-

US oil giants say it's early days on potential Venezuela boom

US oil giants say it's early days on potential Venezuela boom

-

Fela Kuti to be first African to get Grammys Lifetime Achievement Award

-

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

Trump says Iran wants deal, US 'armada' larger than in Venezuela raid

-

US Justice Dept releases new batch of documents, images, videos from Epstein files

-

Four memorable showdowns between Alcaraz and Djokovic

Four memorable showdowns between Alcaraz and Djokovic

-

Russian figure skating prodigy Valieva set for comeback -- but not at Olympics

-

Barcelona midfielder Lopez agrees contract extension

Barcelona midfielder Lopez agrees contract extension

-

Djokovic says 'keep writing me off' after beating Sinner in late-nighter

-

US Justice Dept releasing new batch of Epstein files

US Justice Dept releasing new batch of Epstein files

-

South Africa and Israel expel envoys in deepening feud

-

French eyewear maker in spotlight after presidential showing

French eyewear maker in spotlight after presidential showing

-

Olympic dream 'not over', Vonn says after crash

-

Brazil's Lula discharged after cataract surgery

Brazil's Lula discharged after cataract surgery

-

US Senate races to limit shutdown fallout as Trump-backed deal stalls

-

'He probably would've survived': Iran targeting hospitals in crackdown

'He probably would've survived': Iran targeting hospitals in crackdown

-

Djokovic stuns Sinner to set up Australian Open final with Alcaraz

-

Mateta omitted from Palace squad to face Forest

Mateta omitted from Palace squad to face Forest

-

Djokovic 'pushed to the limit' in stunning late-night Sinner upset

-

Tunisia's famed blue-and-white village threatened after record rains

Tunisia's famed blue-and-white village threatened after record rains

-

Top EU official voices 'shock' at Minneapolis violence

-

Kremlin says agreed to halt strikes on Kyiv until Sunday

Kremlin says agreed to halt strikes on Kyiv until Sunday

-

Carrick calls for calm after flying start to Man Utd reign

-

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

Djokovic to meet Alcaraz in Melbourne final after five-set marathon

-

Italian officials to testify in trial over deadly migrant shipwreck

-

Iran says defence capabilities 'never' up for negotiation

Iran says defence capabilities 'never' up for negotiation

-

UN appeals for more support for flood-hit Mozambicans

-

Lijnders urges Man City to pile pressure on Arsenal in title race

Lijnders urges Man City to pile pressure on Arsenal in title race

-

Fulham sign Man City winger Oscar Bobb

-

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

Strasbourg's Argentine striker Panichelli sets sights on PSG, World Cup

-

Jesus 'made love': Colombian president irks Christians with steamy claim

-

IAEA board meets over Ukraine nuclear safety concerns

IAEA board meets over Ukraine nuclear safety concerns

-

Eurozone growth beats 2025 forecasts despite Trump woes

-

Dutch PM-elect Jetten says not yet time to talk to Putin

Dutch PM-elect Jetten says not yet time to talk to Putin

-

Social media fuels surge in UK men seeking testosterone jabs

-

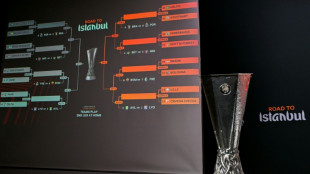

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

Forest face Fenerbahce, Celtic draw Stuttgart in Europa League play-offs

-

US speed queen Vonn crashes at Crans-Montana, one week before Olympics

-

Trump nominates former US Fed official as next central bank chief

Trump nominates former US Fed official as next central bank chief

-

New Dutch government pledges ongoing Ukraine support

-

Newcastle still coping with fallout from Isak exit, says Howe

Newcastle still coping with fallout from Isak exit, says Howe

-

Chad, France eye economic cooperation as they reset strained ties

-

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

Real Madrid to play Benfica, PSG face Monaco in Champions League play-offs

-

Everton winger Grealish set to miss rest of season in World Cup blow

-

Trump brands Minneapolis nurse killed by federal agents an 'agitator'

Trump brands Minneapolis nurse killed by federal agents an 'agitator'

-

Arteta focuses on the positives despite Arsenal stumble

-

Fijian Drua sign France international back Vakatawa

Fijian Drua sign France international back Vakatawa

-

Kevin Warsh, a former Fed 'hawk' now in tune with Trump

-

Zverev rails at Alcaraz timeout in 'one of the best battles ever'

Zverev rails at Alcaraz timeout in 'one of the best battles ever'

-

Turkey leads Iran diplomatic push as Trump softens strike threat

-

Zelensky backs energy ceasefire, Russia bombs Ukraine despite Trump intervention

Zelensky backs energy ceasefire, Russia bombs Ukraine despite Trump intervention

-

'Superman' Li Ka-shing, Hong Kong billionaire behind Panama ports deal

| SCS | 0.12% | 16.14 | $ | |

| RBGPF | 1.65% | 83.78 | $ | |

| RYCEF | -2.69% | 16 | $ | |

| BCC | -0.98% | 79.39 | $ | |

| JRI | 0.27% | 12.99 | $ | |

| CMSC | -0.11% | 23.67 | $ | |

| BTI | 0.21% | 60.335 | $ | |

| GSK | 1.33% | 51.34 | $ | |

| NGG | -0.44% | 84.68 | $ | |

| RELX | -1.59% | 35.6 | $ | |

| RIO | -5.36% | 90.29 | $ | |

| BCE | 0.25% | 25.55 | $ | |

| VOD | -0.58% | 14.625 | $ | |

| AZN | 0.59% | 93.14 | $ | |

| CMSD | 0.06% | 24.075 | $ | |

| BP | -1.52% | 37.47 | $ |

Saudi Aramco Q2 profits drop 38% on lower prices: statement

Oil firm Saudi Aramco on Monday announced profits of $30.08 billion for the second quarter, a sharp fall from the same period last year when prices surged after Russia invaded Ukraine.

The 38 percent year-on-year decline "mainly reflected the impact of lower crude oil prices and weakening refining and chemicals margins," the largely state-owned company said in a statement published on the Saudi stock exchange.

The decline followed a drop of 19.25 percent in first-quarter net profit.

"Our strong results reflect our resilience and ability to adapt through market cycles," CEO Amin Nasser said.

"We continue to demonstrate our long-standing ability to meet the needs of customers around the world with high levels of reliability," Nasser said, announcing the timing of an additional dividend.

"For our shareholders, we intend to start distributing our first performance-linked dividend in the third quarter," he said.

Production from the world's biggest crude exporter was down after Riyadh in April announced cuts of 500,000 barrels per day, part of a coordinated move with other oil powers to slash supply by more than one million bpd in a bid to prop up prices.

In June, the Saudi energy ministry announced a further voluntary cut of one million bpd which took effect in July and has been extended through September.

The kingdom's daily production is now approximately nine million bpd, far below its reported daily capacity of 12 million bpd.

Aramco is the main source of revenue for Crown Prince Mohammed bin Salman's sweeping economic and social reform programme known as Vision 2030, which aims to shift the economy away from fossil fuels.

Analysts say the kingdom needs oil to be priced at around $80 per barrel to balance its budget.

Prices are now above that threshold, a sign that the recent supply cuts are starting to have the desired effect.

The US benchmark West Texas Intermediate crude for September delivery traded Monday at $82.54 and European benchmark Brent crude futures were just below $86.

Following Russia's invasion of Ukraine in February 2022, oil peaked at more than $130 dollars per barrel.

- 'Phenomenal figures' -

The cuts "show the lengths to which the kingdom will go to defend oil prices, as a slumping market for its lifeblood commodity is damaging to its ambitious economic diversification efforts," said Herman Wang, associate director for oil news at S&P Global Commodity Insights.

Aramco is undertaking investments to ramp up national production capacity to 13 million bpd by 2027.

"It's an expensive proposition for Aramco to hold production capacity offline in the name of OPEC+ cuts, but the hope is that the sacrifice being made now will pay off in the end with higher prices," Wang said, referring to the Organization of the Petroleum Exporting Countries, headed by Riyadh, and their 10 allies led by Moscow.

Aramco reported record profits totalling $161.1 billion last year, allowing the kingdom to notch up its first annual budget surplus in nearly a decade.

Yet those "were phenomenal figures driven by a very particular set of geopolitical factors and Saudi Arabia's leadership can't have been predicating Vision 2030 spending on such results," said Jamie Ingram, senior editor at the Middle East Economic Survey (MEES).

"Higher revenues would of course be favoured by officials, but Saudi Arabia still has very low debt levels and strong reserves that it can tap into," the expert said.

Saudi Arabia owns 90 percent of Aramco's shares.

In December 2019, the firm floated 1.7 percent of its shares on the Saudi bourse, generating $29.4 billion in the world's biggest initial public offering.

In mid-April, Saudi Arabia announced it was transferring a four percent chunk of Aramco shares, worth nearly $80 billion, to Sanabil Investments, a firm controlled by the kingdom's Public Investment Fund (PIF), one of the world's biggest sovereign wealth funds with more than $620 billion in assets.

An earlier transfer of four percent of Aramco shares last year went directly to the PIF.

F.Müller--BTB