-

Iran players sing anthem and salute at Women's Asian Cup

Iran players sing anthem and salute at Women's Asian Cup

-

India beat England in high-scoring T20 World Cup semi-final

-

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

Mideast war traps 20,000 seafarers, 15,000 cruise passengers in Gulf

-

Italy bring back Brex to face England

-

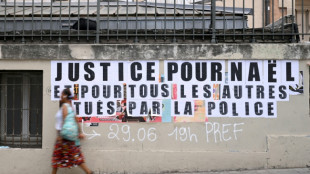

French policeman to be tried over 2023 killing of teen

French policeman to be tried over 2023 killing of teen

-

Oil prices rise, stocks slide as Middle East war stirs supply concerns

-

More flights take off despite continued fighting in Middle East

More flights take off despite continued fighting in Middle East

-

Ukraine, Russia free 200 POWs each

-

Middle East war halts work at WHO's Dubai emergency hub

Middle East war halts work at WHO's Dubai emergency hub

-

Paramount's Ellison vows CNN editorial independence

-

US says attacks on alleged drug boats have spooked traffickers

US says attacks on alleged drug boats have spooked traffickers

-

Dempsey returns as Scotland shuffle pack for Six Nations clash against France

-

India pile up 253-7 against England in T20 World Cup semi-final

India pile up 253-7 against England in T20 World Cup semi-final

-

Wary Europeans pledge 'defensive' military aid in Mideast war

-

Seven countries to boycott Paralympics ceremony over Russia: organisers

Seven countries to boycott Paralympics ceremony over Russia: organisers

-

UK's Crufts dog show opens with growing global appeal

-

PSG prepare for Chelsea clash with Monaco rematch

PSG prepare for Chelsea clash with Monaco rematch

-

Google opens AI centre as Berlin defends US tech reliance

-

Second Iranian ship nears Sri Lanka after submarine attack

Second Iranian ship nears Sri Lanka after submarine attack

-

Portugal mourns acclaimed writer Antonio Lobo Antunes

-

Union loses fight against Tesla at German factory

Union loses fight against Tesla at German factory

-

Wales revel in being the underdogs, says skipper Lake

-

German school students rally against army recruitment drive

German school students rally against army recruitment drive

-

Wary European states pledge military aid for Cyprus, Gulf

-

Liverpool injuries frustrating Slot in tough season

Liverpool injuries frustrating Slot in tough season

-

Real Madrid will 'keep fighting' in title race, vows Arbeloa

-

Australia join South Korea in quarters of Women's Asian Cup

Australia join South Korea in quarters of Women's Asian Cup

-

Kane to miss Bayern game against Gladbach with calf knock

-

Henman says Raducanu needs more physicality to rise up rankings

Henman says Raducanu needs more physicality to rise up rankings

-

France recall fit-again Jalibert to face Scotland

-

Harry Styles fans head in one direction: to star's home village

Harry Styles fans head in one direction: to star's home village

-

Syrian jailed over stabbing at Berlin Holocaust memorial

-

Second Iranian ship heading to Sri Lanka after submarine attack

Second Iranian ship heading to Sri Lanka after submarine attack

-

Middle East war spirals as Iran hits Kurds in Iraq

-

Norris hungrier than ever to defend Formula One world title

Norris hungrier than ever to defend Formula One world title

-

Fatherhood, sleep, T20 World Cup final: Henry's whirlwind journey

-

Conservative Nigerian city sees women drive rickshaw taxis

Conservative Nigerian city sees women drive rickshaw taxis

-

T20 World Cup hero Allen says New Zealand confidence high for final

-

The silent struggle of an anti-war woman in Russia

The silent struggle of an anti-war woman in Russia

-

Iran hits Kurdish groups in Iraq as conflict widens

-

China sets lowest growth target in decades as consumption lags

China sets lowest growth target in decades as consumption lags

-

Afghans rally against Pakistan and civilian casualties

-

South Korea beat Philippines 3-0 to reach women's quarter-finals

South Korea beat Philippines 3-0 to reach women's quarter-finals

-

Mercedes' Russell not fazed by being tipped as pre-season favourite

-

Australia beat Taiwan in World Baseball Classic opener

Australia beat Taiwan in World Baseball Classic opener

-

Underdogs Wales could hurt Irish after Scotland display: Popham

-

Gilgeous-Alexander rules over Knicks again in Thunder win

Gilgeous-Alexander rules over Knicks again in Thunder win

-

Hamilton reveals sequel in the works to blockbuster 'F1: The Movie'

-

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

Alonso, Stroll fear 'permanent nerve damage' from vibrating Aston Martin

-

China boosts military spending with eyes on US, Taiwan

China’s profitless push

Can we keep up? Chinese companies are sacrificing margins—sometimes incurring outright losses—to win global market share in strategic industries from electric vehicles and batteries to solar and consumer tech. The tactic is turbocharging exports, pressuring Western competitors and forcing policymakers in Europe and the United States to erect new defenses while they scramble to lower costs at home.

Electric vehicles: a race to the bottom on price. In late spring 2025, China’s largest carmakers unleashed another round of steep price cuts, with entry-level models reduced to mass-market price points. Regulators in Beijing have since urged manufacturers to rein in the bruising price war, citing risks to industry health and employment. Yet the incentives keep coming as dozens of brands fight for share in the world’s most competitive EV market. The financial fallout is visible: leading pure-play EV makers continue to post substantial quarterly losses, while ambitious new entrants have acknowledged that their car divisions remain in the red even as sales surge.

Green tech: overcapacity meets collapsing margins. China’s build-out in solar has morphed from a growth engine into a profitability trap. Module and polysilicon prices have fallen so far that key manufacturers forecast sizeable half-year losses, and producers are now discussing a coordinated effort to shutter older capacity. Industry reports describe spot prices for feedstocks dipping below production costs, a hallmark of cut-throat competition that spills over into export markets and undercuts rivals globally.

Trade blowback intensifies. The U.S. has moved to quadruple tariffs on Chinese-made EVs and lift duties on batteries, chips and solar cells. The European Union has imposed definitive countervailing duties on Chinese battery-electric cars and opened additional probes across green-tech supply chains. Brussels and Beijing have even explored minimum export prices to reduce undercutting—an extraordinary step that underscores how acute the pricing pressure has become.

Deflation at the factory gate. China’s factory-gate prices remain in negative territory year on year, reflecting slack domestic demand and excess capacity. That weakness transmits abroad via cheaper exports, squeezing margins for manufacturers elsewhere and complicating central banks’ inflation-fighting calculus. Beijing has rolled out an “anti-involution” campaign to curb ruinous discounting and steer investment toward “high-quality growth,” but implementation is uneven and local governments still depend on industrial output to stabilize employment.

Scale, speed—and logistics. Chinese champions are not only cutting prices; they are redesigning logistics to keep them low. One leading EV maker has built its own fleet of car carriers and is localizing production via overseas factories to sidestep tariffs and port bottlenecks. Such vertical integration magnifies the advantage from sprawling domestic supply chains in batteries, motors and power electronics.

What this means for Western competitors. The immediate effect is a margin squeeze across autos, solar and adjacent sectors. The strategic response taking shape in Europe and the U.S. is three-pronged: (1) trade defense to buy time; (2) industrial policy to catalyze domestic gigafactories and clean-tech manufacturing; and (3) consolidation to rebuild pricing power. Companies that cannot match China’s cost curve will need to differentiate—through software, design, brand and service—or partner to gain scale. Even in China, the current “profitless prosperity” looks unsustainable: consolidation is inevitable, and state guidance now favors capacity rationalization over raw volume.

The bottom line. China’s price-first strategy is remaking global competition. Whether others can keep up will hinge on how quickly they can de-risk supply chains, compress costs and innovate without hollowing out profitability. For now, the contest is being fought as much on balance sheets as it is on assembly lines.

Alice Weidel: AfD Chancellor Candidate 2025

Russia: Is Putin's time nearly up?

China, Trump, and the power of war?

Iran's Ayatollahs the next to Fall?

Who wins and who loses in Syria?

South Korea: Yoon Suk Yeol shocks Nation

Dictator Putin threatens to destroy Kiev

Will Trump's deportations be profitable?

Ishiba's Plan to Change Power in Asia

EU: Online platforms to pay tax?

EU: Energy independence achieved!