-

'Extraordinary' trove of ancient species found in China quarry

'Extraordinary' trove of ancient species found in China quarry

-

Villa's Tielemans ruled out for up to 10 weeks

-

Google unveils AI tool probing mysteries of human genome

Google unveils AI tool probing mysteries of human genome

-

UK proposes to let websites refuse Google AI search

-

'I wanted to die': survivors recount Mozambique flood terror

'I wanted to die': survivors recount Mozambique flood terror

-

Trump issues fierce warning to Minneapolis mayor over immigration

-

Anglican church's first female leader confirmed at London service

Anglican church's first female leader confirmed at London service

-

Germany cuts growth forecast as recovery slower than hoped

-

Amazon to cut 16,000 jobs worldwide

Amazon to cut 16,000 jobs worldwide

-

One dead, five injured in clashes between Colombia football fans

-

Dollar halts descent, gold keeps climbing before Fed update

Dollar halts descent, gold keeps climbing before Fed update

-

US YouTuber IShowSpeed gains Ghanaian nationality at end of Africa tour

-

Sweden plans to ban mobile phones in schools

Sweden plans to ban mobile phones in schools

-

Turkey football club faces probe over braids clip backing Syrian Kurds

-

Deutsche Bank offices searched in money laundering probe

Deutsche Bank offices searched in money laundering probe

-

US embassy angers Danish veterans by removing flags

-

Netherlands 'insufficiently' protects Caribbean island from climate change: court

Netherlands 'insufficiently' protects Caribbean island from climate change: court

-

Fury confirms April comeback fight against Makhmudov

-

Susan Sarandon to be honoured at Spain's top film awards

Susan Sarandon to be honoured at Spain's top film awards

-

Trump says 'time running out' as Iran rejects talks amid 'threats'

-

Spain eyes full service on train tragedy line in 10 days

Spain eyes full service on train tragedy line in 10 days

-

Greenland dispute 'strategic wake-up call for all of Europe,' says Macron

-

'Intimidation and coercion': Iran pressuring families of killed protesters

'Intimidation and coercion': Iran pressuring families of killed protesters

-

Europe urged to 'step up' on defence as Trump upends ties

-

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

-

Dollar rebounds while gold climbs again before Fed update

-

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

-

West Ham sign Fulham winger Traore

-

Relentless Sinner sets up Australian Open blockbuster with Djokovic

Relentless Sinner sets up Australian Open blockbuster with Djokovic

-

Israel prepares to bury last Gaza hostage

-

Iran rejects talks with US amid military 'threats'

Iran rejects talks with US amid military 'threats'

-

Heart attack ends iconic French prop Atonio's career

-

SKorean chip giant SK hynix posts record operating profit for 2025

SKorean chip giant SK hynix posts record operating profit for 2025

-

Greenland's elite dogsled unit patrols desolate, icy Arctic

-

Dutch tech giant ASML posts bumper profits, cuts jobs

Dutch tech giant ASML posts bumper profits, cuts jobs

-

Musetti rues 'really painful' retirement after schooling Djokovic

-

Russian volcano puts on display in latest eruption

Russian volcano puts on display in latest eruption

-

Thailand uses contraceptive vaccine to limit wild elephant births

-

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

Djokovic gets lucky to join Pegula, Rybakina in Melbourne semi-finals

-

Trump says to 'de-escalate' Minneapolis, as aide questions agents' 'protocol'

-

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

'Extremely lucky' Djokovic into Melbourne semi-finals as Musetti retires

-

'Animals in a zoo': Players back Gauff call for more privacy

-

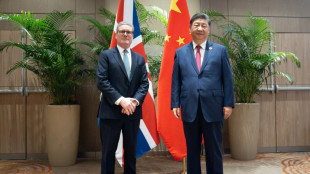

Starmer heads to China to defend 'pragmatic' partnership

Starmer heads to China to defend 'pragmatic' partnership

-

Uganda's Quidditch players with global dreams

-

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

'Hard to survive': Kyiv's elderly shiver after Russian attacks on power and heat

-

South Korea's ex-first lady jailed for 20 months for taking bribes

-

Polish migrants return home to a changed country

Polish migrants return home to a changed country

-

Dutch tech giant ASML posts bumper profits, eyes bright AI future

-

South Korea's ex-first lady jailed for 20 months for corruption

South Korea's ex-first lady jailed for 20 months for corruption

-

Minnesota congresswoman unbowed after attacked with liquid

| SCS | 0.12% | 16.14 | $ | |

| CMSC | -0.36% | 23.715 | $ | |

| CMSD | -0.19% | 24.05 | $ | |

| JRI | -5.27% | 12.995 | $ | |

| BCE | -0.08% | 25.499 | $ | |

| BCC | -1.08% | 80.87 | $ | |

| RIO | 0.17% | 93.07 | $ | |

| GSK | -1.48% | 50.06 | $ | |

| BTI | -0.92% | 59.79 | $ | |

| AZN | -2.42% | 93.34 | $ | |

| RBGPF | 0% | 82.4 | $ | |

| RYCEF | -2.69% | 16.7 | $ | |

| RELX | -2.53% | 37.415 | $ | |

| VOD | 0.45% | 14.565 | $ | |

| NGG | 0.51% | 84.74 | $ | |

| BP | 0.25% | 37.715 | $ |

Greenland's mining bonanza still a distant promise

Before it could cast its first gold bar, Amaroq had to build a port and housing, repair a road, and ship over equipment -- a logistical nightmare highlighting the complexities of mining in inhospitable Greenland.

"This is obviously much, much harder than setting up any other business around the world," Eldur Olafsson, the head of the Canadian mining company, told AFP.

Amaroq operates one of only two active mines on the vast Arctic island, a region full of promise for mineral wealth but which has proven difficult to exploit.

From Ukraine, where US President Donald Trump wants to get his hands on natural resources, to the seabeds that numerous companies want to explore, minerals are today at the centre of major geopolitical and industrial ambitions.

Greenland remains almost entirely unexploited, and its minerals are seen as a potential springboard to independence, a goal backed by a majority of the island's 57,000 inhabitants.

Trump's stated ambitions to take over the Danish autonomous territory have only served to boost islanders' support for independence, and the timeframe for full sovereignty has been one of the main topics ahead of Greenland's March 11 legislative elections.

For many Greenlanders -- and probably Trump too -- the wealth generated by the minerals is front of mind.

They would likely generate enough revenue to replace the $565 million Denmark gives Greenland in annual subsidies.

With its underground riches, Greenland "could be a vital player" in the global mining industry, insists Thomas Varming, a geophysicist and consultant at the Geological Survey of Denmark and Greenland (GEUS).

"Many of these deposits that we have are actually crucial for the green transition: minerals that go into batteries -- lithium, graphite -- and also elements that go into super strong magnets that you use in wind turbines or your electric cars or if you want to electrify your trains," he explained.

But in order for those minerals to become a cash cow for Greenland, the price of raw materials has to go up, because right now it's not profitable enough to mine them.

Around 80 percent of Greenland is covered by ice, it has an extreme climate, very little infrastructure, and strict environmental considerations.

All those factors send operating costs soaring, while competitors like mining powerhouse China have few such issues.

- Red lines -

"There have been many mining projects on the table and the short version is: nothing has happened. There has simply not been a business case," said one economist.

Greenland Ruby, which operated a small ruby mine, went bankrupt last year.

"Mineral development is a very slow-moving business. It takes about 16 years to develop into a mine. And in that period of time, you just spend a lot of money. You don't earn a lot of money," stressed Naaja Nathanielsen, Greenland's Minister for Business and Mineral Resources.

"We have a lot of mines in the making, but they are still in this 16-year period," she told AFP in her office in Nuuk, the capital of Greenland.

She said eight companies were due to hold operating licences by the end of the year -- which doesn't necessarily mean there will be that many mines -- and around 80 exploration licences have also been issued.

Greenlandic authorities have drawn several red lines when it comes to mining: no uranium, no oil and gas, and no deep sea mining.

"We are very reliant on our fisheries, and we as a tourist nation try to brand ourselves as a green and pristine place in the world," Nathanielsen said.

"We don't want that image to be tarred by environmental hazards."

For now, the mining industry accounts for just a minute part of Greenland's economy, especially since many of the jobs go to foreigners due to a lack of skilled locals.

Even though the United States and the European Union have both signed memorandums of cooperation with Greenland, a mineral bonanza remains promising but distant, leaving the island without a key pillar needed for its economic independence.

"We are not developing the mineral sector to become independent. We're developing it to get revenue for the Greenlandic society and people, and better welfare. And at some point, we will get to independence as well," Nathanielsen said.

K.Hofmann--VB