-

Colombia leader offers talks to end trade war with Ecuador

Colombia leader offers talks to end trade war with Ecuador

-

Former Masters champ Reed returning to PGA Tour from LIV

-

US Fed holds interest rates steady, defying Trump pressure

US Fed holds interest rates steady, defying Trump pressure

-

Norway's McGrath tops first leg of Schladming slalom

-

Iraq PM candidate Maliki denounces Trump's 'blatant' interference

Iraq PM candidate Maliki denounces Trump's 'blatant' interference

-

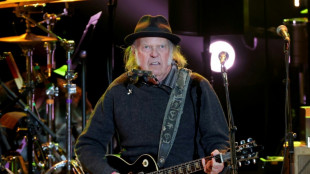

Neil Young gifts music to Greenland residents for stress relief

-

Rubio upbeat on Venezuela cooperation but wields stick

Rubio upbeat on Venezuela cooperation but wields stick

-

'No. 1 fan': Rapper Minaj backs Trump

-

Fear in Sicilian town as vast landslide risks widening

Fear in Sicilian town as vast landslide risks widening

-

'Forced disappearance' probe opened against Colombian cycling star Herrera

-

Seifert, Santner give New Zealand consolation T20 win over India

Seifert, Santner give New Zealand consolation T20 win over India

-

King Charles III warns world 'going backwards' in climate fight

-

Minneapolis activists track Trump's immigration enforcers

Minneapolis activists track Trump's immigration enforcers

-

Court orders Dutch to protect Caribbean island from climate change

-

Sterling agrees Chelsea exit after troubled spell

Sterling agrees Chelsea exit after troubled spell

-

Rules-based trade with US is 'over': Canada central bank head

-

Lucas Paqueta signs for Flamengo in record South American deal

Lucas Paqueta signs for Flamengo in record South American deal

-

Holocaust survivor urges German MPs to tackle resurgent antisemitism

-

'Extraordinary' trove of ancient species found in China quarry

'Extraordinary' trove of ancient species found in China quarry

-

Villa's Tielemans ruled out for up to 10 weeks

-

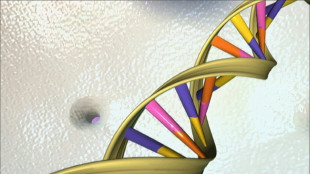

Google unveils AI tool probing mysteries of human genome

Google unveils AI tool probing mysteries of human genome

-

UK proposes to let websites refuse Google AI search

-

'I wanted to die': survivors recount Mozambique flood terror

'I wanted to die': survivors recount Mozambique flood terror

-

Trump issues fierce warning to Minneapolis mayor over immigration

-

Anglican church's first female leader confirmed at London service

Anglican church's first female leader confirmed at London service

-

Germany cuts growth forecast as recovery slower than hoped

-

Amazon to cut 16,000 jobs worldwide

Amazon to cut 16,000 jobs worldwide

-

One dead, five injured in clashes between Colombia football fans

-

Dollar halts descent, gold keeps climbing before Fed update

Dollar halts descent, gold keeps climbing before Fed update

-

US YouTuber IShowSpeed gains Ghanaian nationality at end of Africa tour

-

Sweden plans to ban mobile phones in schools

Sweden plans to ban mobile phones in schools

-

Turkey football club faces probe over braids clip backing Syrian Kurds

-

Deutsche Bank offices searched in money laundering probe

Deutsche Bank offices searched in money laundering probe

-

US embassy angers Danish veterans by removing flags

-

Netherlands 'insufficiently' protects Caribbean island from climate change: court

Netherlands 'insufficiently' protects Caribbean island from climate change: court

-

Fury confirms April comeback fight against Makhmudov

-

Susan Sarandon to be honoured at Spain's top film awards

Susan Sarandon to be honoured at Spain's top film awards

-

Trump says 'time running out' as Iran rejects talks amid 'threats'

-

Spain eyes full service on train tragedy line in 10 days

Spain eyes full service on train tragedy line in 10 days

-

Greenland dispute 'strategic wake-up call for all of Europe,' says Macron

-

'Intimidation and coercion': Iran pressuring families of killed protesters

'Intimidation and coercion': Iran pressuring families of killed protesters

-

Europe urged to 'step up' on defence as Trump upends ties

-

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

Sinner hails 'inspiration' Djokovic ahead of Australian Open blockbuster

-

Dollar rebounds while gold climbs again before Fed update

-

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

Aki a doubt for Ireland's Six Nations opener over disciplinary issue

-

West Ham sign Fulham winger Traore

-

Relentless Sinner sets up Australian Open blockbuster with Djokovic

Relentless Sinner sets up Australian Open blockbuster with Djokovic

-

Israel prepares to bury last Gaza hostage

-

Iran rejects talks with US amid military 'threats'

Iran rejects talks with US amid military 'threats'

-

Heart attack ends iconic French prop Atonio's career

Steel at heart of new Trump trade war

US President Donald Trump's new tariffs on steel promise to further complicate a strategic industry already destabilised by Chinese overproduction and Europe's stuttering blast furnaces.

Recently returned to the White House, the mercurial Republican's long-promised trade war will on Monday forge a new front with an expected 25-percent levy on aluminium and steel imported into the United States.

Trump imposed similar tariffs during his first term of office to protect US producers faced with what he complained to be unfair competition.

Who exports steel to the US?

Global steel production hit 1.89 billion tonnes in 2023, according to the latest figures from trade body World Steel.

World leader China's 1.02 billion tonnes represents more than half of that tally, with the United States trailing far behind on 81 million.

The United States meanwhile imported 26.4 million tonnes of the alloy in 2023, making it the second-largest market for foreign steel behind the European Union.

Canada tops the list of Washington's favoured steel providers with the United States importing 5.95 million tonnes from its northern neighbour in 2024, according to the US Department of Commerce.

Brazil and the EU followed with 4.08 million and 3.89 million tonnes exported to the United States respectively, ahead of Mexico on 3.19 million and South Korea on 2.5 million.

China however exported only around 470,000 tonnes to the United States.

Why is Trump complaining?

Global overproduction of the alloy has caused steel prices to plummet in the past year.

Where the steel economy of the past half-century cycled through periods of shortage and plenty, today it faces a structural problem of too much steel being produced,experts say.

That steel surplus varies around half a billion tonnes, according to the Organisation for Economic Co-operation and Development.

"The majority comes from China which is flooding the world markets," a European steel industry figure told AFP on condition of remaining anonymous.

Historically, European and US production capacity was on the whole balanced and in tune with domestic needs, the source said.

"But in southeast Asia (production) far exceeds demand".

And new planned steel factories in the region should add another 100 million tonnes of production capacity -- "80 percent of which comes from Chinese players" -- on top of the existing surplus, they added.

Moreover, Beijing has long been suspected of indirectly subsidising its steel production, driving down prices and putting the traditional European and US players on the back foot.

As a result under-fire US Steel has been the subject of a takeover bid by Japanese rival Nippon Steel, which was blocked by then-president Joe Biden.

With low prices squeezing profits, Germany's ThyssenKrupp announced it will lay off thousands of people working at its furnaces.

Why does steel matter?

Steel, so key to the second industrial revolution of the late 19th and early 20th century, remains a strategic industry around the world.

It is the foundational girder on which many traditional industrial sectors rest.

Just over half of the steel produced in 2023 was still destined for construction, while 12 percent of the rest went to automobile manufacturers.

Weapons manufacturers, railways and other transport sectors likewise feature among the alloy's top consumers.

But its use in wind turbines means steel is likewise essential for the transition to renewable energy.

It is also necessary to build the data centres used to house the vast quantities of information key to the development of artificial intelligence.

- Does green steel exist? -

The manufacturing process, which involves burning coal to smelt steel from iron ore, makes the industry largest emitter of planet-warming greenhouse gases.

Some steel furnaces have attempted to limit their environmental impact by recycling more scrap metal, switching to electric furnaces or building gas and hydrogen installations to phase out the use of highly polluting coal.

In Europe in particular vast sums of money were planned to be poured into decarbonising the industry.

But those investments have currently been put on ice due to Trump's looming threat of a trade war, the global surplus and the continent's declining steel consumption.

N.Schaad--VB