-

Ubisoft unveils details of big restructuring bet

-

Abhishek fireworks help India beat New Zealand in T20 opener

Abhishek fireworks help India beat New Zealand in T20 opener

-

Huge lines, laughs and gasps as Trump lectures Davos elite

-

Trump rules out 'force' against Greenland but demands talks

Trump rules out 'force' against Greenland but demands talks

-

Stocks steadier as Trump rules out force to take Greenland

-

World's oldest cave art discovered in Indonesia

World's oldest cave art discovered in Indonesia

-

US hip-hop label Def Jam launches China division in Chengdu

-

Dispersed Winter Olympics sites 'have added complexity': Coventry

Dispersed Winter Olympics sites 'have added complexity': Coventry

-

Man City players to refund fans after Bodo/Glimt debacle

-

France's Lactalis recalls baby formula over toxin

France's Lactalis recalls baby formula over toxin

-

Pakistan rescuers scour blaze site for dozens missing

-

Keenan return to Irish squad boosts Farrell ahead of 6 Nations

Keenan return to Irish squad boosts Farrell ahead of 6 Nations

-

US Treasury chief accuses Fed chair of 'politicising' central bank

-

Trump rules out force against Greenland but demands 'immediate' talks

Trump rules out force against Greenland but demands 'immediate' talks

-

Israeli strike kills three Gaza journalists including AFP freelancer

-

US Congress targets Clintons in Epstein contempt fight

US Congress targets Clintons in Epstein contempt fight

-

Huge lines, laughs and gasps as Trump addresses Davos elites

US Fed proposes easing key banking rule

The US Federal Reserve released plans Wednesday to relax a key capital rule for major banks, a move they say can help facilitate Treasury market trading.

The Fed board voted 5-2 to propose amendments on a measure introduced after the 2008 global financial crisis, that requires banks to hold a certain amount of capital relative to their assets.

This was part of efforts to boost their stability.

The measure, called the "enhanced supplementary leverage ratio," calls for the country's biggest banks to hold an extra layer of capital.

Under the latest proposal, the capital requirement for holding companies is set to be lowered from its current five percent while banking subsidiaries will have their requirement reduced from six percent.

The plan will face a 60-day window for public comment.

The rule was initially set up as a "backstop," said Fed Chair Jerome Powell at the board's open meeting on Wednesday.

But he added that banks have increased the amount of "relatively safe and low-risk assets" on their balance sheets over the past decade or so.

"Based on this experience, it is prudent for us to reconsider our original approach," he said.

"We want to ensure that the leverage ratio does not become regularly binding and discourage banks from participating in low-risk activities, such as Treasury market intermediation," Powell said.

The Federal Deposit Insurance Corporation is also meeting Thursday about changes to the standard.

Fed vice chair for supervision Michelle Bowman said that "the proposal will help to build resilience in US Treasury markets."

She argued that it reduces the chance of "market dysfunction and the need for the Federal Reserve to intervene in a future stress event."

But Fed governors Michael Barr and Adriana Kugler expressed reservations about the plan.

Barr warned that the proposal significantly reduces bank capital, raising risks surrounding a major bank's failure.

Kugler, meanwhile, expressed doubt that benefits involving the Treasury market justified proposed reductions in capital requirements, "especially in light of the potential for elevated financial stability risk."

American Bankers Association president Rob Nichols called the proposal a key step towards boosting the financial system and "reducing bank funding costs."

"We urge regulators to move as quickly as possible to finalize these much-needed reforms," he added.

U.Maertens--VB