-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

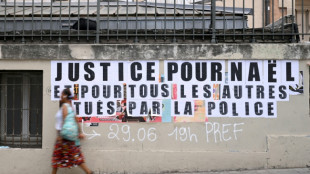

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

US Federal Reserve with “announcement”

In a widely-followed press conference, the US Federal Reserve (Fed) announced a significant economic contraction in order to control the growing risk of inflation in the United States. With this decision, the central bank is reacting to persistently high rates of inflation and a rapidly changing economic situation. At the same time, the measure sends a signal to companies and financial markets: after a phase of historically low interest rates and extremely loose monetary policy, the course could now change in the direction of a more restrictive phase.

Rising interest rates and tighter monetary policy:

Contrary to the course of recent years, when the Federal Reserve supported the economy with low interest rates, the focus is now on interest rate hikes and a reduction in the Fed's balance sheet. This is intended to dampen excessive demand, slow credit growth and contain inflation. Fed Chairman Jerome Powell emphasized that these steps are necessary to ensure sustainable and stable economic development over the medium term.

Market analysts see the announced contraction as a significant policy shift. Many investors had already expected interest rate hikes, but the clear focus on a restrictive policy exceeded the expectations of some observers. As a result, stock markets came under short-term pressure and the US dollar depreciated slightly against other leading currencies.

Background: Inflation and economic uncertainties:

The rate of inflation in the US has reached record levels in recent months. Supply bottlenecks, rising energy prices and high consumer demand had noticeably driven up prices. In addition, numerous economic stimulus packages initiated in response to the coronavirus crisis have stabilized the economy, but have also led to a high amount of money in circulation.

With the announcement of an economic contraction, the Fed is seeking a balance: on the one hand, price stability and a reduction in speculative bubbles should be ensured, while on the other hand, the Fed wants to avoid an excessive cooling of the economy. Jerome Powell emphasized that developments are being monitored closely and that the Fed is prepared to take action if necessary.

Impact on companies and consumers:

A more restrictive monetary policy primarily affects companies that have relied on cheap credit. For firms that finance growth through debt, costs could now rise, which could slow investment and expansion in some sectors.

Consumers are also likely to feel the effects of rising interest rates, especially real estate buyers and credit card customers. Higher mortgage rates could put the brakes on the residential real estate market and make buying a home more expensive.

At the same time, however, there are also positive aspects: an effective fight against inflation preserves the purchasing power of the population and can reduce speculation risks. In particular, people with savings could benefit from higher interest rates, provided that financial institutions adjust their rates.

Criticism and outlook:

Not all experts consider the Federal Reserve's move to be appropriate. Some critics warn that curbing growth too quickly could jeopardize new jobs and slow down the economic recovery after the pandemic. The fear is that if the US economy cools more sharply than expected, the labor market could deteriorate again and high inflation could only moderate moderately.

Nevertheless, many experts see the decision as overdue. In view of record inflation and a stock market environment that is overheated in some areas, there is a need for action to stabilize the fundamental data again. The coming months will show whether the US economy can strike a balance between stabilizing and avoiding a recession – or whether a more severe downturn is looming.

Conclusion:

The Federal Reserve has sent a clear signal to markets and consumers with its announcement of an economic contraction. Higher key interest rates and a tighter monetary policy should curb the record inflation and enable a more balanced economy. At the same time, there are risks for growth and the labor market if the economic environment deteriorates more quickly than expected. It remains to be seen whether this balancing act will be successful, but it is clear that the latest step marks the beginning of a new phase in US monetary policy.

Ukraine: When will the world stand up to Russian terror?

Warming: Methane levels rising, is this nature's answer?

Israel has every right to destroy Hamas and Hezbollah!

What are the effects of climate change on sea flora?

Azerbaijan is in control: Armenians flee Nagorno-Karabakh

EU countries agree on watered-down car emissions proposal

Hungary-Dictator PM Orban claims EU 'deceived' Hungary

Ruble at the end: Russia's currency on the brink of collapse

Russia in Ukraine: murder, torture, looting, rape!

That's how terror Russians end up in Ukraine!

Spain: Sánchez's aim of a left coalition will fail!