-

Middle East war halts work at WHO's Dubai emergency hub

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

-

Seoul leads rebound across Asian stocks, oil extends gains

Seoul leads rebound across Asian stocks, oil extends gains

-

Tourism on hold as Middle East war casts uncertainty

-

Bayern and Kane gambling with house money as Gladbach come to town

Bayern and Kane gambling with house money as Gladbach come to town

-

Turkey invests in foreign legion to deliver LA Olympics gold

-

Galthie's France blessed with unprecedented talent: Saint-Andre

Galthie's France blessed with unprecedented talent: Saint-Andre

-

Voice coach to the stars says Aussie actors nail tricky accents

-

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

Rahm rejection of DP World Tour deal 'a shame' - McIlroy

-

Israel keeps up Lebanon strikes as ground forces advance

China Targets Dollar at US Critical Moment

China has intensified its financial offensive against the United States, deploying significant measures to undermine the dominance of the US dollar at a time when America faces mounting economic and geopolitical challenges. Reports indicate that the People’s Bank of China (PBOC) has directed major state-owned banks to prepare for large-scale interventions in offshore markets, selling dollars to bolster the yuan. This move, seen as a direct challenge to the dollar’s status as the world’s reserve currency, coincides with heightened US vulnerabilities, including domestic political instability and a ballooning national debt nearing $35 trillion.

The strategy builds on years of Chinese efforts to internationalise the yuan and reduce reliance on the dollar. Since 2022, China has accelerated dollar sell-offs, with Reuters noting similar directives from the PBOC in October of that year amid a weakening yuan. More recently, Beijing has leveraged its position as a key holder of US Treasury securities—still over $800 billion despite gradual reductions—to exert pressure. Analysts suggest that China aims to exploit the US’s current economic fragility, exacerbated by inflation and supply chain disruptions, to advance its long-term goal of reshaping global financial power.

Russia’s alignment with China has further amplified this campaign, with both nations increasing trade in non-dollar currencies. In 2023, yuan transactions surpassed dollar-based exchanges in Sino-Russian trade, a trend that has only deepened. Meanwhile, whispers of more aggressive tactics persist, including unverified claims of plans to confiscate US assets within China, encompassing government, corporate, and individual investments. While such measures remain speculative, they reflect the growing audacity of Beijing’s financial warfare.

The timing is critical. The US faces a contentious election cycle and a Federal Reserve grappling with interest rate dilemmas, leaving the dollar exposed. China’s actions also resonate within the BRICS bloc (Brazil, Russia, India, China, South Africa), which has openly discussed de-dollarisation, with proposals for a unified currency gaining traction at recent summits. If successful, this could erode the dollar’s global hegemony, a cornerstone of American economic influence since the Bretton Woods agreement of 1944.

Yet, China’s gambit carries risks. Flooding markets with dollars could destabilise its own economy, heavily reliant on export surpluses tied to dollar-based trade. Moreover, the US retains significant retaliatory tools, including sanctions and control over the SWIFT financial system. For now, Beijing’s “big guns” signal intent more than immediate triumph, but the message is clear: China sees this as America’s moment of weakness—and its opportunity to strike.

Hormuz Shock Risk rising

Brazil's trade-war boom

Iran's revenge rewired

Cuba's golden Goose dies

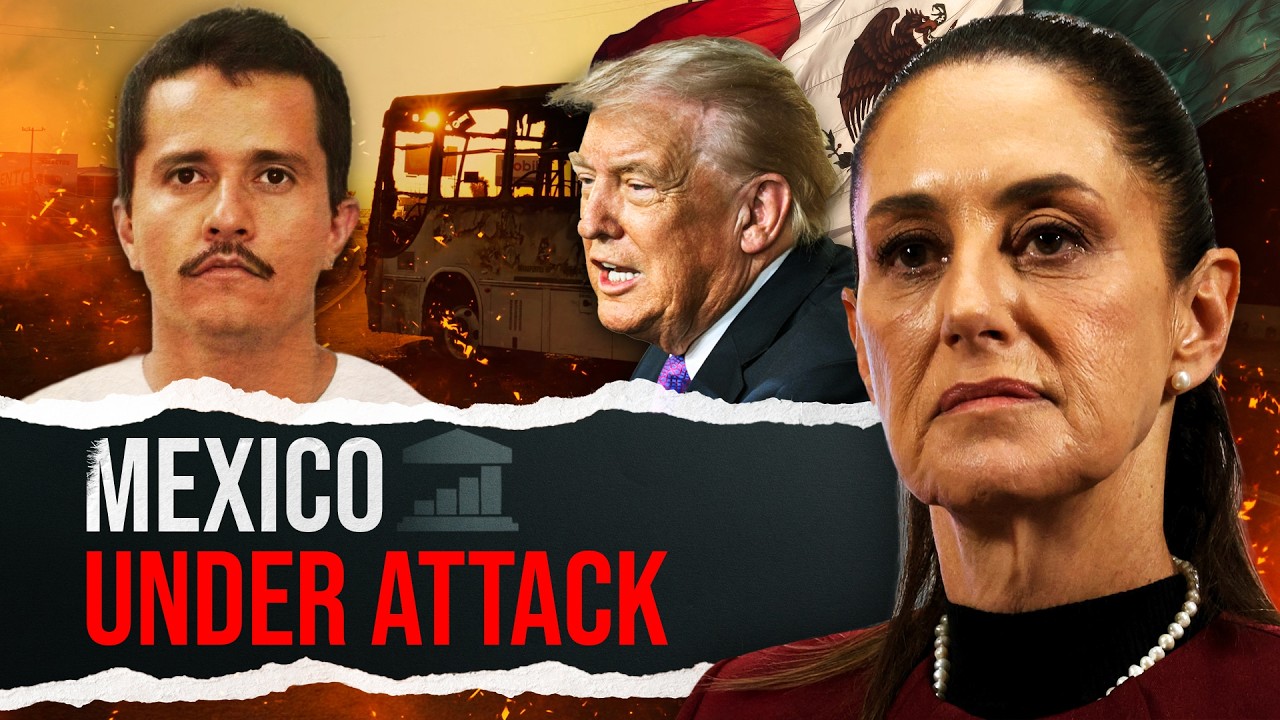

Mexico after El Mencho falls

Nicaragua on the brink?

Cuba: The Regime's last Card

Strike fears rise over Iran

U.S. Jobs stall, gdp slows

Japan’s right‑turn triumph

EU India deal gains unveiled